This article was first sent to our newsletter subscribers. To receive our monthly reports on the 1st of each month, subscribe now for free.

TL;DR

- Renewables in December 2025: Renewable generation equalled 43.3% of all-island demand in December 2025: 43.1% of the Republic of Ireland (ROI) demand and 43.9% of Northern Ireland (NI) demand.

- Renewables in the year of 2025: For the entire year of 2025, our preliminary numbers show renewable generation met 38.4% of all-island demand: 38.9% of ROI demand and 35.9% of NI demand. We have also updated our county-level renewables rankings for 2025. We'll send out a more detailed annual report soon, so stay tuned!

- Peak wind output records: Peak wind output reached new highs last month: 4637MW on December 5 followed by 4661MW on December 13. The previous record of 4624MW occurred two years ago in December 2023. Despite almost 500MW of wind capacity having energised since then, the new records are only beating the old one by 37MW, demonstrating grid capacity limits.

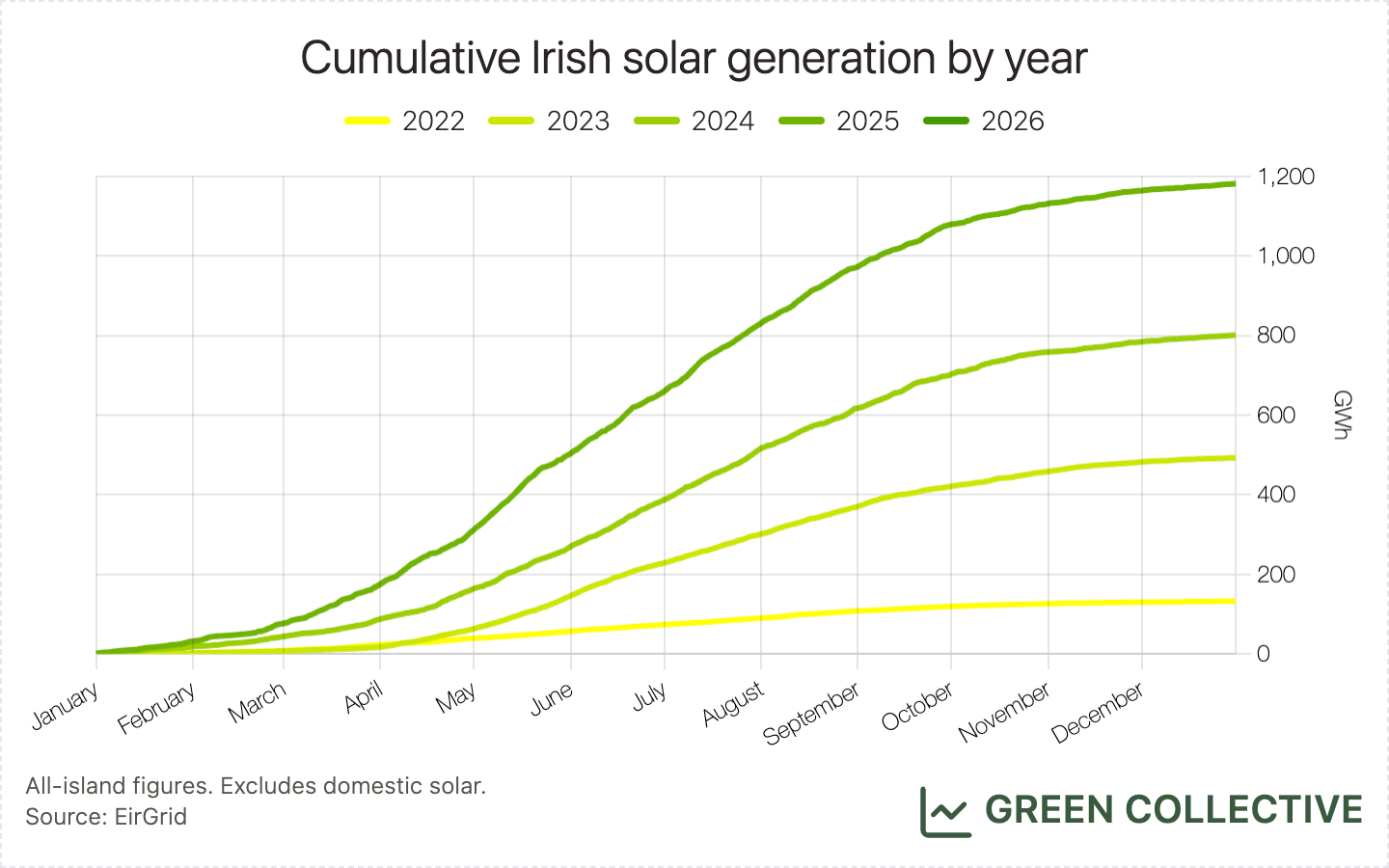

- Solar capacity expansion: ESB Networks announced total solar capacity expanded to 2.1GW in the Republic of Ireland. Based on what we can gather from public documents, utility-scale solar and microgeneration together add up to 1.8GW in ROI. The ~300MW gap between our tally and ESB's press release is due to additional categories of solar capacity without detailed data available to the public. However, the largest gap in solar data transparency still remains to be the lack of visibility into how much rooftop solar generation feeds back into the grid. This issue will become more significant as microgeneration capacity continues to climb, as it already makes up 1/3 of all solar capacity in ROI. For the part of solar generation on which we do have data, annual generation from solar farms reached 1182GWh in 2025, a 47.6% year-on-year increase.

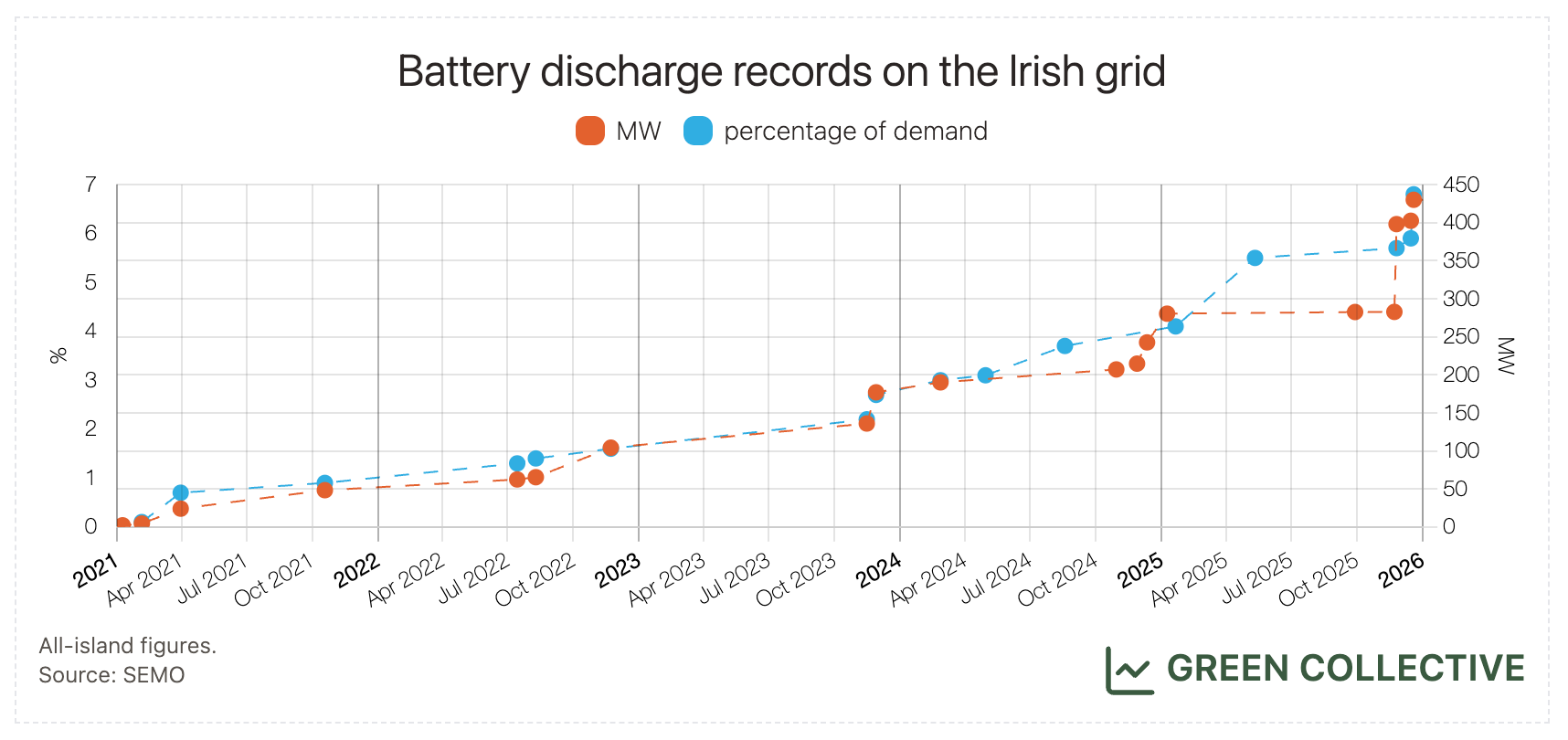

- Battery discharge records: As a result of recent grid operator system updates called SDP_02, more battery energy storage assets are participating in trading and we have seen an increase in battery discharges, especially during peak hours with low wind output. On December 19, discharging batteries reached 430MW at 17:45 and met 6.8% of peak demand, reaching new highs. More in the battery section below and we also go into some wonky details about the updates in the latest Benchmarking Batteries issue.

High-level all-island stats

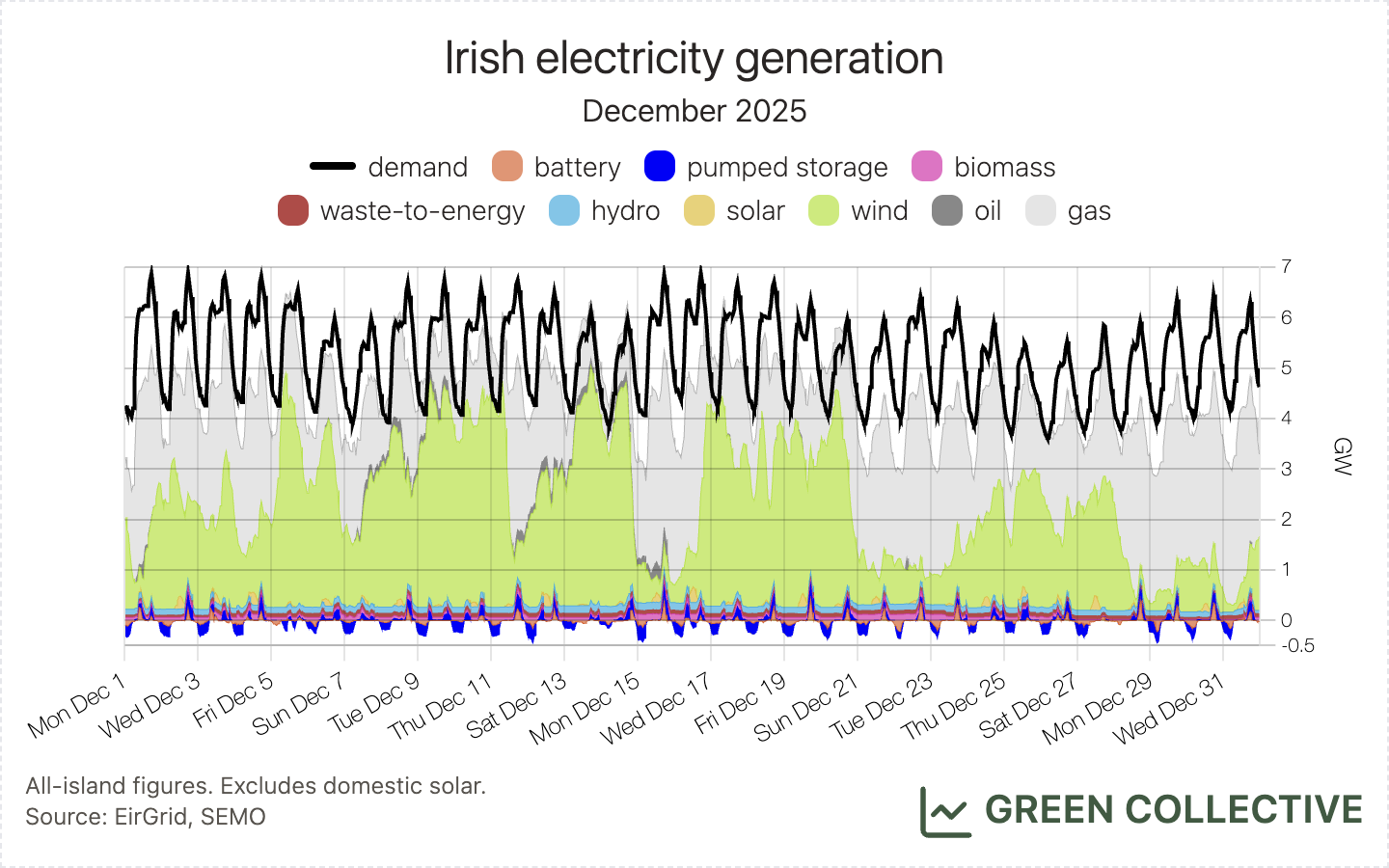

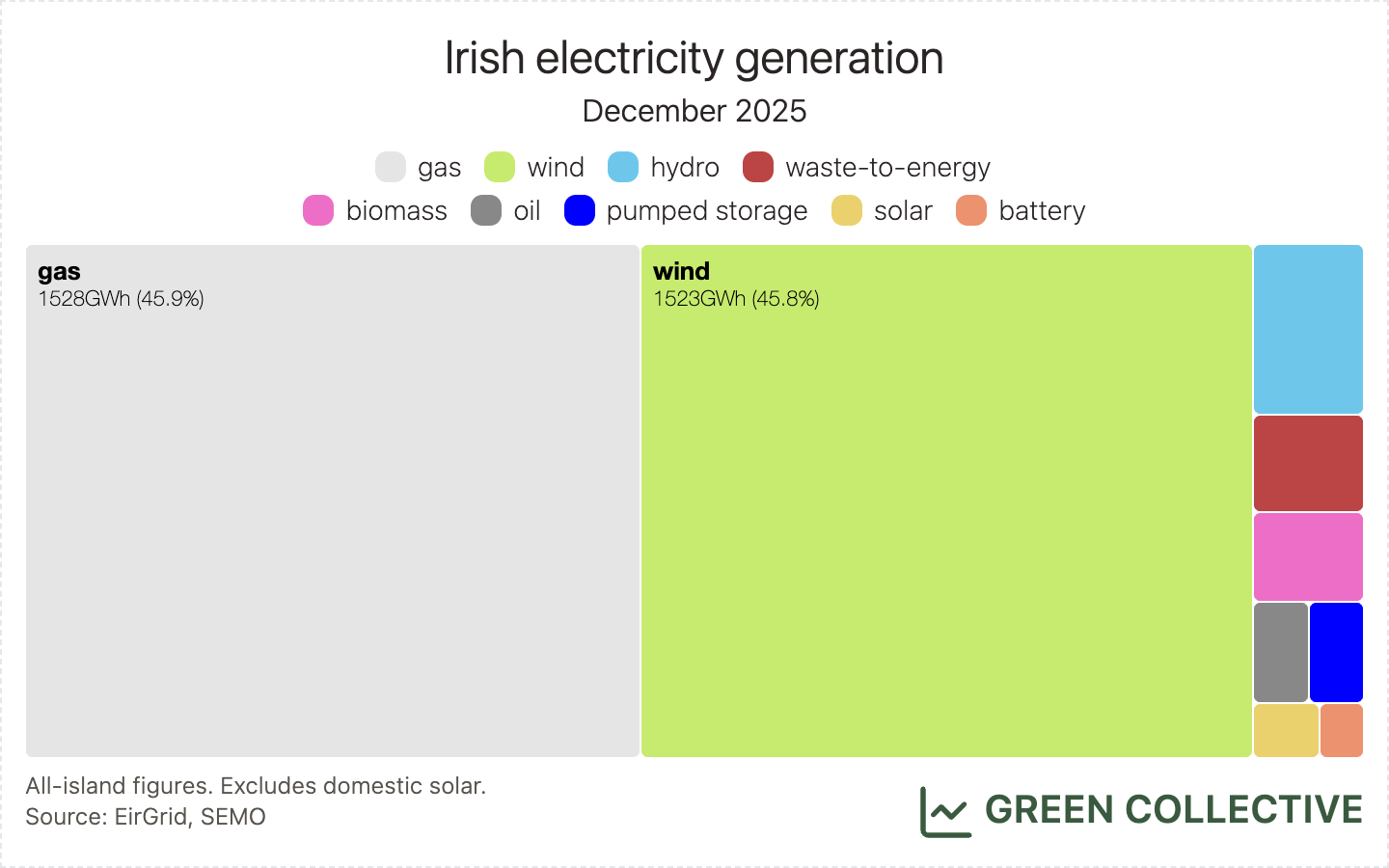

Electricity demand for the month totalled 3884.5GWh. This was the highest ever demand in a December month and the second-highest ever monthly total, behind only January 2025's 3912.6GWh. Year-on-year, this represented a rise of approximately 4% since December 2024.

Here's a breakdown of how much electricity demand each source met:

- renewable generation:

- wind: 39.2%

- hydro: 2.4%

- biomass: 1.2%

- solar: 0.5%

- fossil fuels:

- gas: 39.3%

- oil: 0.7%

- waste-to-energy: 1.4%

- discharging storage:

- pumped hydro: 0.7%

- batteries: 0.3%

Wind

1523.5GWh was the second-highest amount of energy generated from wind in a December month, just beating December 2024's 1518.1GWh. This was equivalent to 39.2% of electricity demand, about normal for a December month but down year-on-year – owing to rising demand – from December 2024's 40.6%.

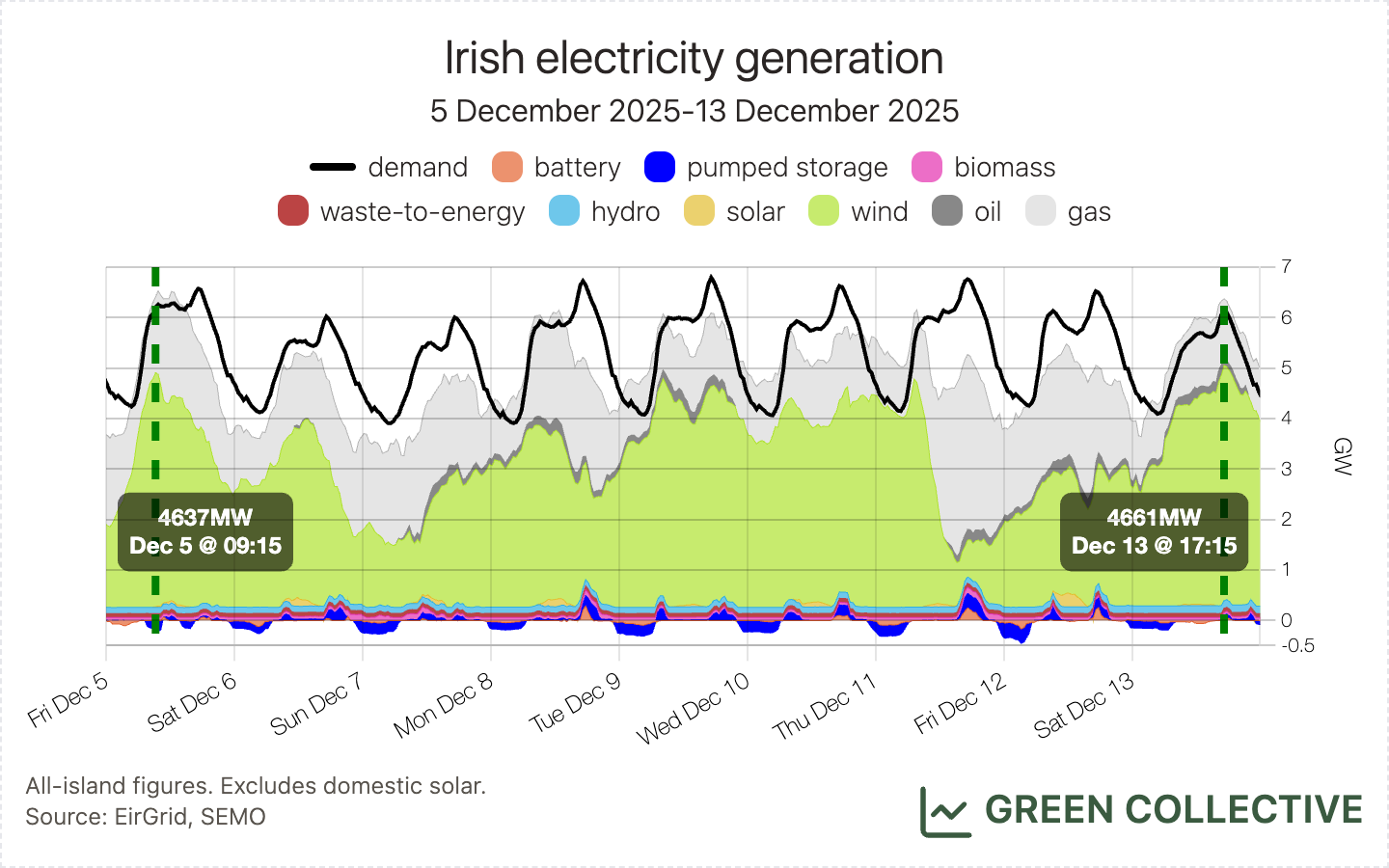

We saw new all-time highs for wind on the Irish grid during December – and not once, but twice: on December 5, wind output reached 4637MW and, barely a week later, on December 13, 4661MW.

It's a long time since this record was broken: the last significant record was December 6, 2023, almost exactly two years prior. Because it's a significant record and it's been so long, we wanted to drill down into what's changed on the grid over the past two years to allow this. Unfortunately, our analysis is severely hampered by a lack of data: SEMO still hasn't published availability figures for this time period (an ongoing issue which we cover later) but we can tell you a few things:

- If you didn't otherwise hear about this record, it's because it's an all-island record. While EirGrid and others sometimes put out press releases for Republic of Ireland events which are dutifully picked up by the Irish Times, et al, nobody is doing anything similar for Northern Ireland or the island as a whole (except perhaps yours truly).

- This was not a new high for wind in Northern Ireland, which hasn't seen a new wind output record since February 2022: that's almost three years. The chief reason is that electricity demand in Northern Ireland has been steadily falling.

- The record set on December 5, 2025 (4637MW) beat the previous record set in December 2023 (4624MW) by just 13MW. The December 13 record adds only another 24MW. During that time, wind capacity on the island increased by 471MW. That's also, unfortunately, not a lot – but we should be seeing wind peaking at 5GW by now.

- Both records were set on a Saturday. This is unusual because usually two conditions are needed for a wind record: high demand and as much exports as possible, to maximise the amount of available wind power that can be captured. While winter demand in Ireland is higher than summer, a weekend in December has some of the lowest winter demand – and exports weren't particularly high that day.

That's all we can confidently say for now. We very much look forward to analysing the dispatch down data for these days once SEMO finally makes it available!

Solar

It's a good thing the grand auld stretch has set in because 17.7GWh from utility-scale solar farms was equivalent to just 0.5% of electricity demand. While this was the most ever from solar during a December month, it represents only a 2% rise year-on-year from December 2024's total of 17.3GWh. We have generally seen year-on-year rises around the 50% mark for solar throughout 2025. We don't see evidence of much dispatch down; instead, we can see some solar farms, e.g. Meath's Gallanstown, operating well below their maximum capacity during December. We have been pointing out unexplained production "caps" at Gallanstown throughout 2025 and still don't know why.

Capacity-wise, ESB Networks announced in November that solar capacity in the Republic of Ireland expanded to 2.1GW. The press release didn’t provide further breakdown of capacity by different categories. However, based on public documents, here are the latest data points we gathered:

- Solar farms (utility-scale): 1142MW as of December 2025

- Rooftop solar (microgeneration): 664MW across 155,769 connections as of October 2025

These two categories of solar add up to 1.8GW of solar capacity in ROI. The 300 MW gap between our tally and ESB’s is due to the existence of additional categories of solar capacity, but no public data is available for such categories.

It’s important to point out rooftop solar now makes up about 1/3 of solar capacity in ROI and we can expect the scale of microgeneration to rise, as the SEAI rooftop solar grant will remain at 1800 euro for 2026. The impact of rooftop solar on the grid will be more significant, particularly during the next summer, so it’s crucial for ESB Networks and/or suppliers to release aggregate data on how much of rooftop solar generation is feeding back to the grid. The lack of visibility into how rooftop solar interacts with the grid remains the largest gap in solar data transparency in Ireland.

Storage

11.9GWh was by far the most ever discharged from batteries in a single month, comfortably beating the 8.6GWh discharged in both November and May. This is no surprise as December was the first full month following the launch of the second initiative of the Scheduling and Dispatch Programme (SDP_02) during November which we covered in detail in last month's newsletter.

Like wind, we saw the all-time high for battery discharge broken twice this month: on December 15 battery discharge exceeded 400MW for the first time, peaking at 402MW. A few days later on December 19 batteries reached 430MW. The second record was equivalent to 6.8% of electricity demand at the time, also a new record on the Irish grid.

(source: Green Collective Irish Grid Records Dashboard)

Keen readers will notice that even 430MW is well short of the approximately 1GW of total battery capacity on the island. Our most recent Benchmarking Batteries newsletter investigated this in detail; in short: we look forward to consistent operational advances in 2026 to more fully realise batteries' potential.

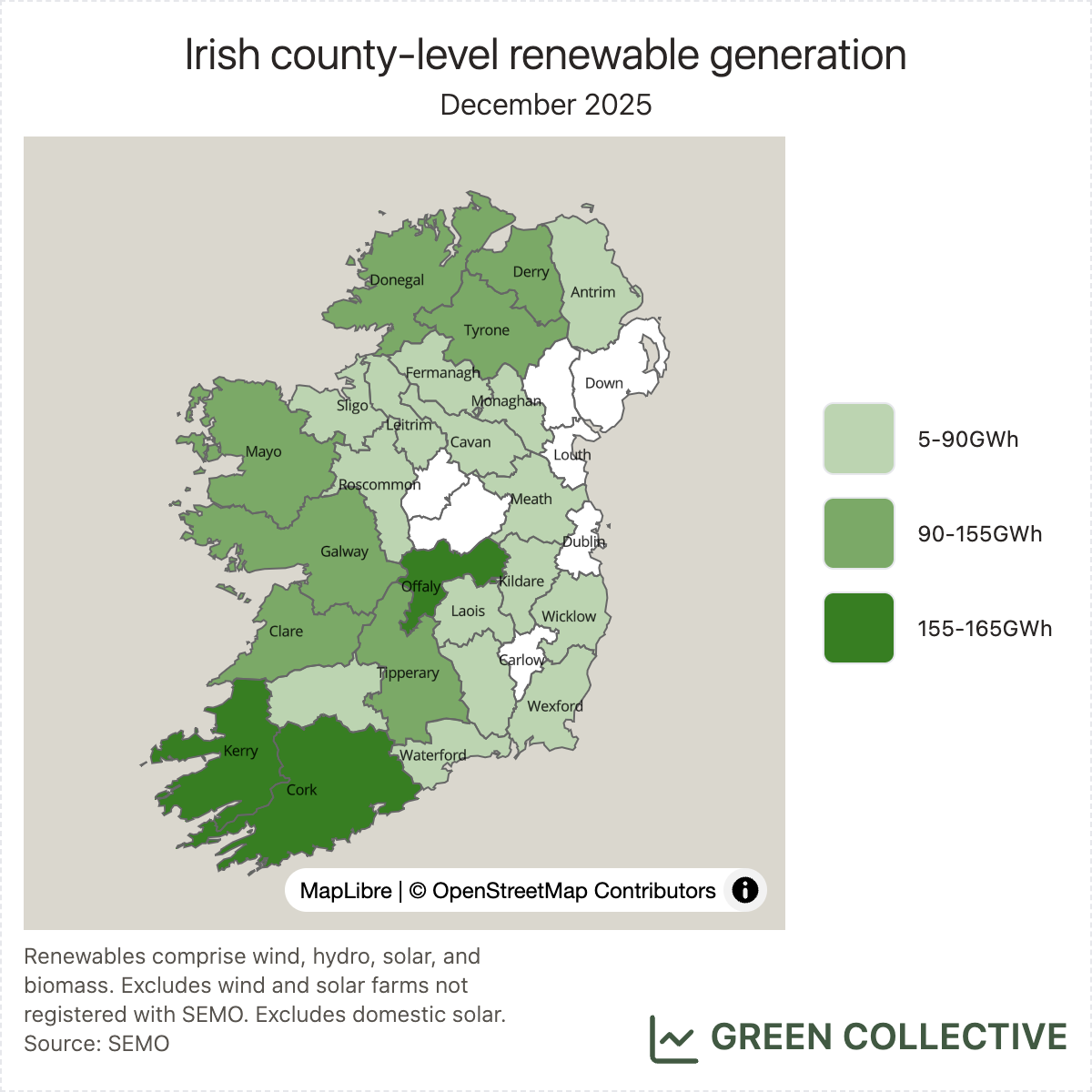

County-level analysis

During December 2025, the top five renewable-producing counties were:

- Cork

- Kerry

- Offaly

- Galway

- Derry

Although Kerry was top for wind power, Cork's solar farm at Lysaghtstown (the top solar farm on the island this month, in fact) along with the River Lee hydro plant gave it the edge for overall renewable generation. Offaly is home to several large wind farms and the biomass plant at Edenderry provides a large, continuous stream of renewable generation. Rounding off the top five renewable producers are Galway – home to Galway Wind Park, one of the largest wind farms on the island – and Derry, a regular "top five counties" wind producer since the summer of this year following the opening of Corlacky as well as home to the island's only other biomass plant at Lisahally.

To see the full ranking of counties by renewable generation in 2025 (more on this in the upcoming annual report), you can check out the latest map on our recently-revamped county dashboard.

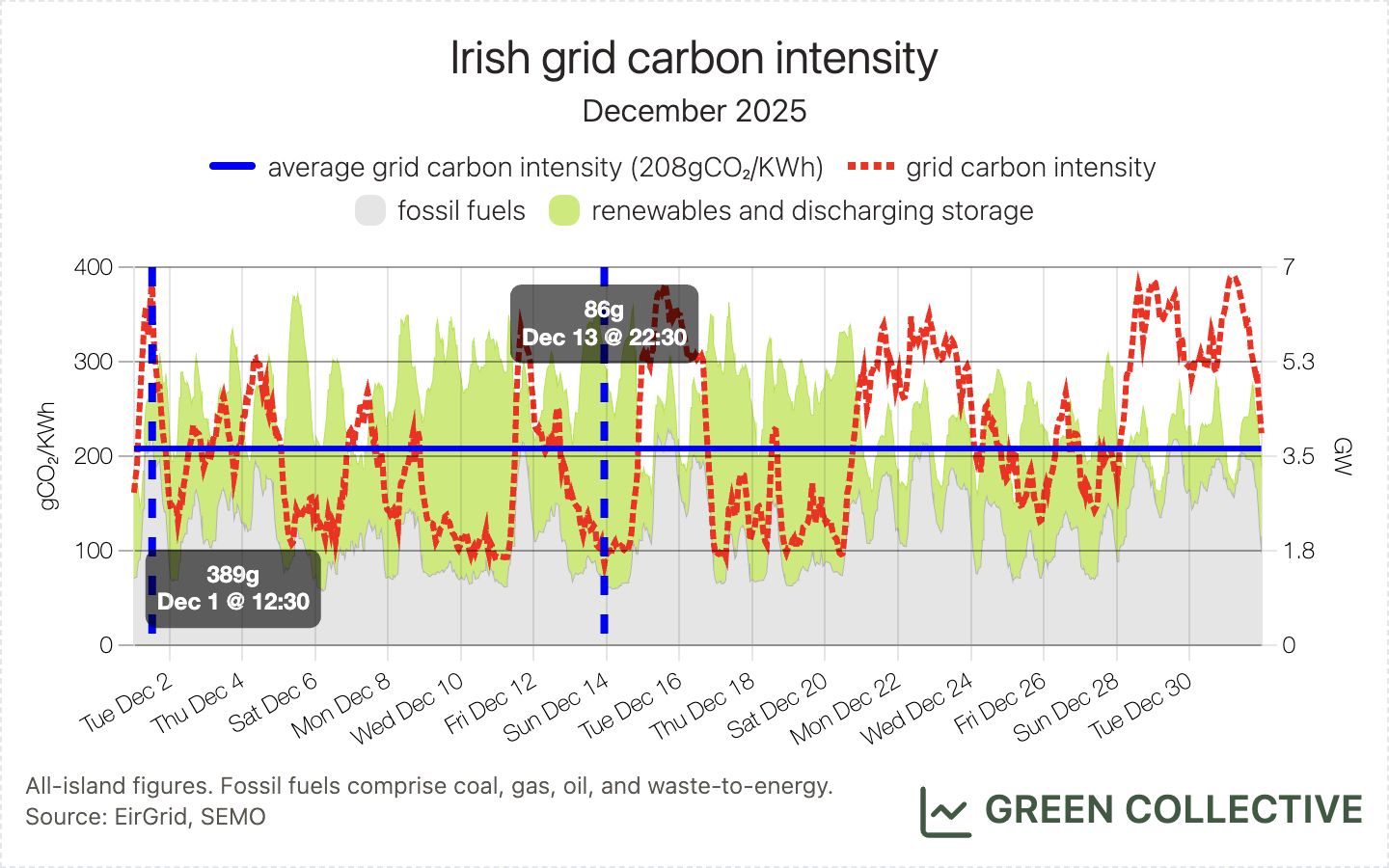

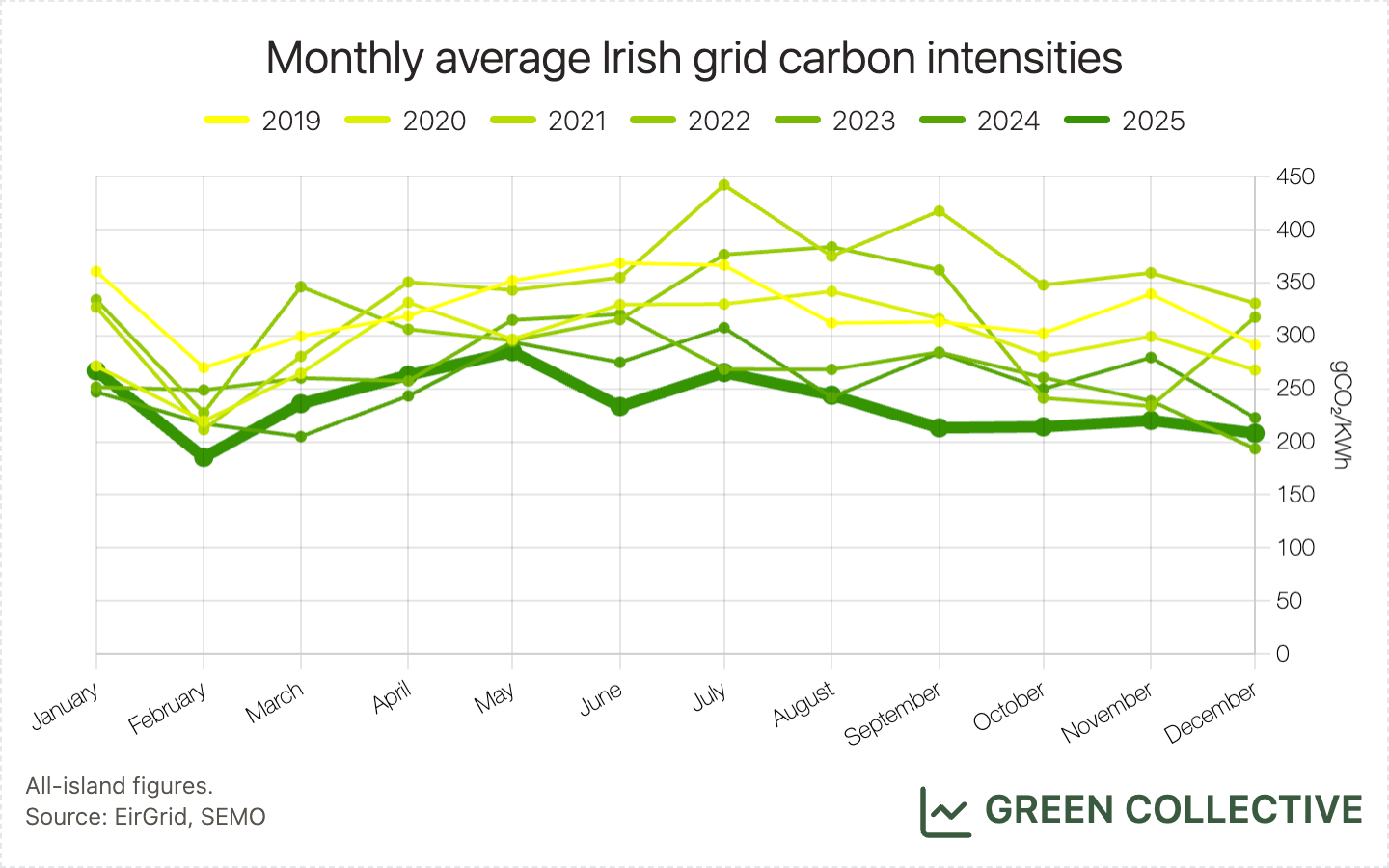

Carbon emissions

We estimate that during December 2025 the Irish grid emitted approximately 690,000 tonnes of CO₂, emitting between 86g and 389g of CO₂ for each kWh of electricity generated for an average grid carbon intensity of 208gCO₂/KWh.

This was the second-lowest average grid carbon intensity and CO₂ emissions for a December month, ahead only of December 2023's exceptionally low 193gCO₂/KWh, and unfortunately breaks the streak we had for the past four months where each month had seen the lowest CO₂ emissions for that time of the year – though not by very much.

Hatches & dispatches

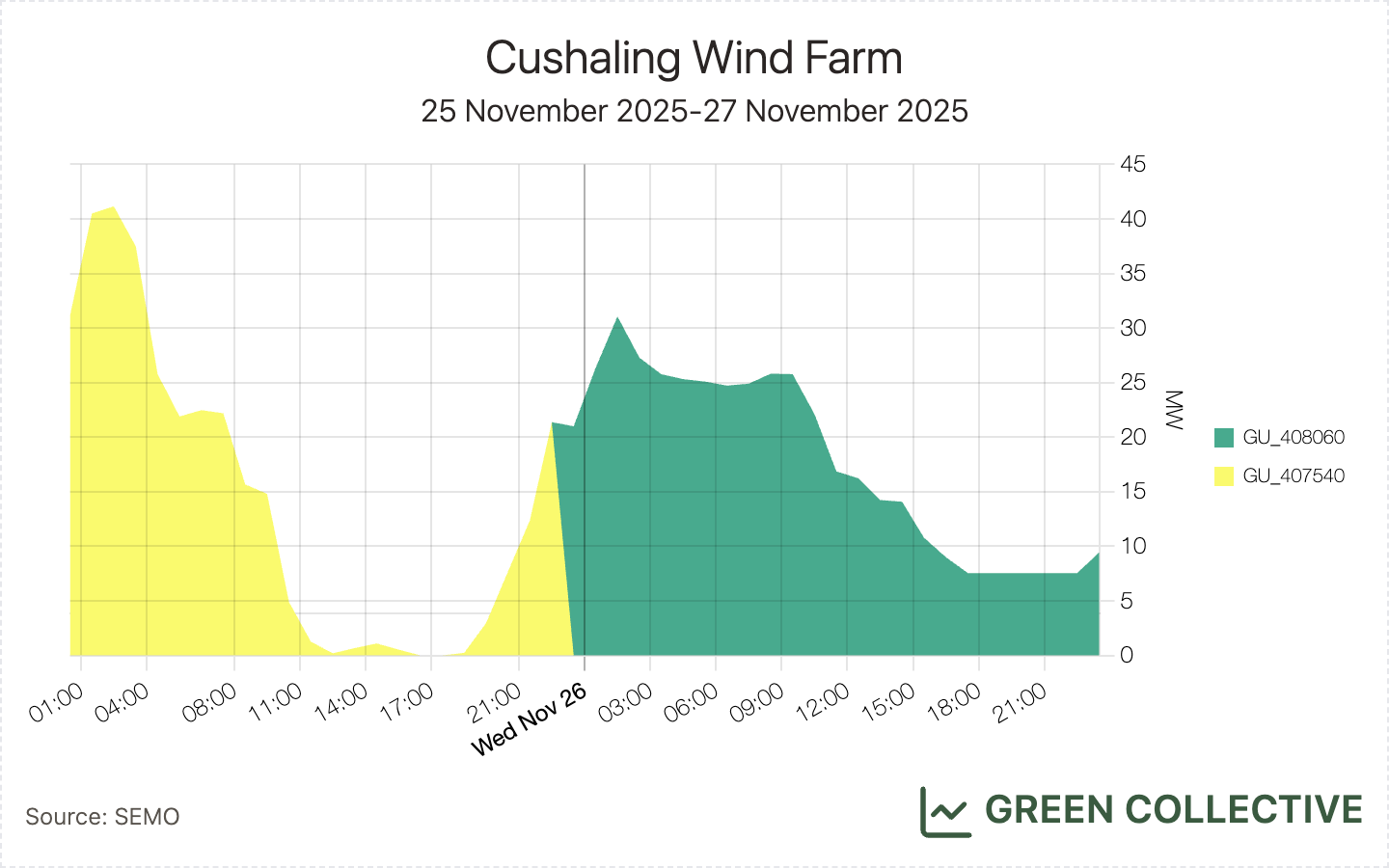

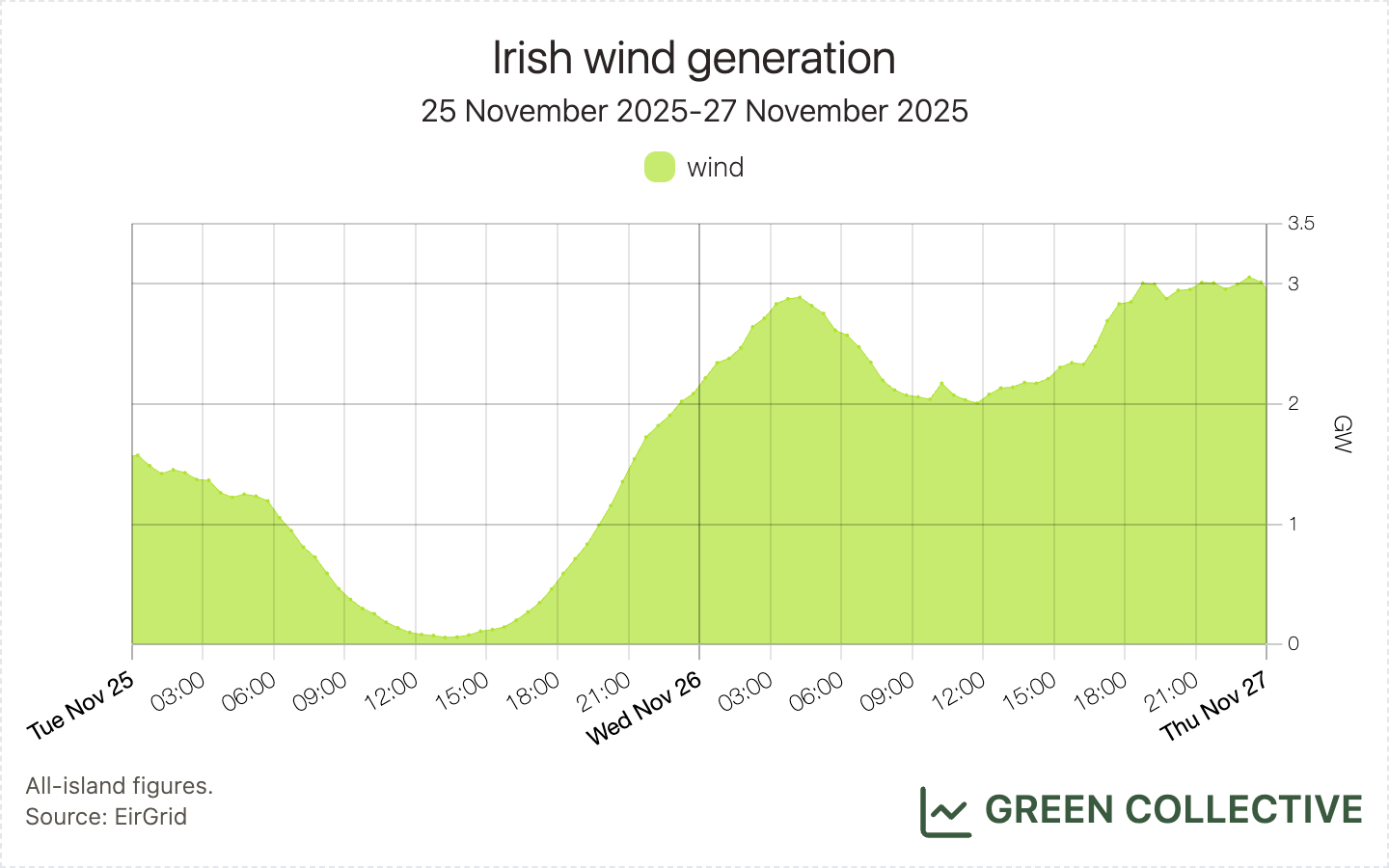

- Last month, we recounted our efforts to identify a new generating unit in

SEMO's publications. The answer was the wind farm at Cushaling in Offaly.

While our hunch that it was a re-registered unit proved correct, we had

discounted wind as a possibility. In our defence, it's unusual for such a new

unit to be re-registered and the charts below may illustrate how drastically

production at one wind farm can differ from the island as a whole. SEMO

eventually updated their directory, and thanks to everyone who reached out!

- Speaking of SEMO, following an unusually long wait for the daily publications we reached out to SEMO for clarification; with that query having gone unanswered, a little digging of our own uncovered metered generation in a new, ever-so-slightly different report. We tweaked our data pipeline…at which point the old report sprang back to life. The two formats spent the remainder of the month taking turns to stall for multiple days at a time. As it stands, unit-level metered generation data for December is only possible by piecing together four distinct reports. Thankfully, our pipeline is flexible enough to handle all this but it's maddening to consider the collective amount of wasted effort by other consumers of these feeds. And it's a similar story with dispatch down data. While we've generally found SEMO responsive to requests for historical data, other queries typically go unanswered — when something like this happens, we're unfortunately reminded of just how haphazard data transparency on the grid is on the island of Ireland.

- Two new renewable generators are now on the list of registered units by SEMO: Clonfad Solar in Westmeath and Ballylongford Wind Farm in Kerry. With 100MW of maximum export capacity, Clonfad will be the second largest solar farm on the island, only second to Gallanstown in Meath. The addition of Clonfad Solar brings the total capacity of solar farms to 1250MW: 1142MW in ROI and 108MW in NI.

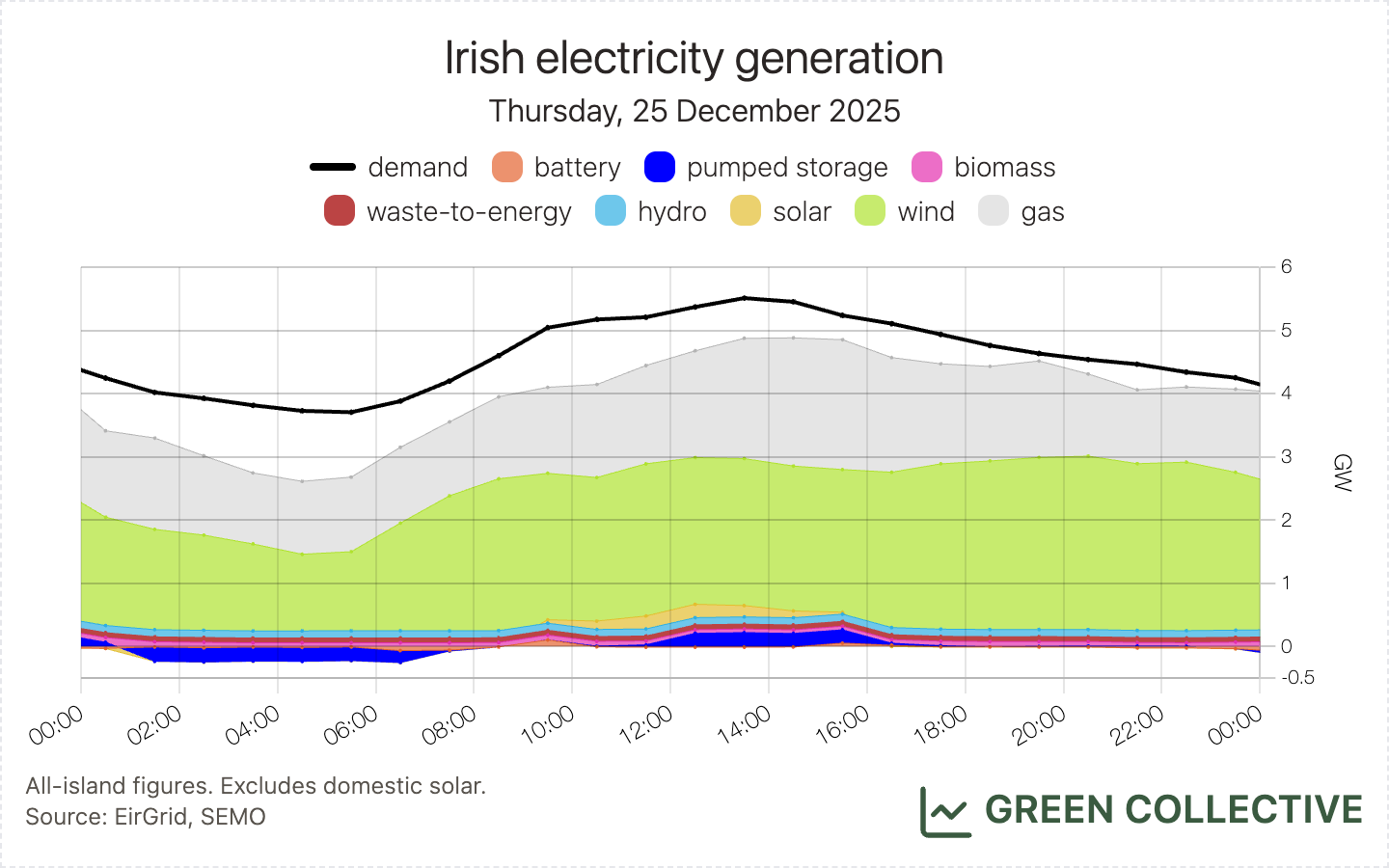

Holiday special: a fun discovery over Christmas

You might have seen this already if you follow us on Bluesky and/or LinkedIn: December 25 is just about the only day when electricity demand in Ireland peaks around lunchtime rather than in the evening (see below). When else can you expect this behaviour? Easter Sunday. No more evidence needed to demonstrate the Irish’s love for our roasts!