This article was first sent to our newsletter subscribers. To receive our monthly reports on the 1st of each month, subscribe now for free.

In case you missed it, we recently published our first subscriber-only post benchmarking batteries in Ireland. We have received some valuable feedback and will be making this a monthly series, available to subscribers. The next update of this series will include July 2025 data and comes out in mid-August. If you have any questions or comments about our battery benchmarks and indices, please don't hesitate to reach out to us.

Now onto the July recap!

Summary

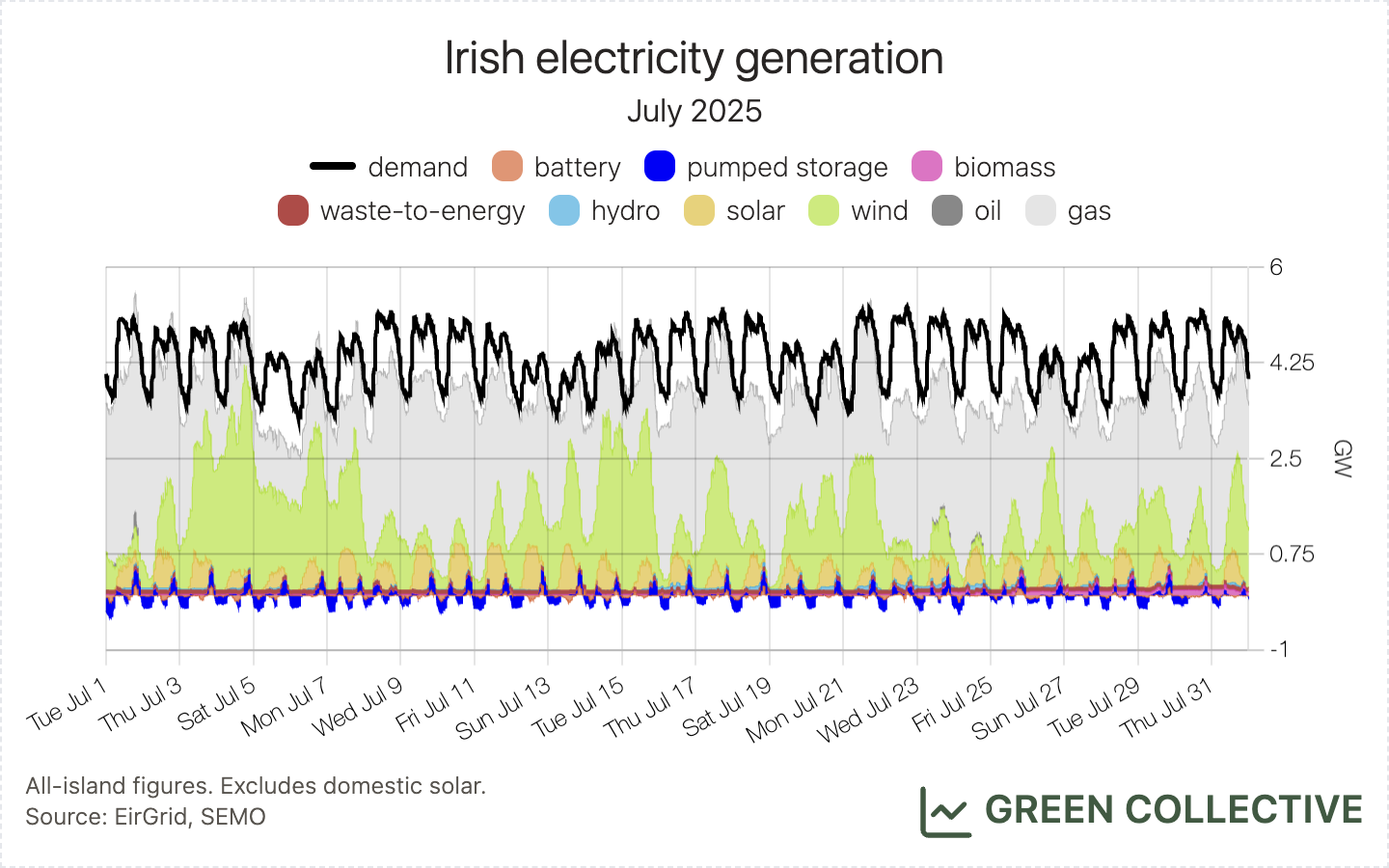

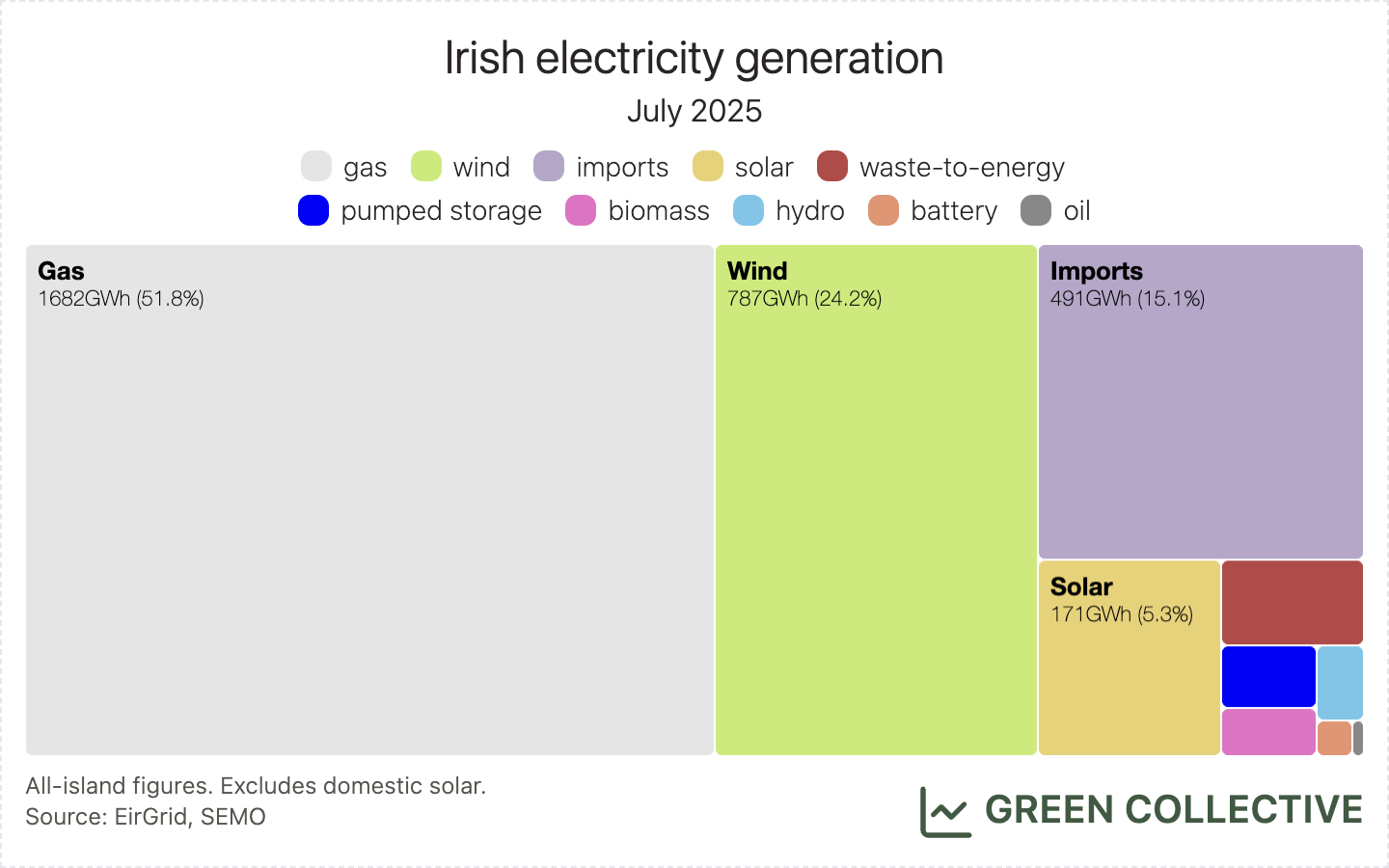

During July 2025, renewable generation was equivalent to 30.7% of all-island electricity demand, the third-highest share for renewables in a July month. Fossil fuel generation was equivalent to 53.7% of electricity demand, the second-lowest share in any July month for which we have data (that's 2019 onwards). Imports met 15.1% of demand, a figure we would have expected to be higher – reducing fossil fuel generation further – given that the new Greenlink interconnector pushed imports' share of demand to approximately 20% during May and June.

Wind

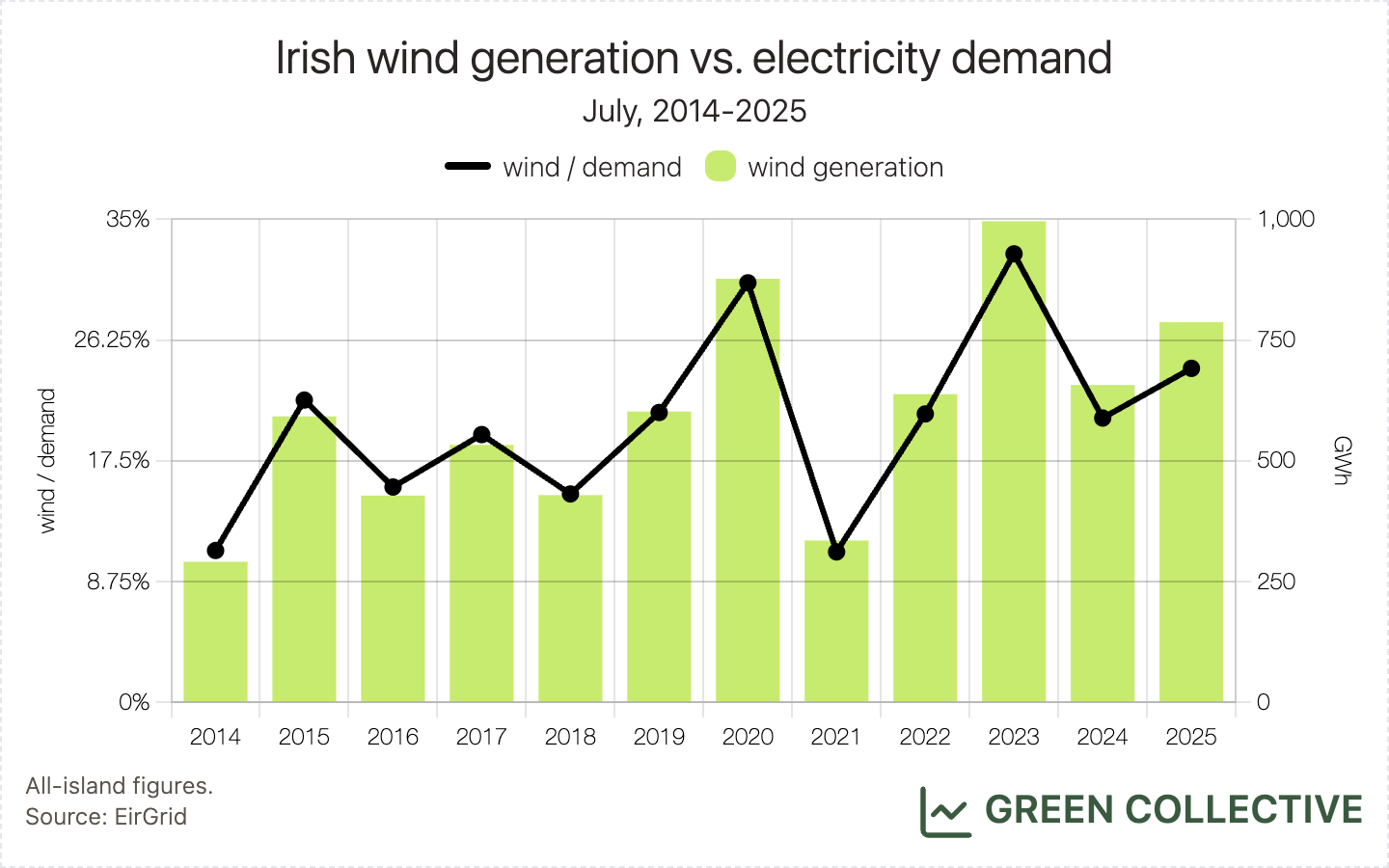

While 786.9GWh from wind was up noticeably year-on-year from July 2024, this was only the third-highest monthly total for wind in a July month and significantly behind both 2023's 876.9GWh and 2020's 995.9GWh. This was equivalent to 24.2% of the month's all-island electricity demand: the third-highest monthly ratio for wind in a July month but, again, significantly behind 2023's 30.4% and 2020's 32.5%.

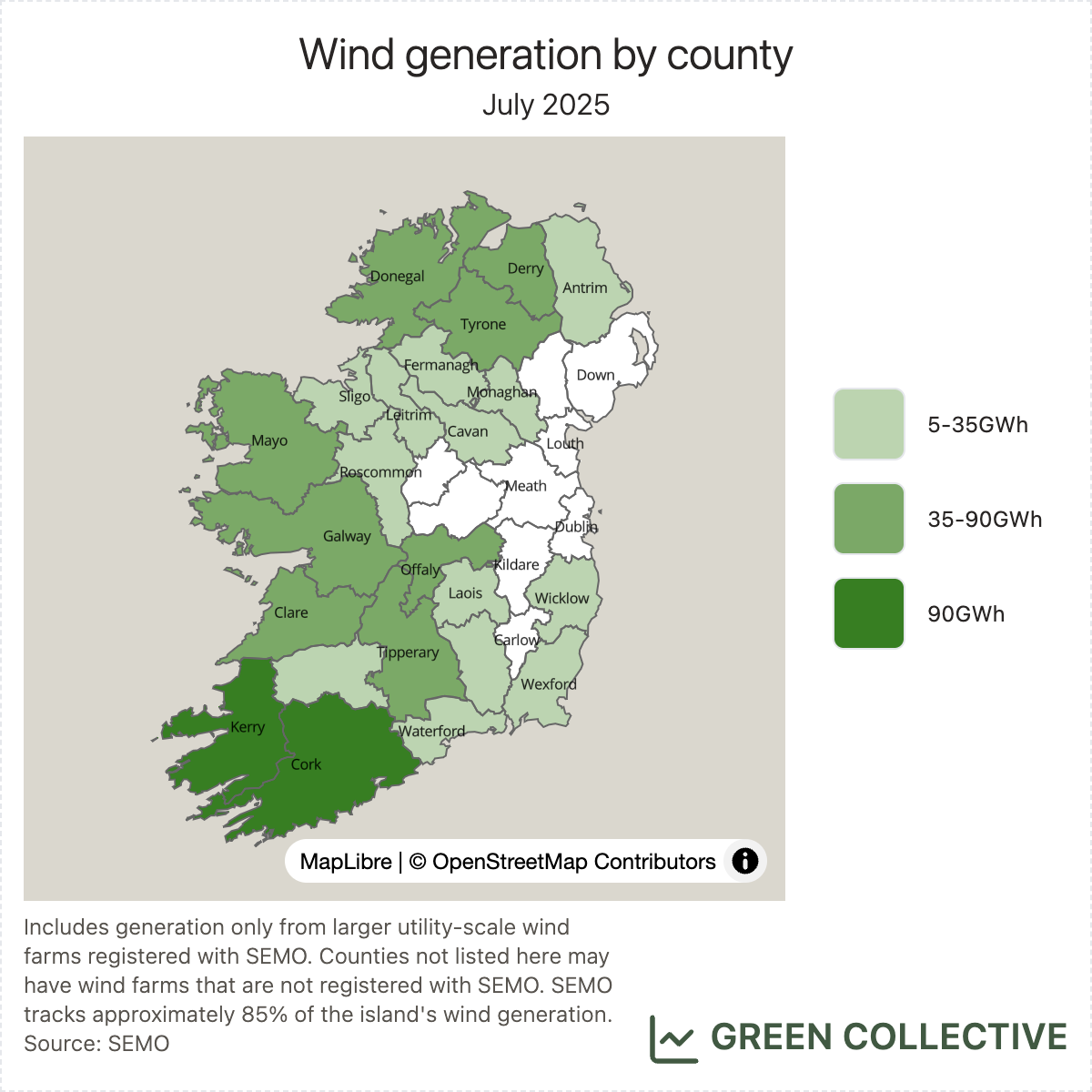

The top wind-producing counties during July 2025:

- Cork (90GWh)

- Kerry (88GWh)

- Offaly (54.9GWh)

- Galway (53.7GWh)

- Mayo (52.8GWh)

Cork tops the table for the first time since January. For only the second time ever, Offaly reaches #3 (the first time, coincidentally, was also in January). Offaly has been a regular in the top #5 since December 2024 and what may have made the difference this month was that Galway Wind Park – the #2 wind-producing wind farm so far in 2025 – seems to have been offline for several days during July.

Solar

171.2GWh was the second-highest total for solar in any month, exceeding last month's 155.7GWh but well short of June 2025's 193.9GWh. This was equivalent to 5.3% of the month's all-island demand; again, ahead of June's 4.9% but well behind May's 6%.

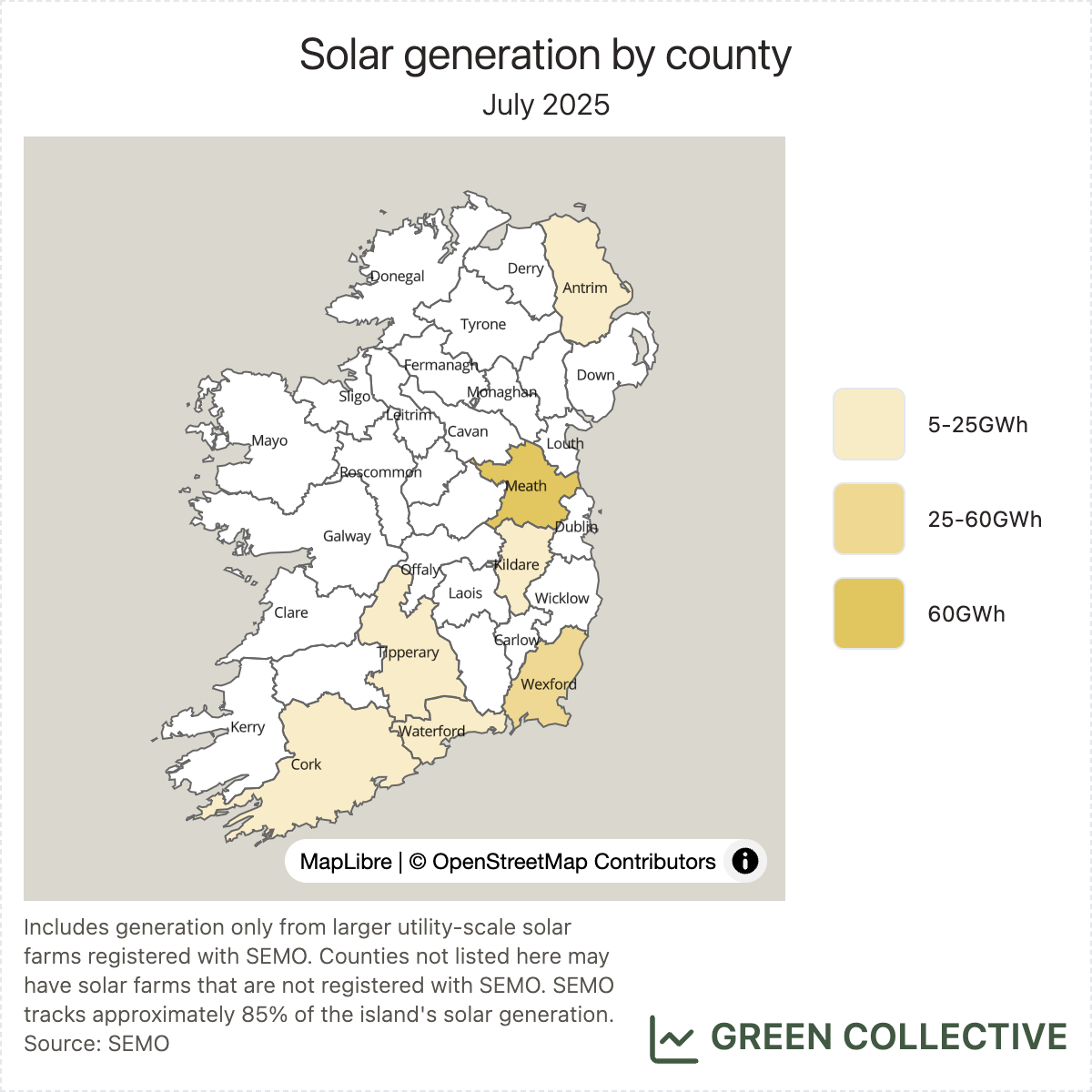

The top solar-producing counties during July 2025:

- Meath (59.3GWh)

- Wexford (26.5GWh)

- Cork (17.5GWh)

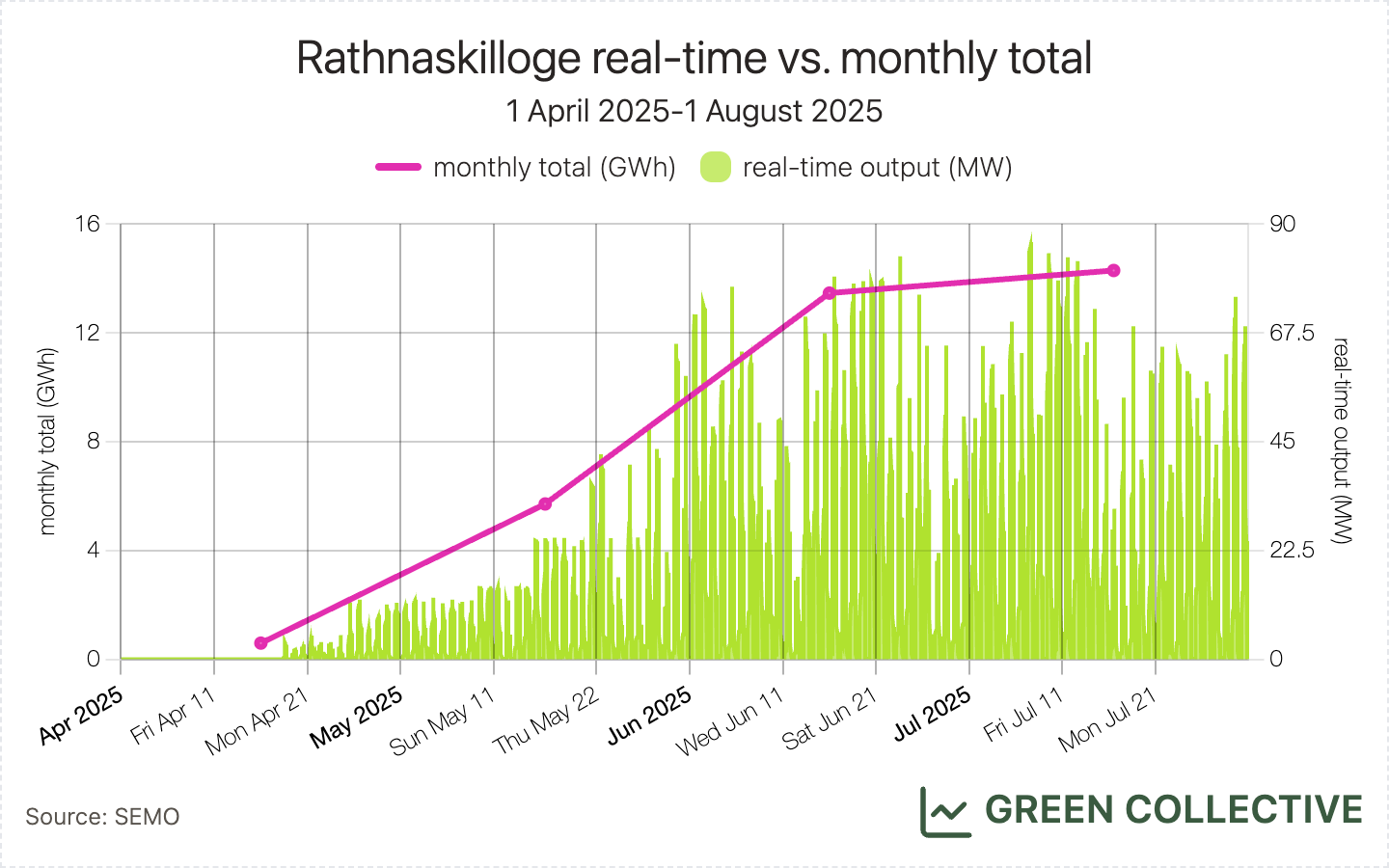

The county rankings are unchanged since March, when Kildare briefly displaced Cork to enter the top three. Although Kildare's Dunmurry Springs started exporting towards the end of July, its final capacity of 12MW is unlikely to help Kildare re-enter the top three anytime soon, particularly now that Rathnaskilloge in Waterford has started reaching peaks of almost 90MW. That one solar farm has propelled Waterford into the top five for two months running now. Both Dunmurry Springs and Rathnaskilloge featured in last month's newsletter.

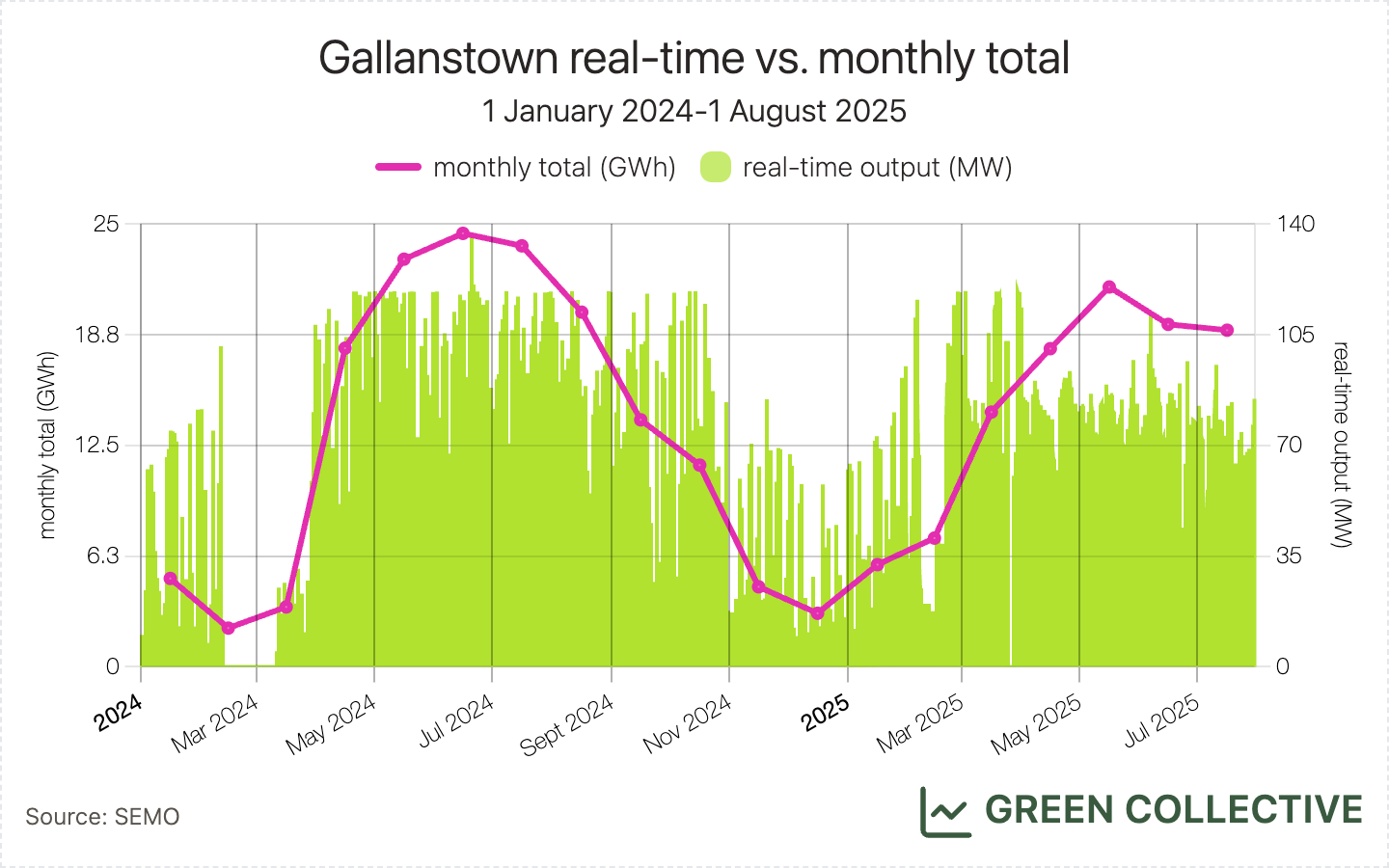

Speaking of larger solar farms, we note that several larger solar farms in Meath continue to produce significantly less than last summer. This is particularly noticeable at Gallanstown: although it's still the highest-producing solar farm on the island, peak output there seems to have fallen from 120MW during summer 2024 to about 95MW in 2025.

We first highlighted this in our May newsletter and we wonder if this – and not just the poorer weather – is one reason why July was the second month in a row that solar generation did not virtually double year-on-year (July 2025's 171.2GWh representing a 36% growth from July 2024's 127.3GWh) despite some new large solar farms such as Rathnaskilloge having come online this summer. Again, if you have any information on this we would love to hear from you.

Storage

Discharging batteries totalled 6GWh, with a peak of 211MW on July 12 equivalent to 4.8% of demand at the time. This was approximately the same total discharge as June, and both June and July fell well short of the all-time monthly high of 8.4GWh set during May. Unlike June, however, winds were not particularly strong during July and so we don't have a good theory on why battery discharge was lower. The need for improved control systems on the grid is clear; unfortunately, as we wrote about last month, the new schedule and dispatch system originally scheduled for launch in June has been pushed back to at least November.

CO₂ Emissions

Fossil fuel generation during July comprised almost entirely gas: oil generation totalled just 2GWh and, as we reported in detail last month, coal generation in Ireland ended during June. While this of course has the effect of simply shifting at least some coal generation to gas (indeed, July's gas total was almost exactly the sum of July 2024's gas and coal generation), gas burns cleaner than coal; we rate gas' CO₂ intensity at less than half that of coal.

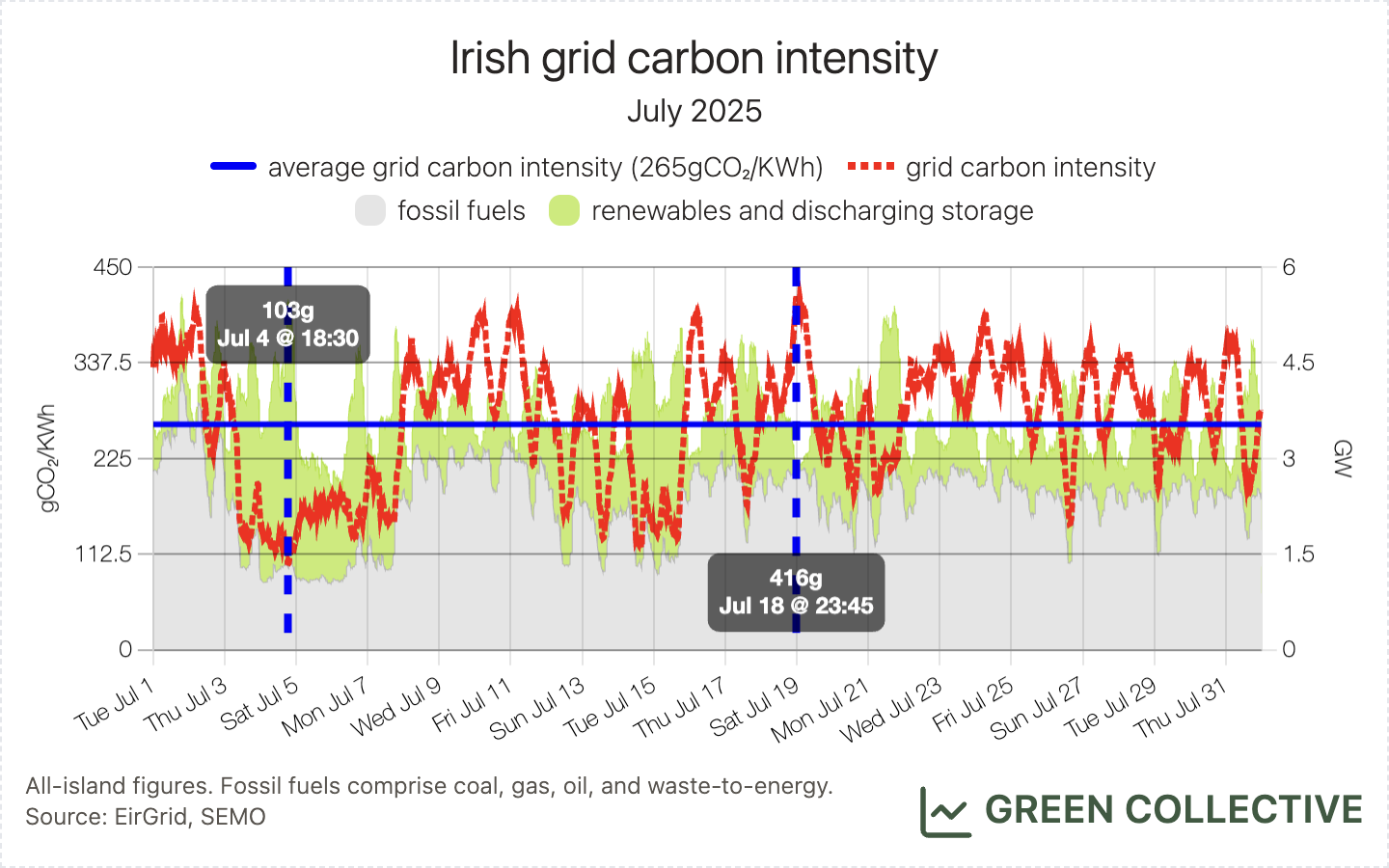

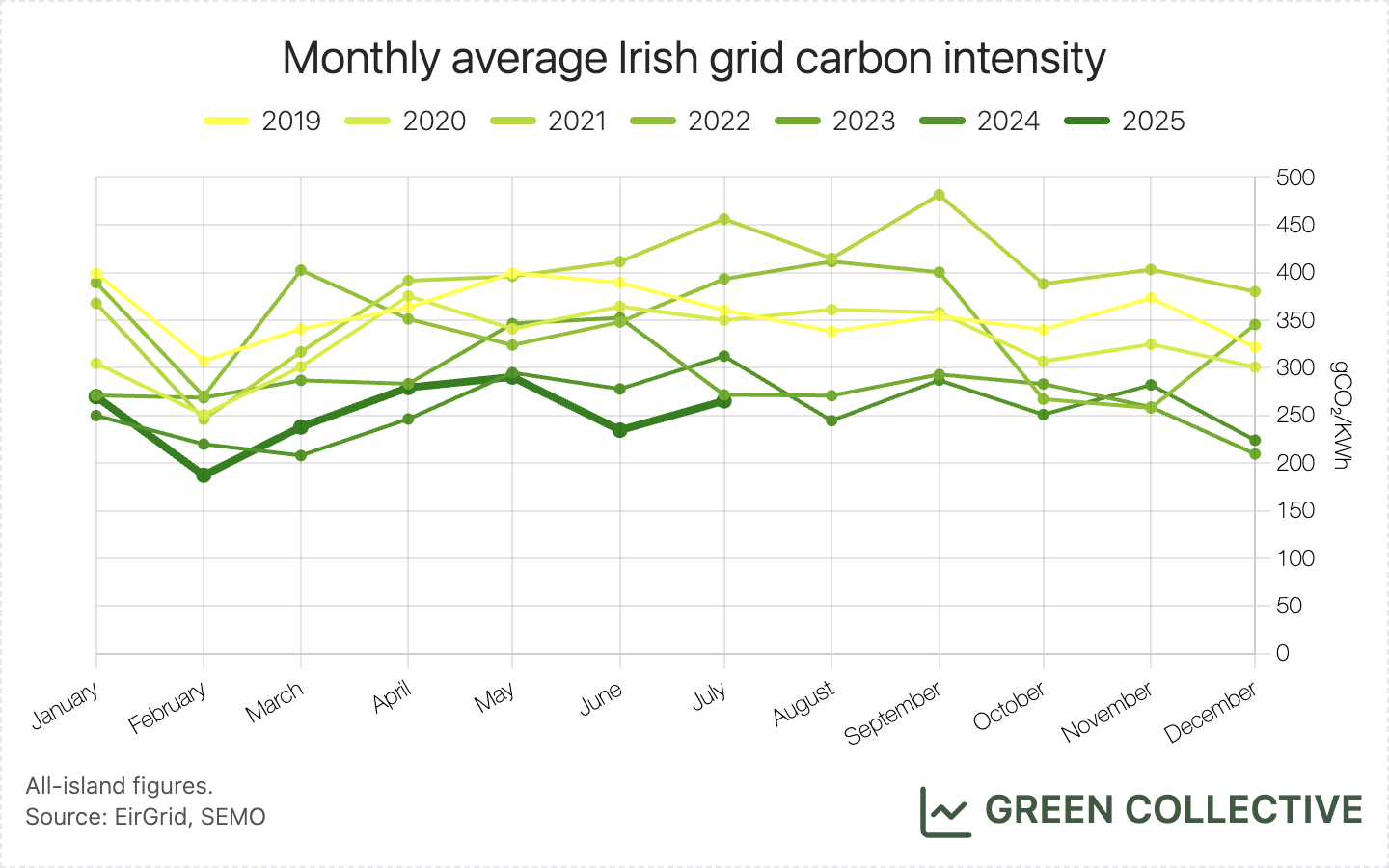

We estimate that for each kWh of electricity generated during July 2025 the Irish grid emitted between between 103g and 416g of CO₂, for an average of 265gCO₂/kWh. This was the lowest monthly average grid carbon intensity yet seen during a July month, beating July 2023's 272gCO₂/kWh. That high for the month of 416gCO₂/kWh was also (bear with us here, this is a little tricky to phrase) the lowest ever high for a July month and, in fact, only a little higher than the lowest ever monthly high of 405g set during February of this year. This we can likely attribute directly to the elimination of coal: regular readers will know that over the past year or so we've seen grid carbon intensity plumbing new depths multiple times when (and only when) Moneypoint was offline.

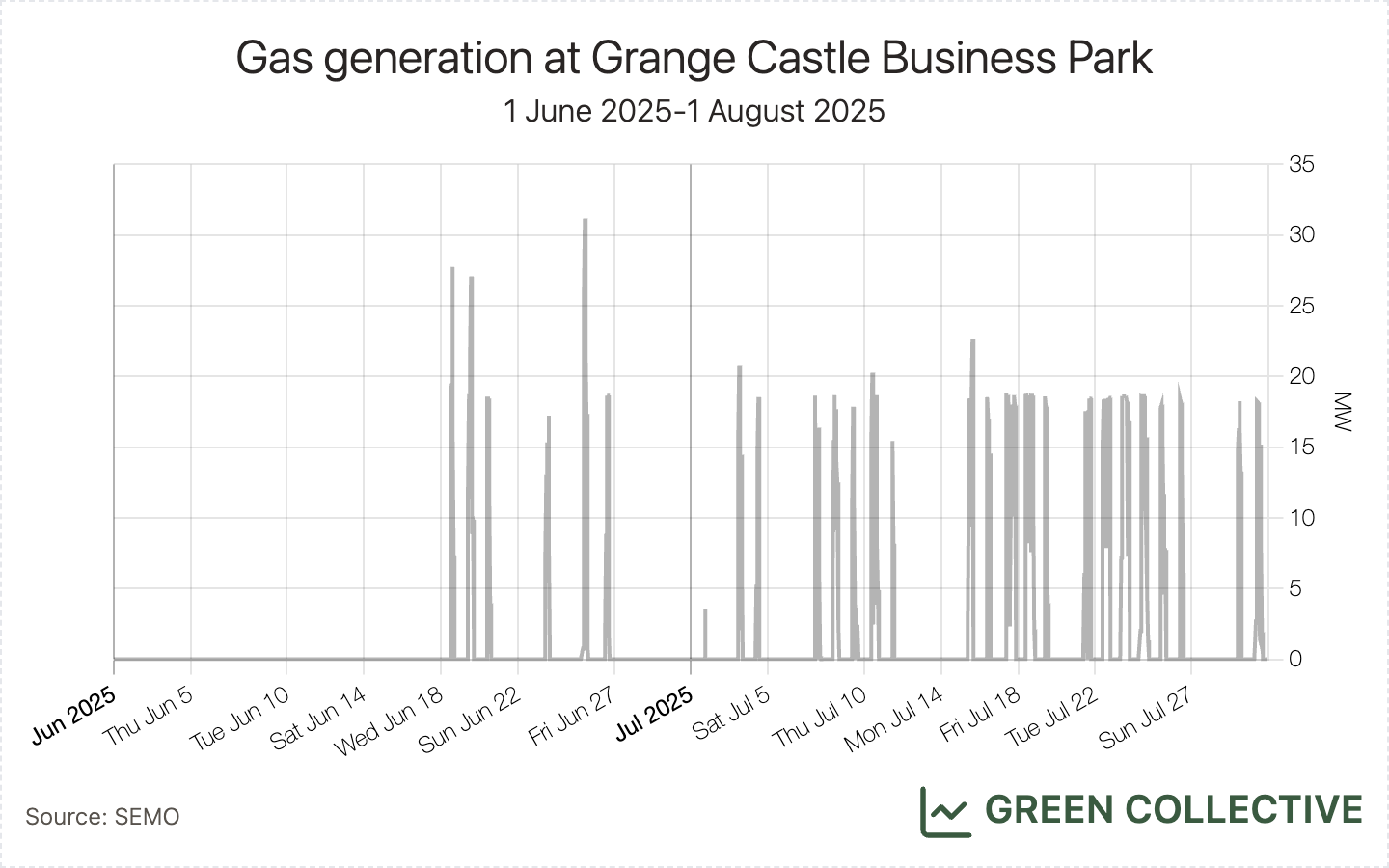

Last month, we reported that gas generation had begun at Grange Castle Business Park (in our newsletter, we incorrectly stated that generation occurred on only one day during June; it did in fact occur on multiple days, as now corrected on our website). Activity there continued through throughout July, albeit with lower peaks of just under 20MW.

Imports/exports

The island imported 491.1GWh of electricity, enough to meet 15.1% of electricity demand. This was down from the past couple of months when approximately 20% of demand was covered by imports; this looked to be the new normal in the first summer of operation of the new Greenlink interconnector and a welcome one given the relatively low summer wind generation. However, July 2025's share was, in fact, lower, year-on-year, than July 2024's back before Greenlink came online.

Hatches & Dispatches

A total of four new units showed up in SEMO's database: two battery assets and two wind farms.

- The second phase of Shannonbridge BESS in Offaly with a capacity of 63.2MW/160MWh, indicating 2.5 hours of duration, is now registered with SEMO as a generator. The previous phase of Shannonbridge BESS, online since 2021, has a total capacity of 100MW/60MWh.

- The Cushaling battery and wind project, also in Offaly, registered as Ballykilleen BESS and Ballykilleen Wind Farm, joined the registered unit list towards the end of the July. The battery has a capacity of 20MW/80MWh, marking the energisation of the first 4-hour grid-scale battery in Ireland. We will be covering the revenue streams of this new storage asset in our battery benchmarking series and it will be interesting to see if its co-location with a wind farm influences the battery storage system's behaviour.

- Corlacky Wind Farm in Northern Ireland is also a new addition to the grid in July 2025. The wind farm is located in Derry with a capacity of 47MW. Amazon has signed a PPA for energy produced there.

Help Needed: Private Wires & Data Centres

A significant policy update in July 2025 was the Government's publication of the Private Wires Policy Statement. After perusing the source document and news coverage that followed, it seems to us the biggest impact from this step change will be on large energy users, namely data centres. The next step would be for the Government to introduce legislation to permit private wires, likely in 2026. If private wires do become a reality in Ireland, data centres would have the option to meet the ever growing demand with a combination of renewables, storage, and electricity distribution infrastructure without entirely relying on grid connections.

However, this policy change should not be viewed in a vacuum. Specifically it should be analysed side-by-side with the CRU's large energy users connection policy, published in February 2025. In that decision paper, data centres are required to build on-site generation to reduce their strain on the grid, but they are also allowed to rely on fossil fuels, whether it’s connecting to the gas network or using backup generators. They are required to report their emissions, but there are no penalties for emissions caused by the increasing reliance on oil and gas.

When we read the policy statement on private wires, our main question is: does the availability of private wires present enough incentives for data centres to favour wind/solar/storage over oil/gas-fueled backup generation? We do not claim to have a clear answer and would like to see if any our readers have insights. If you work in the data centre industry and/or have knowledge that might help us answer this question, please do reach out to us. Many thanks!