This article was first sent to our newsletter subscribers. To receive our monthly reports on the 1st of each month, subscribe now for free.

The year's half over already! It's been an eventful year on the Irish grid so far and June sums this up perfectly with both the end of coal generation and the first court-mandated (partial) shut-down of a wind farm announced this month. We explore both announcements in depth later but, first, we thought it was time for a little summary of the past six months...

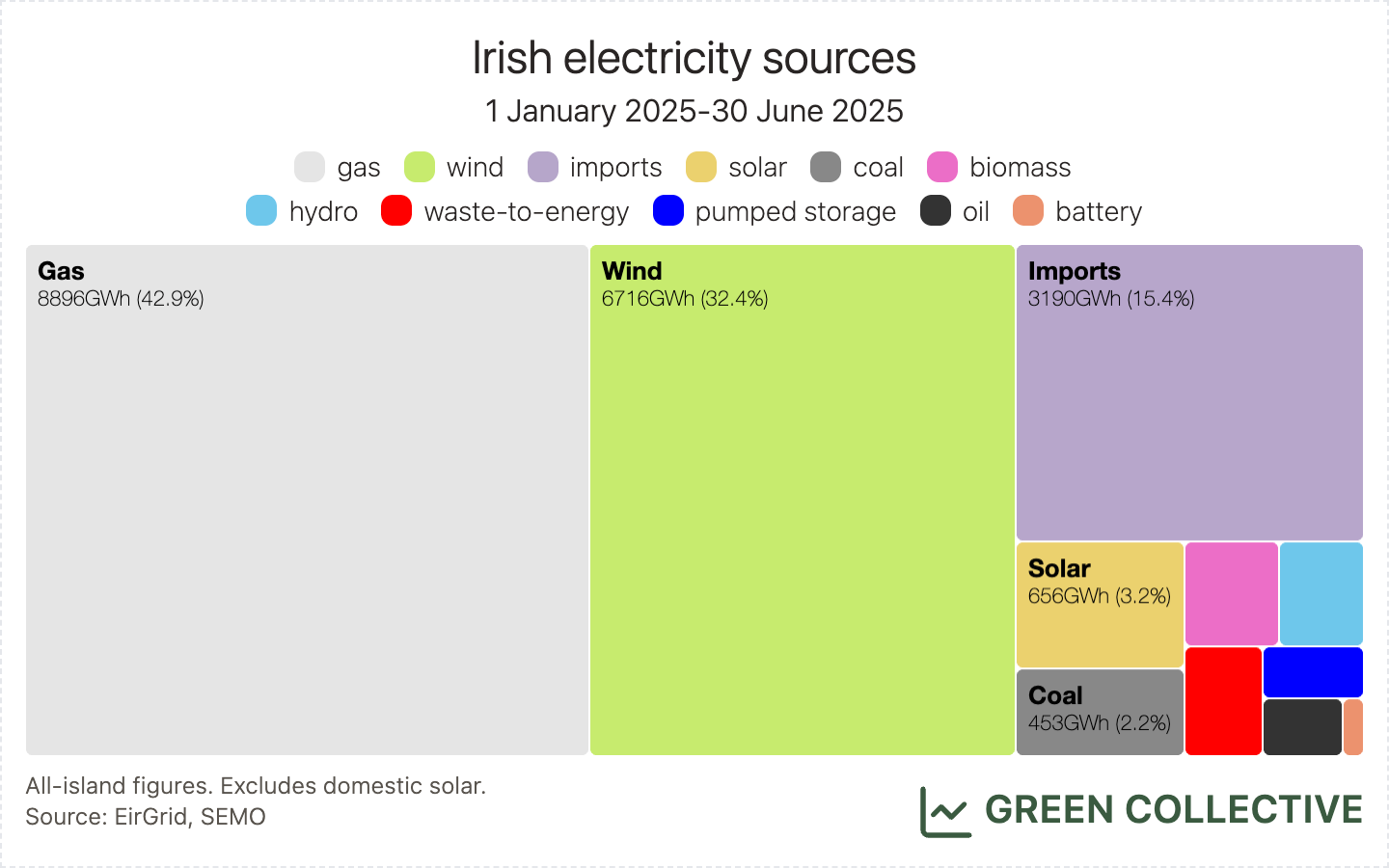

During the first half of 2025, renewables supplied 38.3% of all-island demand:

- wind: 32.4%

- solar: 3.2%

- biomass: 1.5%

- hydro: 1.3%

This was strong but not record-breaking renewable generation; however, 2025 has definitely been the greenest yet for the grid thanks to two of the most notable changes over the last six months:

- The Greenlink interconnector commenced full operations officially in February.

- Ireland bid farewell to coal in June.

Now onto our recap of June 2025!

Summary

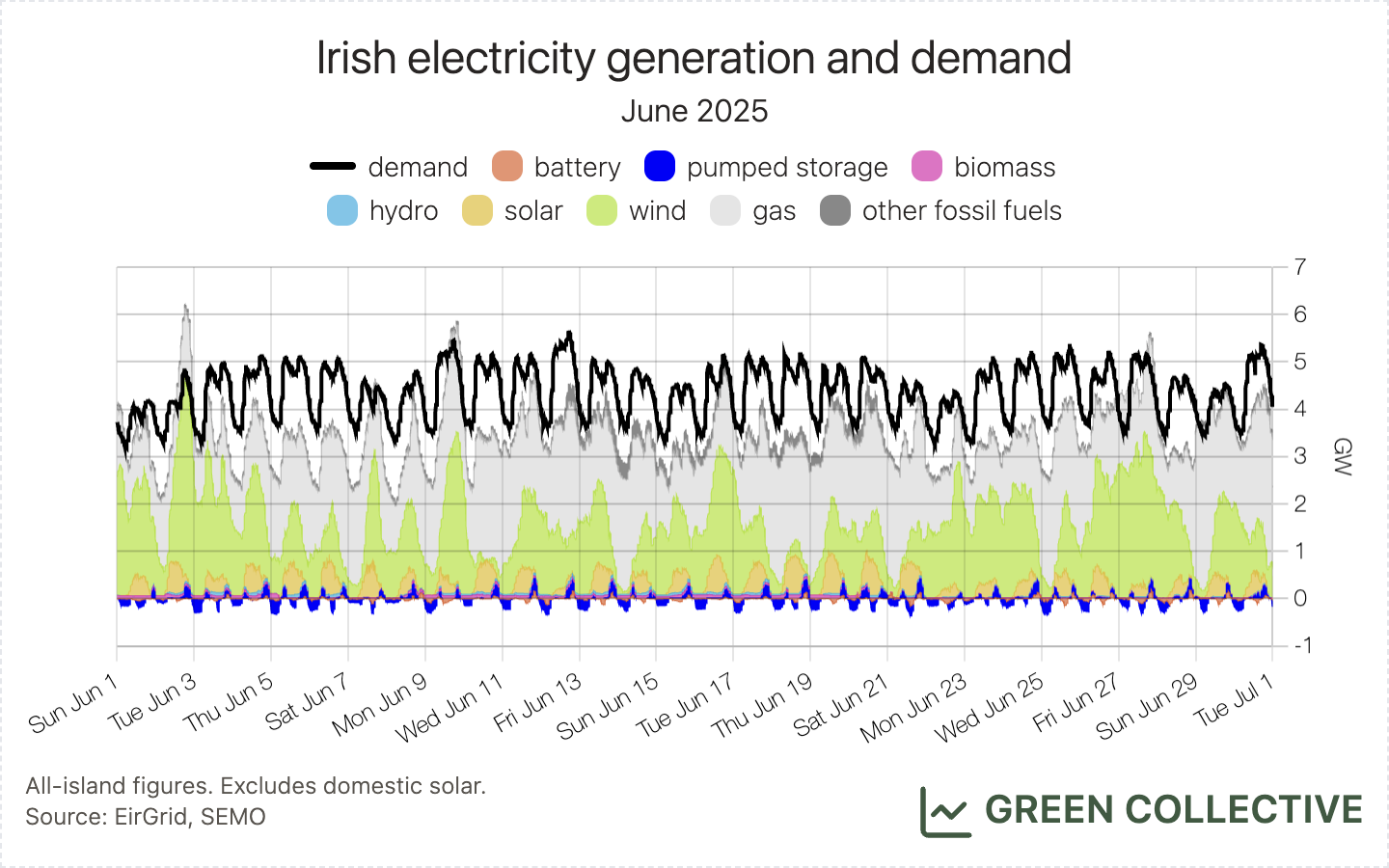

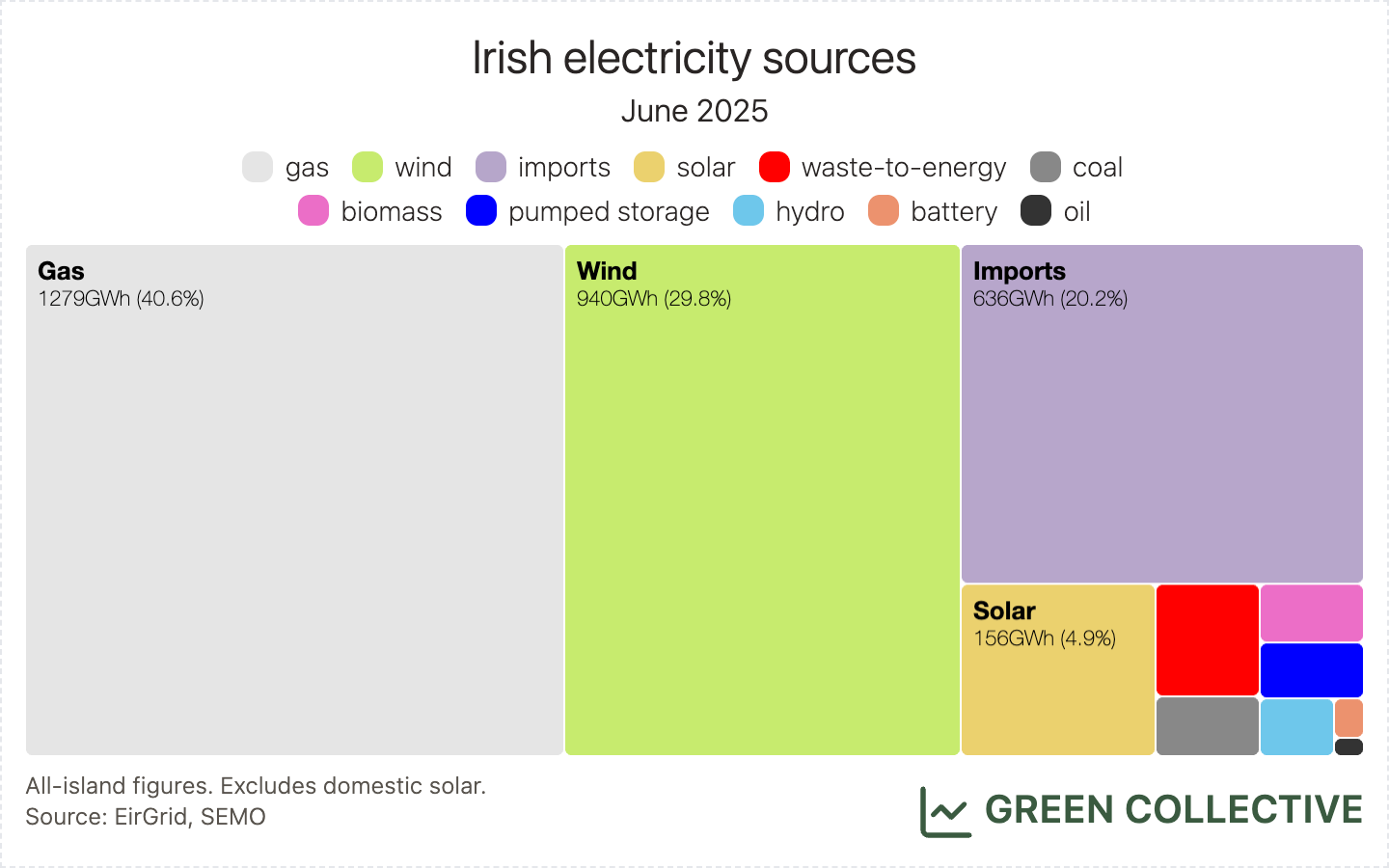

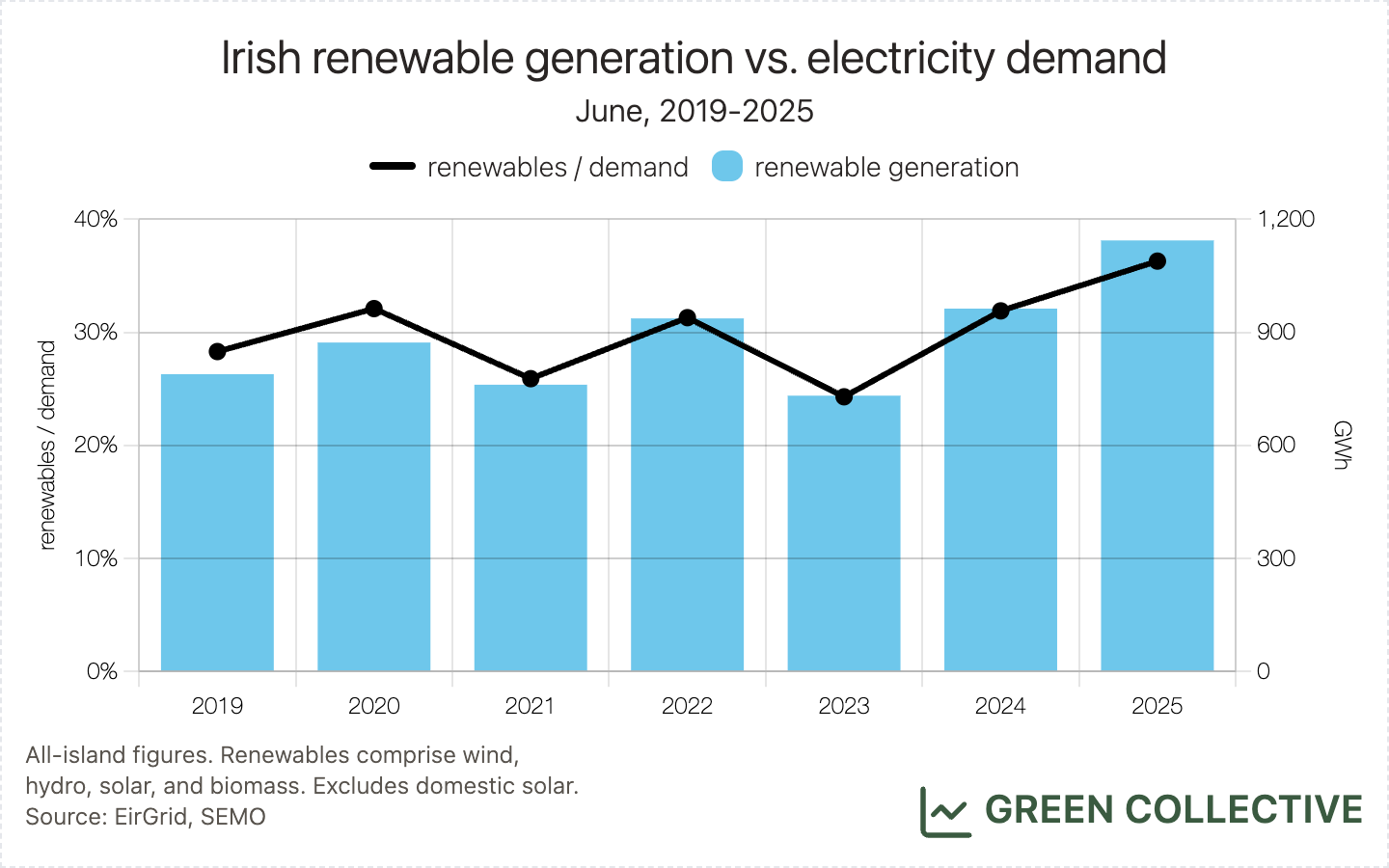

Renewable generation during June 2025 exceeded 1TWh for the first time in a June month, equalling 36.3% of all-island electricity demand; one of the highest monthly shares we've seen in a "summer" month (May through August, when solar generation in Ireland is at its highest). Fossil fuel generation equalled 43.3% of demand, the lowest monthly share we've ever seen for fossil fuels in a summer month. This gap of just 7% between renewables and fossil fuels was by far the narrowest we've ever seen in Ireland during the summer and, just like we were able to say last month about May, this was the greenest June for the Irish grid in modern times. We can attribute this partly to relatively high renewable generation but mostly to greatly increased imports via the new Greenlink interconnector which is having its inaugural summer of operation.

Ratios of generation types over all-island demand are as follows:

- renewables: 36.3%

- wind: 29.8%

- solar: 4.9%

- hydro: 0.6%

- biomass: 0.9%

- fossil fuels: 43.3%

- coal: 0.9%

- gas: 40.6%

- oil: 0.1%

- waste-to-energy: 1.7%

- discharging storage: 1.1%

- batteries: 0.2%

- pumped storage: 0.9%

Wind

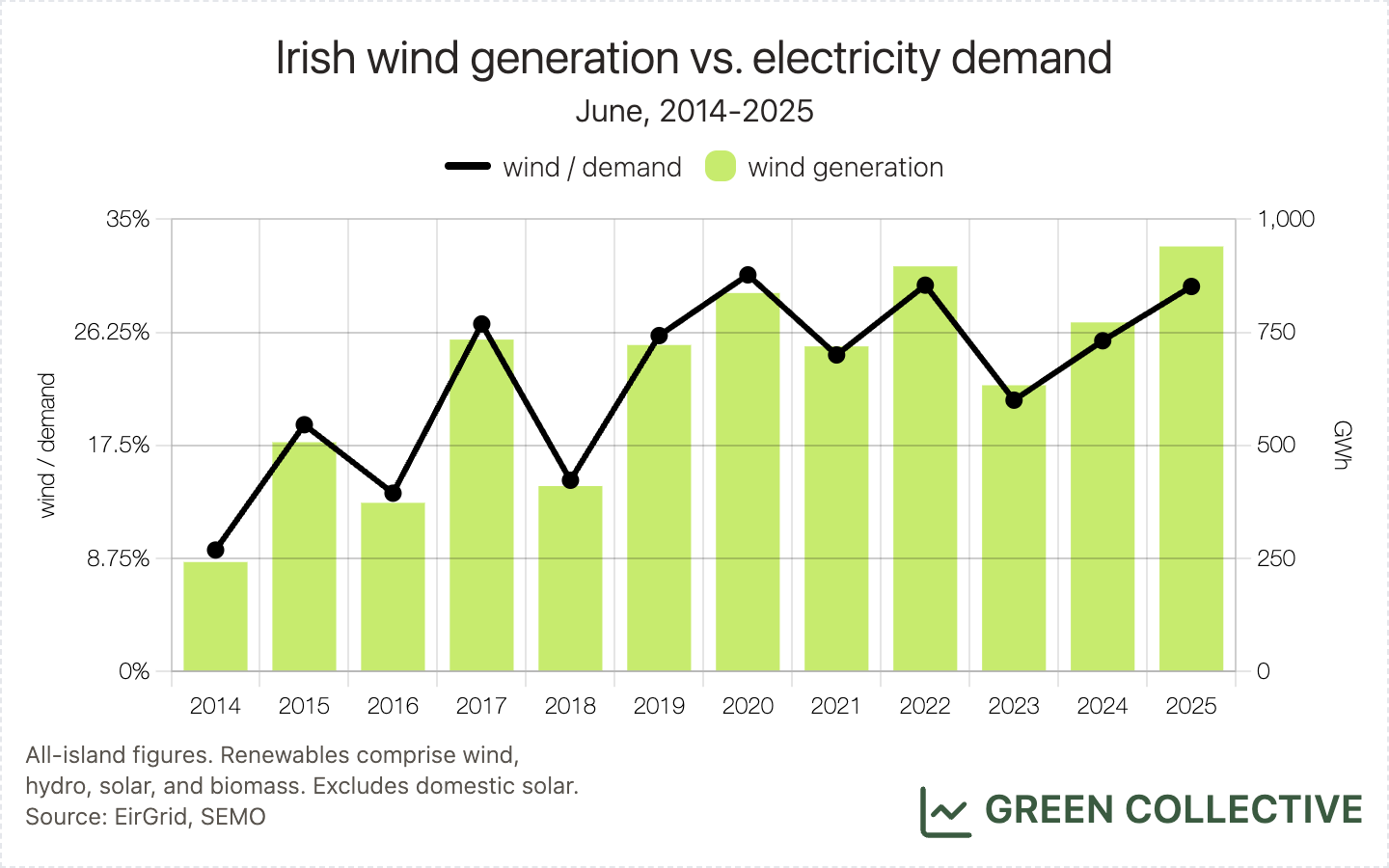

It was a good month for wind, with 939.7GWh the most ever generated in a June month. In addition, wind output exceeded 4GW for the first time in a June month on June 2, peaking at an impressive 87.5% of all-island electricity demand in the late evening.

This is of course welcome but we should note that total wind generation was only slightly ahead of June 2022's 896.3GWh and that we have seen 700GWh+ June months for wind as long ago as 2017.

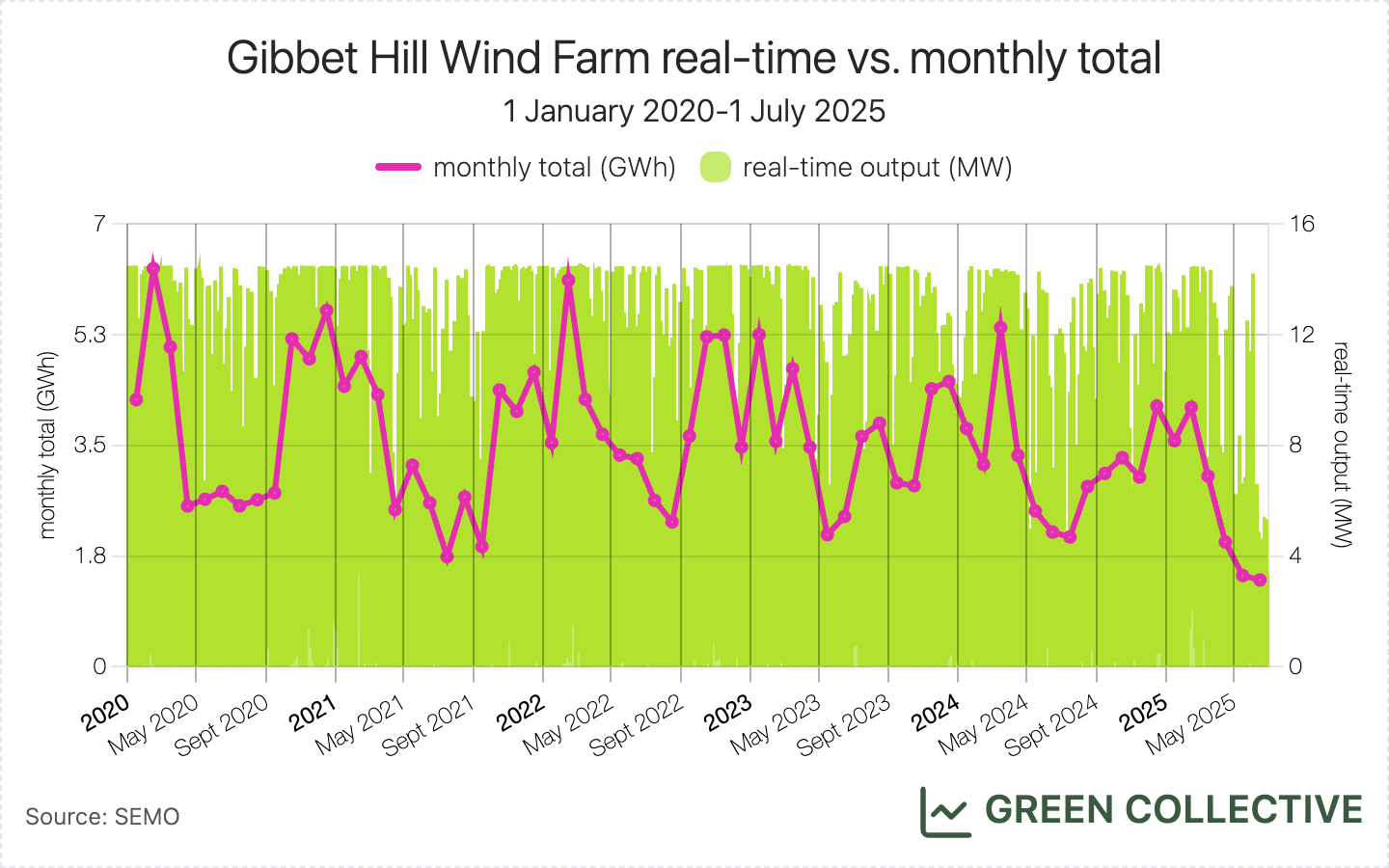

Less encouragingly, on June 5 the Gibbet Hill Wind Farm in County Wexford was ordered to permanently shut down three of its six turbines. In the chart below, the effect is immediately obvious: monthly output plunged from approximately 3.5-5GWh each month over the past several years to approximately 1.5GWh in June 2025, the lowest we've observed.

We read the judgement from the High Court in full. It's important to note that this case was characterised throughout as "unusual", "an outlier", and "extreme and one of the worst cases of wind turbine noise". While the wind farm in question may seem small in the grand scheme of things, there surely will be future cases using Gibbet Hill as a precedence and this introduces more risks to not only planning new wind farms but the continuing operation of existing wind farms. Outside of the detailed descriptions of different noise types and the wind farm operator's behaviour, we were struck by the general tone of the judgement which romanticises rural settings. Maybe it's our urban biases coming out in full force but it's frustrating that in a case centred on wind farm operations and which references Ireland's climate obligations, the tone almost worships the type of one-off housing affected in this case when such a setup is a chief reason why decarbonising Ireland's electricity network while maintaining reliability is challenging. The devastation brought by Storm Éowyn in early 2025 clearly demonstrates how low housing density exacerbates climate resilience issues. While it appears to us that Gibbet Hill is an unfortunate combination of exceptional wind turbine noise and a lack of action from the wind farm operator, how this case is presented illustrates a general cultural bias that results in the disconnect between housing density and climate action. Now, let us get off the soap box and get back to monthly county-level rankings.

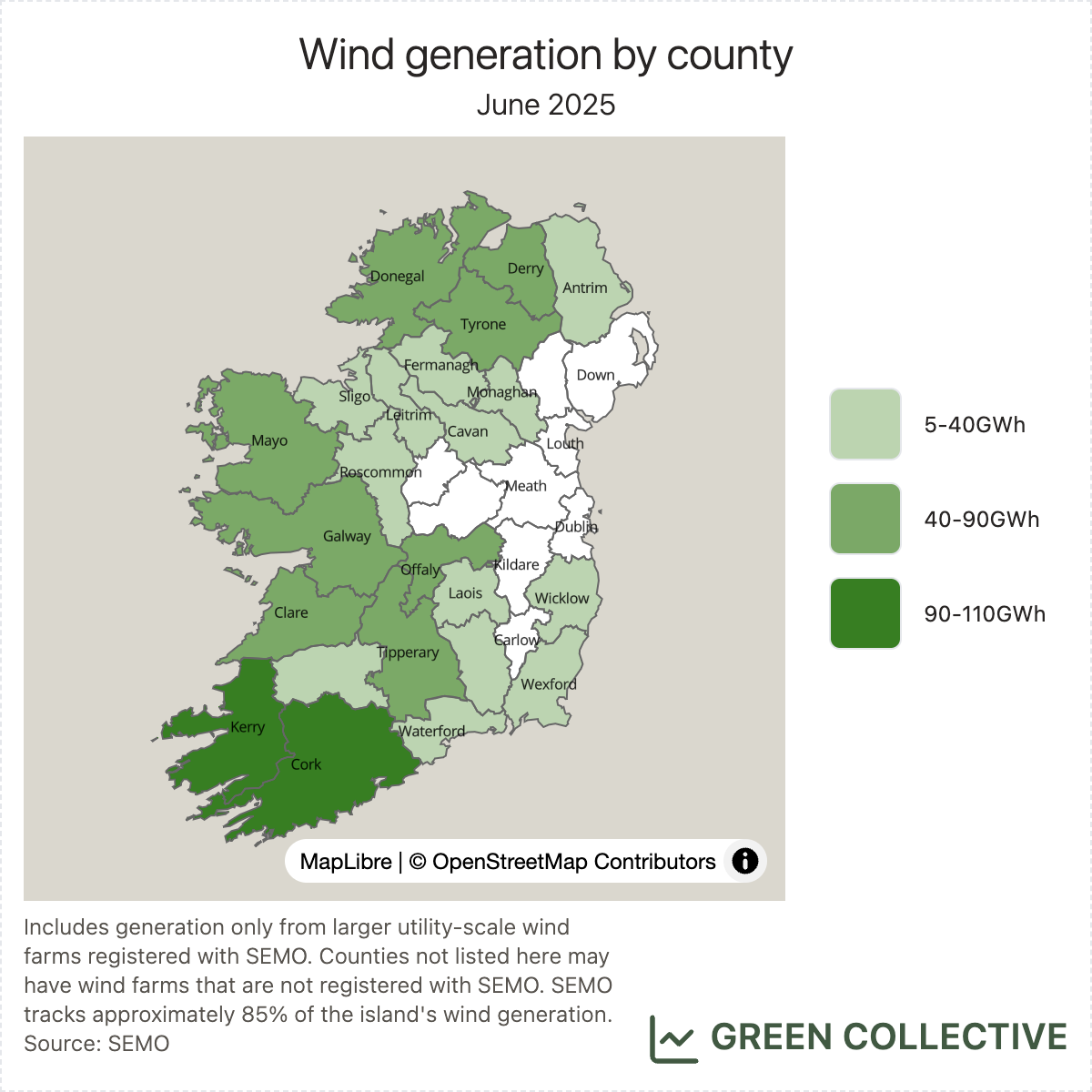

The top wind-producing counties during June 2025:

- Kerry (108.4GWh)

- Cork (88.2GWh)

- Mayo (67.6GWh)

- Galway (67.5GWh)

- Offaly (64.8GWh)

As usual, County Kerry tops the list for wind power with Cork in #2 position. Galway and Mayo - home to the two largest wind farms in the country - are virtually tied for #3 and #4 positions now that Mayo's Oweninny is back at full power having fallen significantly behind during May.

Solar

Wind and solar aren't mutually exclusive but strong winds don't usually mean fantastic solar and this was true of June 2025 which was the first month in several months during which solar did not virtually double year-on-year from 2024.

That said, solar was the #3 source on the grid after gas and wind with 155.7GWh, equal to 4.9% of all-island electricity demand, almost as much as all the remaining sources together. Both figures are all-time #2 monthly highs after only May 2025, which remains the best month ever for Irish solar by some margin.

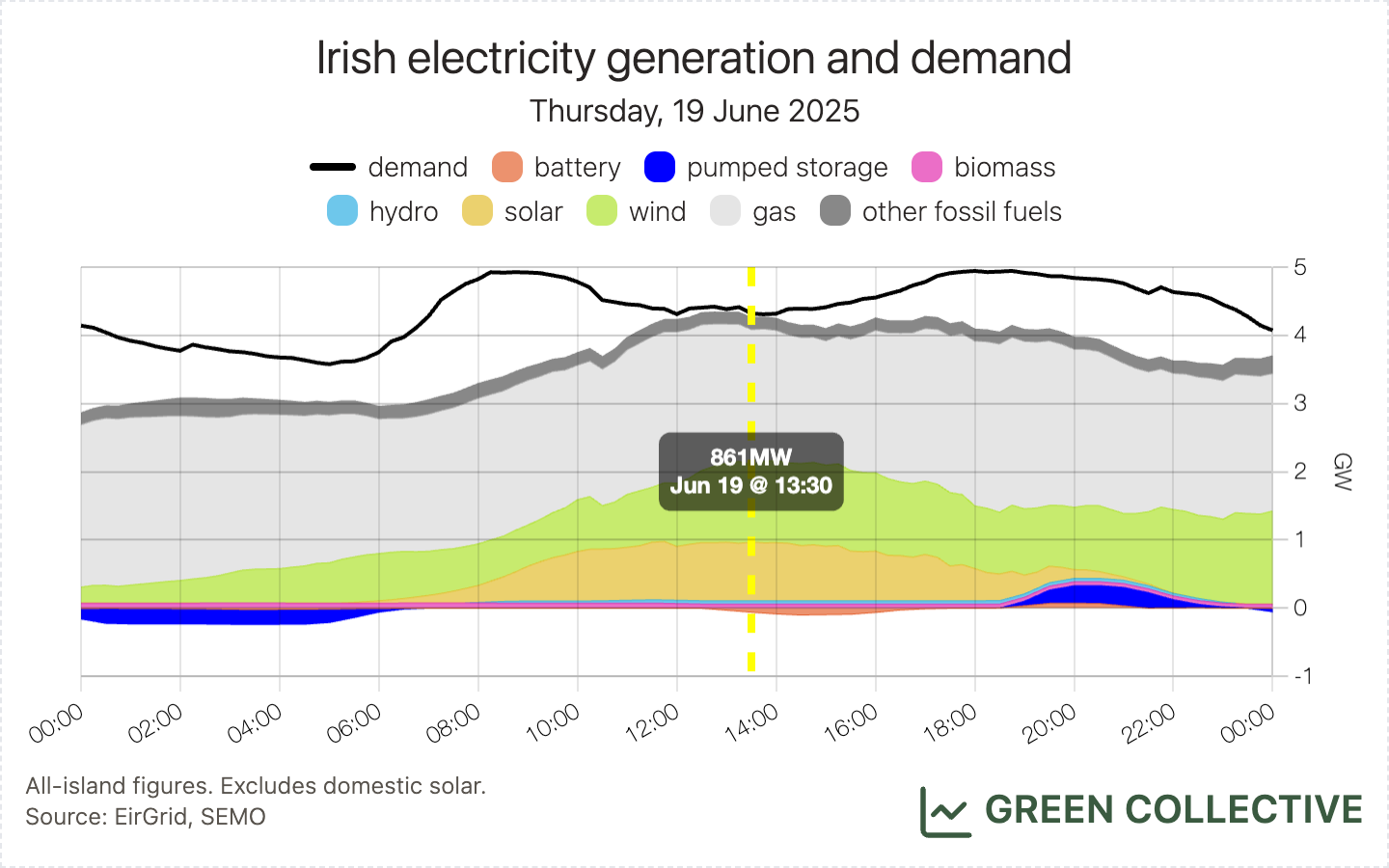

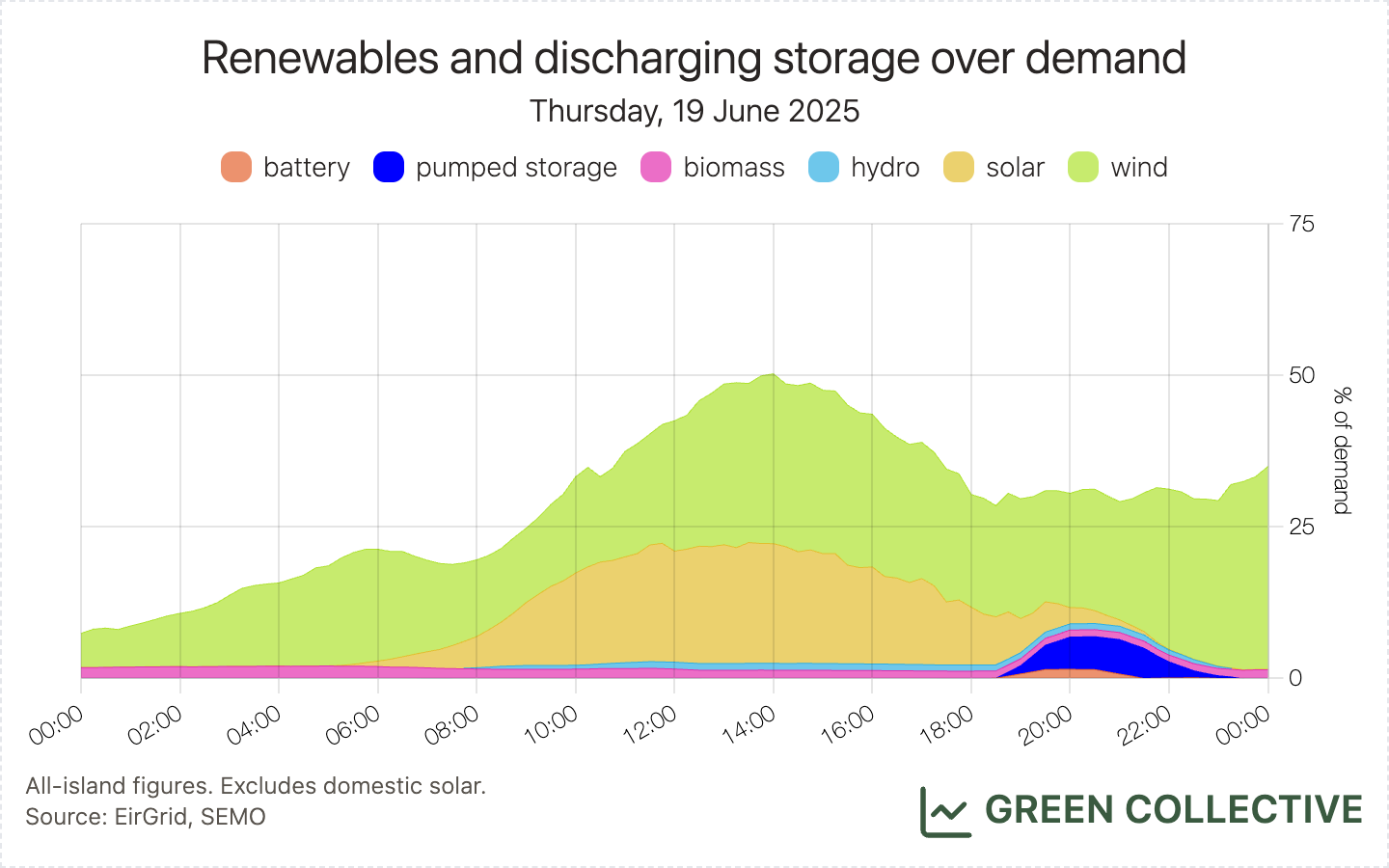

However, we can report one new solar record this month: on June 19 solar output reached 861MW, a new all-island high just ahead of May 17's 859MW.

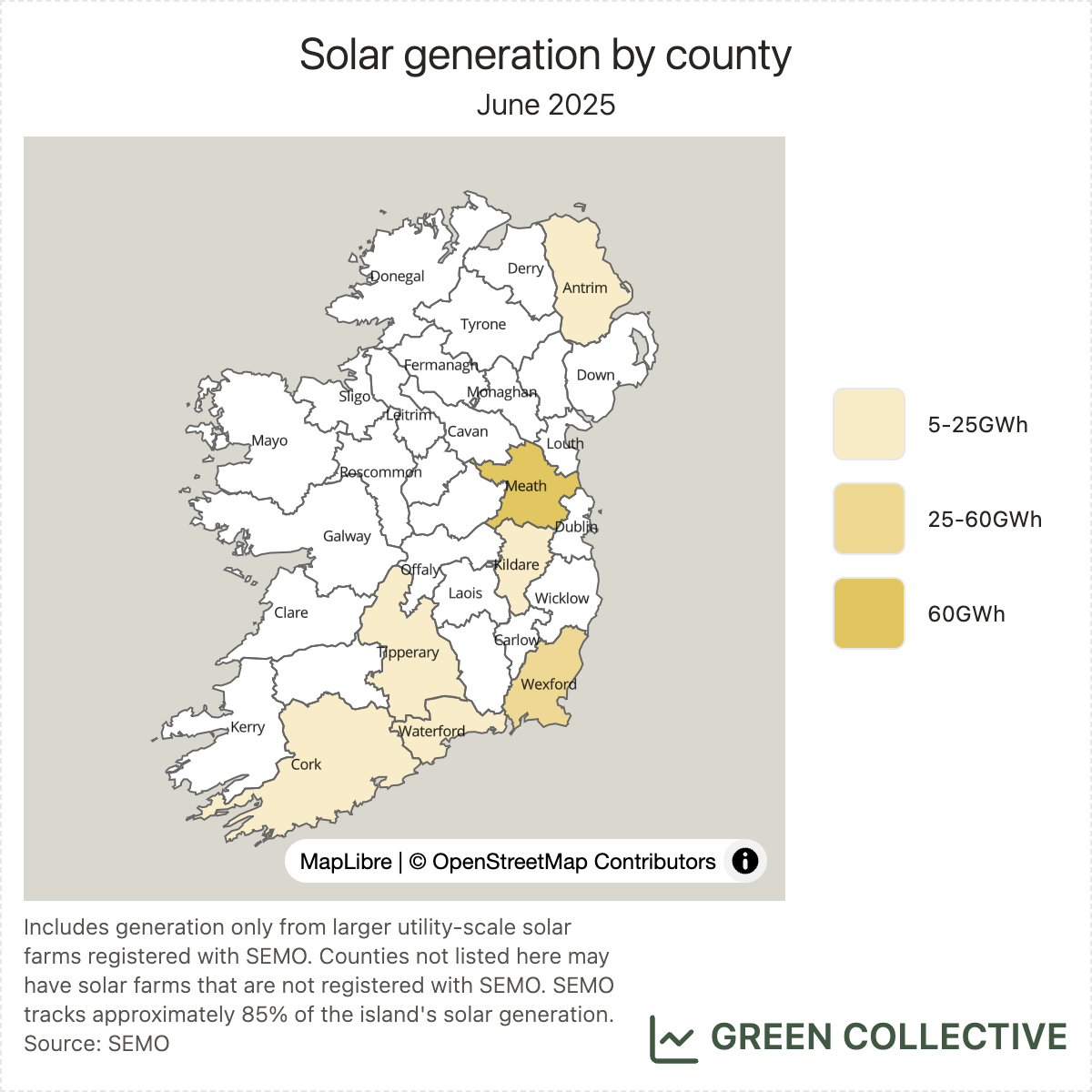

The top solar-producing counties during June 2025:

- Meath (58.3GWh)

- Wexford (24GWh)

- Cork (13.9GWh)

With the exception of Kildare having just pipped Cork in March, these rankings haven't changed during 2025: Meath is far and away the leader in utility-scale solar in Ireland, with Wexford - home to Rosspile, currently the #2 producing farm - producing about half as much.

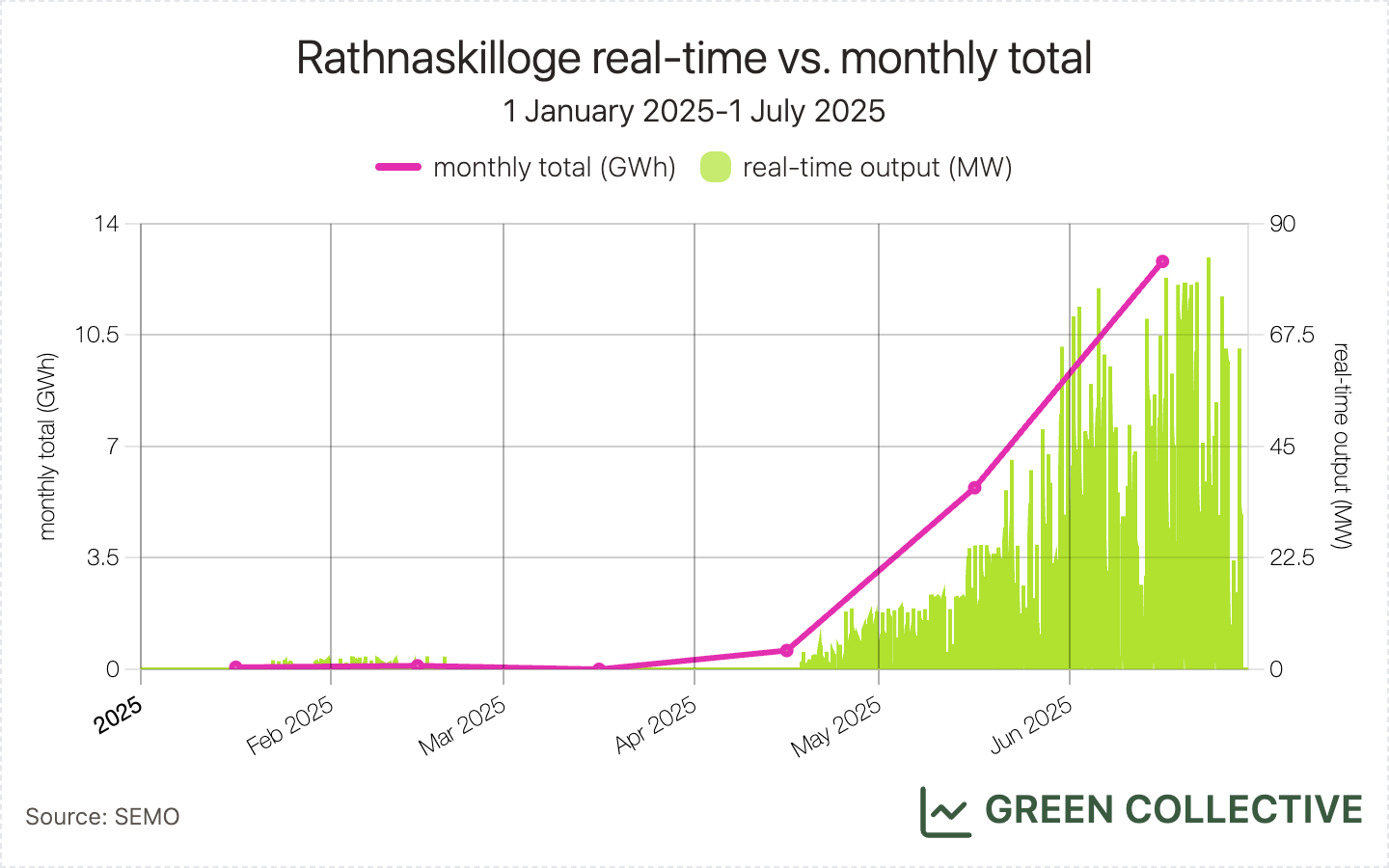

We see that Rathnaskilloge takes #3 for the first time. County Waterford's first solar farm connected to the grid back in December but only approached its maximum output this month. It's currently Waterford's only solar farm but if output at Rathnaskilloge grows much more it may soon make #3 county on the strength of that single solar farm alone.

Storage

Discharging batteries totalled 6GWh, with a peak of 195MW on June 27. This was well down on recent months which peaked at over 8GWh in May.

These figures are more in line with other recent "strong winds" months such as February 2025. Although incentives from ancillary services have been reduced since October 2025, it still proves to be quite lucrative for batteries to be reserve providers. During strong wind and solar months, it's more profitable for batteries to remain available for ancillary services instead of participating in wholesale trading. Since we only see record levels of discharging batteries when they participate in wholesale trading at scale, it makes sense June 2025 saw a dip in discharging batteries.

Additionally, there are still barriers for batteries to fully participate in wholesale markets. We are aware grid operators will be deploying a new schedule and dispatch system which we hope will allow batteries to contribute much more to peak load (the current record of 266MW is less than a third of installed capacity). However, these much anticipated updates (which we looked forward to in last month's newsletter) have been delayed until at least November. The delays are disappointing, as the combination of solar and batteries has been proving itself around the world this year and Ireland already has significant assets deployed.

CO₂ Emissions

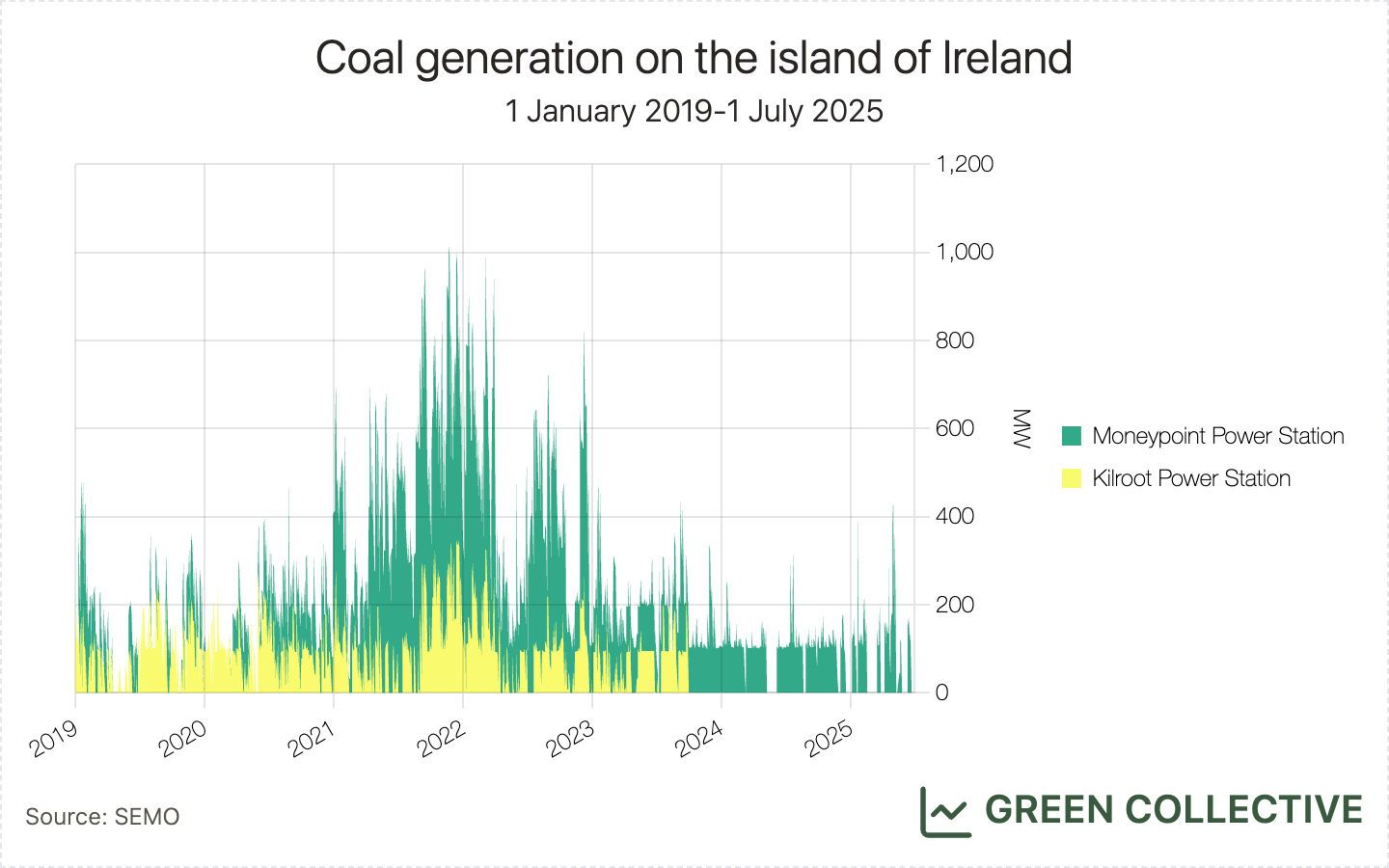

Before we get into the figures, we're delighted to share that the era of coal generation in Ireland has come to an end. The last remaining coal units on these islands - at Moneypoint, County Clare - burned their last on Friday, June 19. Having been slated for the end of this year and after much hesitation and delay (we prematurely announced this at the end of 2024) this was a welcome surprise.

We feel this deserved more coverage; we've been researching the early days of Irish electricity as a side-project and Ireland has had - with the brief exception of roughly 1930-1932 when the new hydro plant at Ardnacrusha was able to meet all demand - a coal-burning plant of some kind since at least 1891. That said, our Bluesky post was far and away our most popular ever so it's nice to see good news doing well.

We're also happy to note that we did anticipate this a little, picking up just a few days prior to June 19 that Moneypoint had been offline for over two weeks, a near-record. Anyway, why do we care so much? After peat, coal was by far the dirtiest source on the Irish grid: we rate gas as less than half as polluting as coal.

Yes, we're aware that the units are not gone: they are switching to oil, and to be used in emergencies only for the next few years. Don't worry, we'll be keeping an eye on them; so far, no activity.

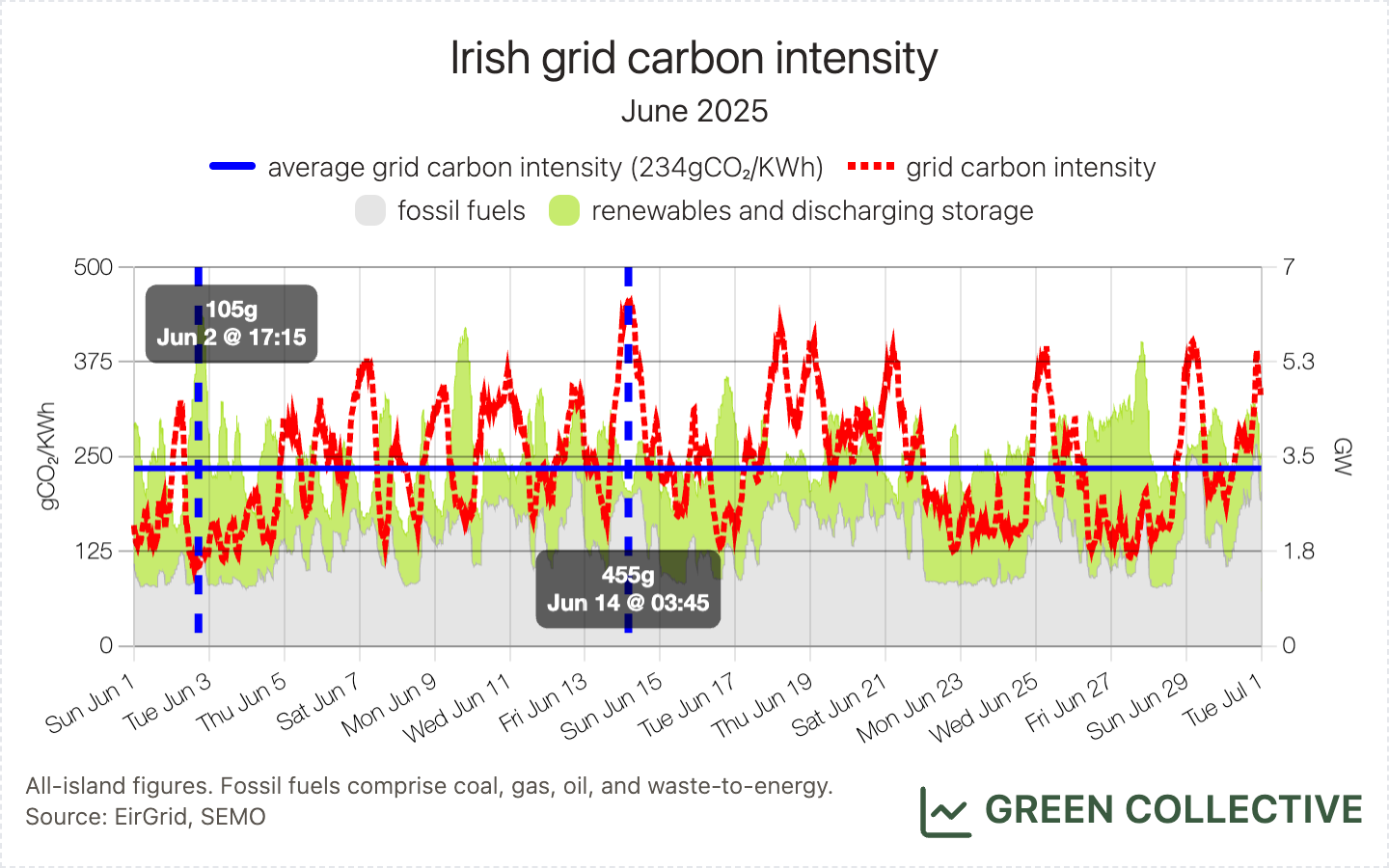

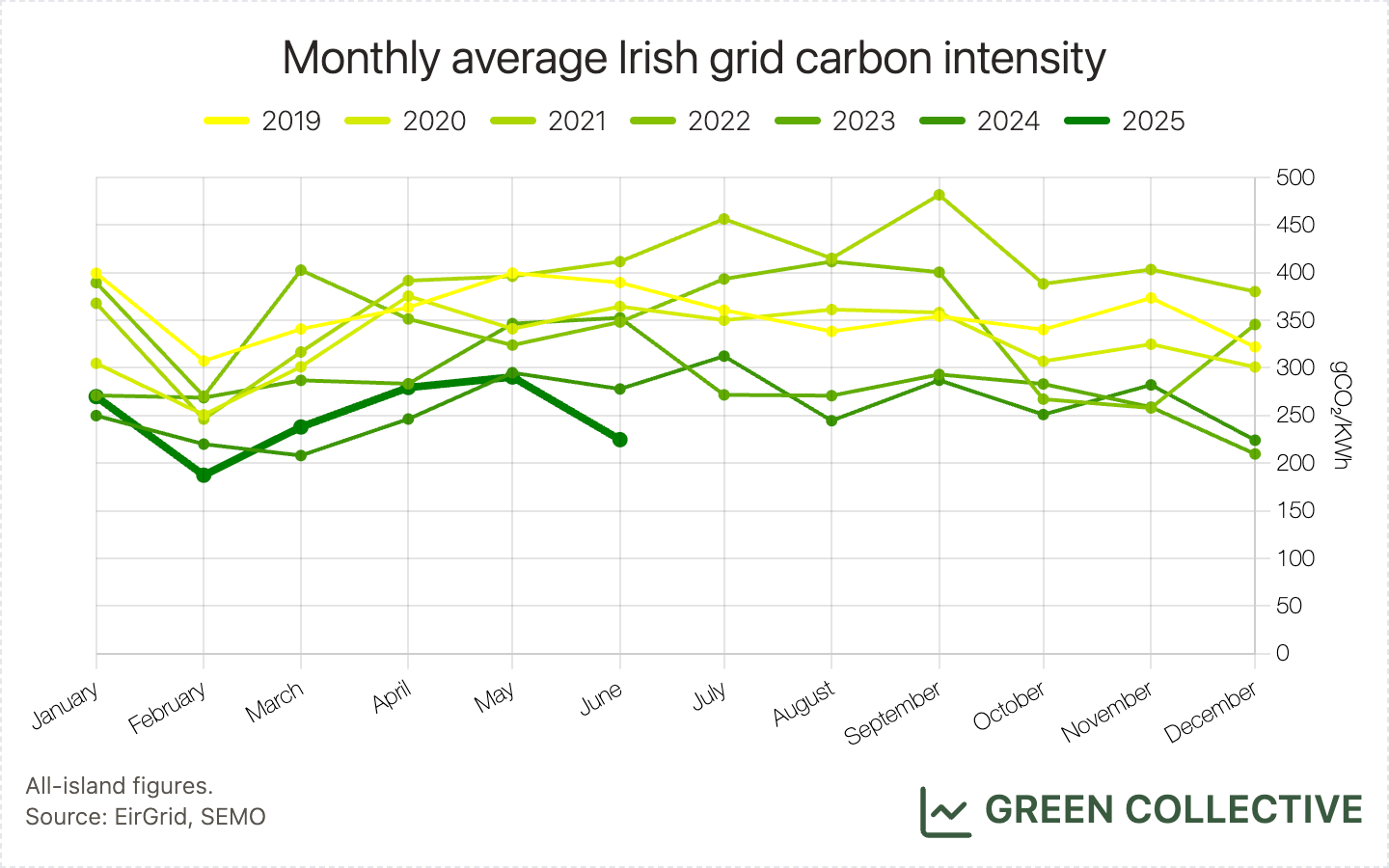

We estimate that for each kWh of electricity generated during June 2025 the Irish grid emitted between between 105g and 455g of CO₂, for an average of 234gCO₂/kWh. This was the lowest monthly average grid carbon intensity yet seen during a June month and the second-lowest this year, beaten only by February 2025's all-time low of 187gCO₂/kWh. In terms of CO2 emitted, we estimate that we have a new all-time record low: approximately 595,000 tonnes, less even than February 2025. We can attribute this partly to the end of coal generation but also to strong winds, very low oil generation, lower summer demand, and greatly increased imports.

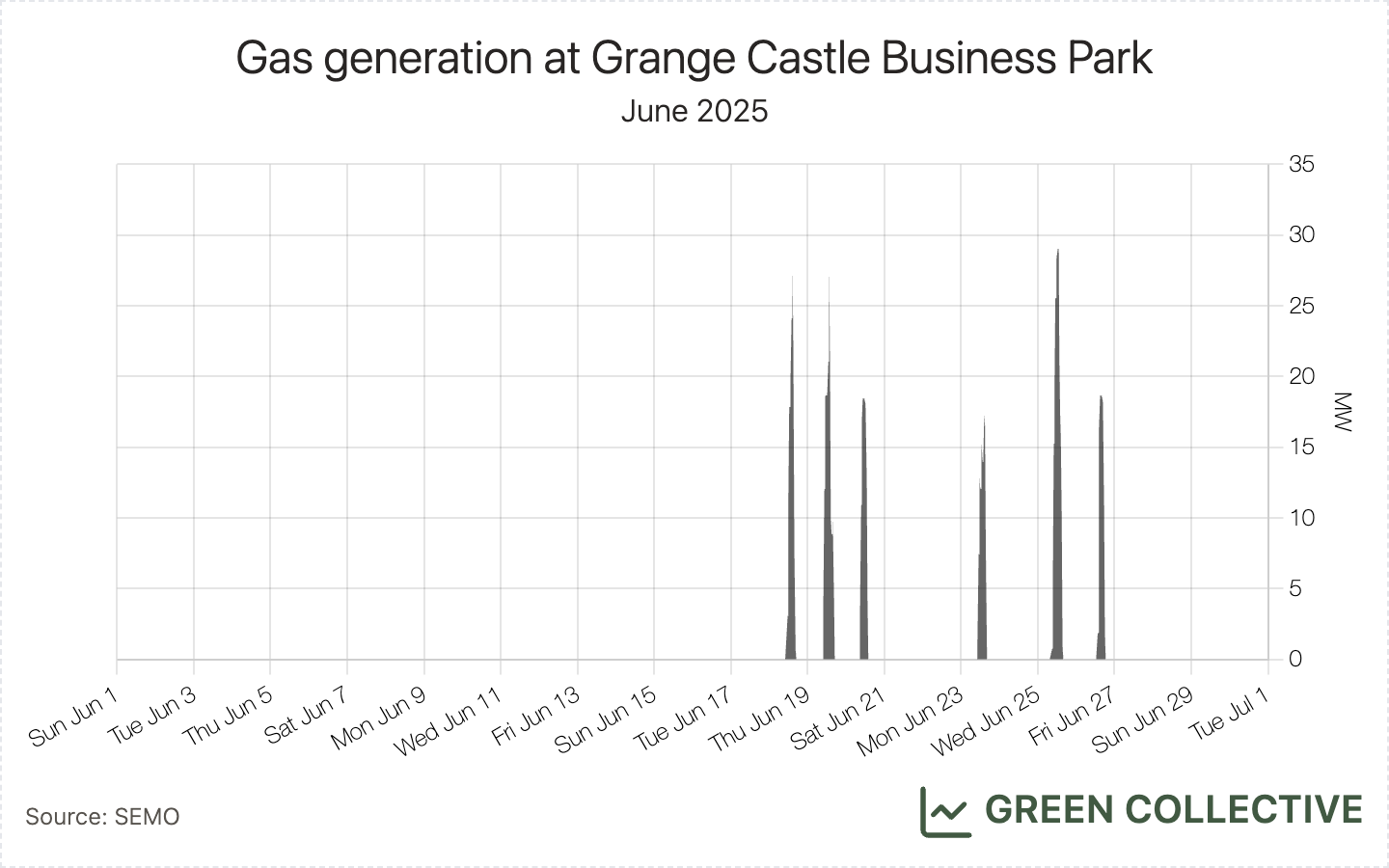

However, it's not all good news. We see that the new gas units at the Grange Castle Business Park have started to spin up: since Wednesday, June 18, they've been in operation multiple times with a peak of just under 30MW (of a total capacity of approximately 100MW) on the afternoon of June 25. We're no fans of the (largely underinformed) prevailing scepticism around datacenter generation in Ireland but we definitely don't see why datacenter builders can't be required to help build out renewables in all cases. We'll be watching these units closely.

Imports/exports

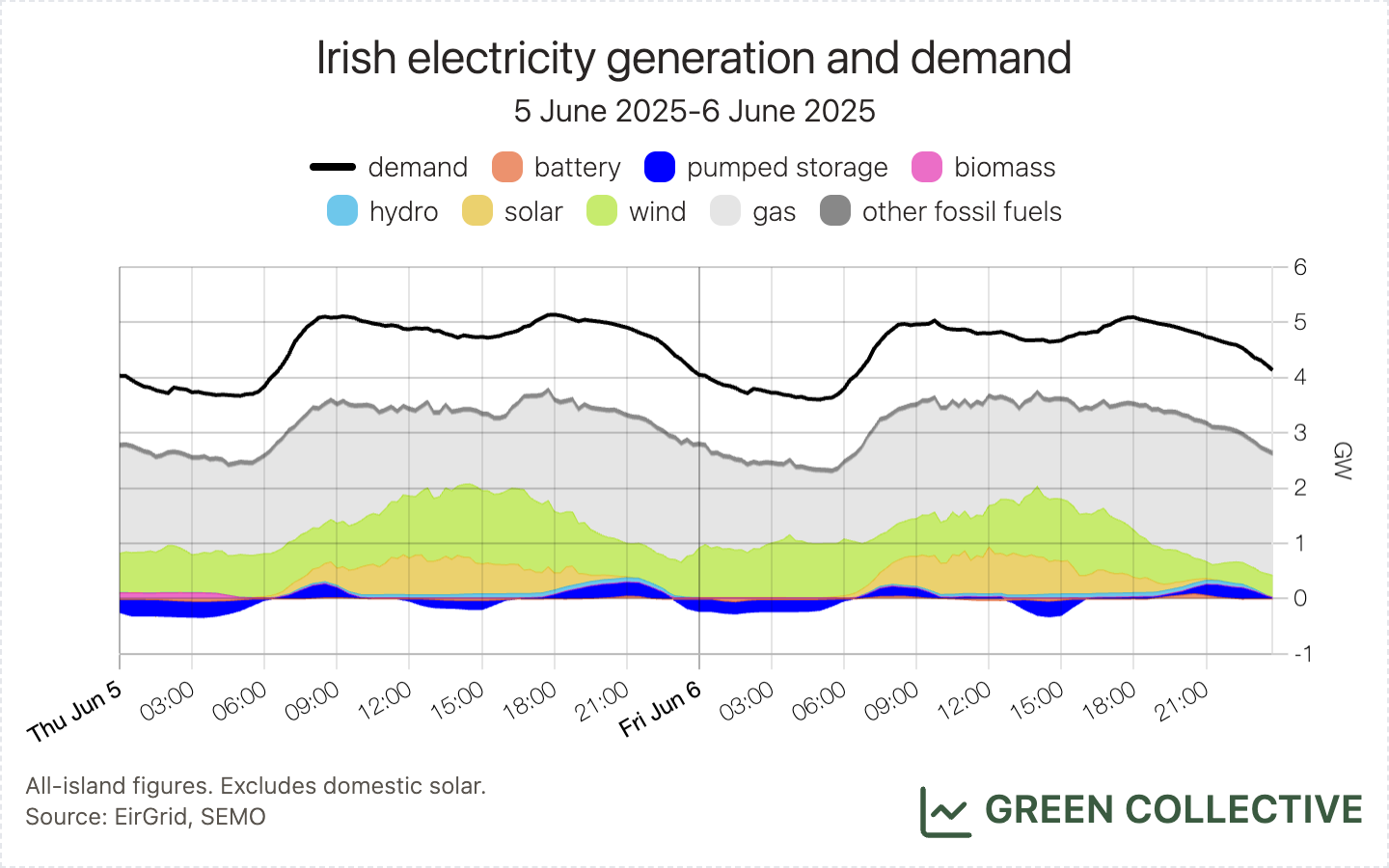

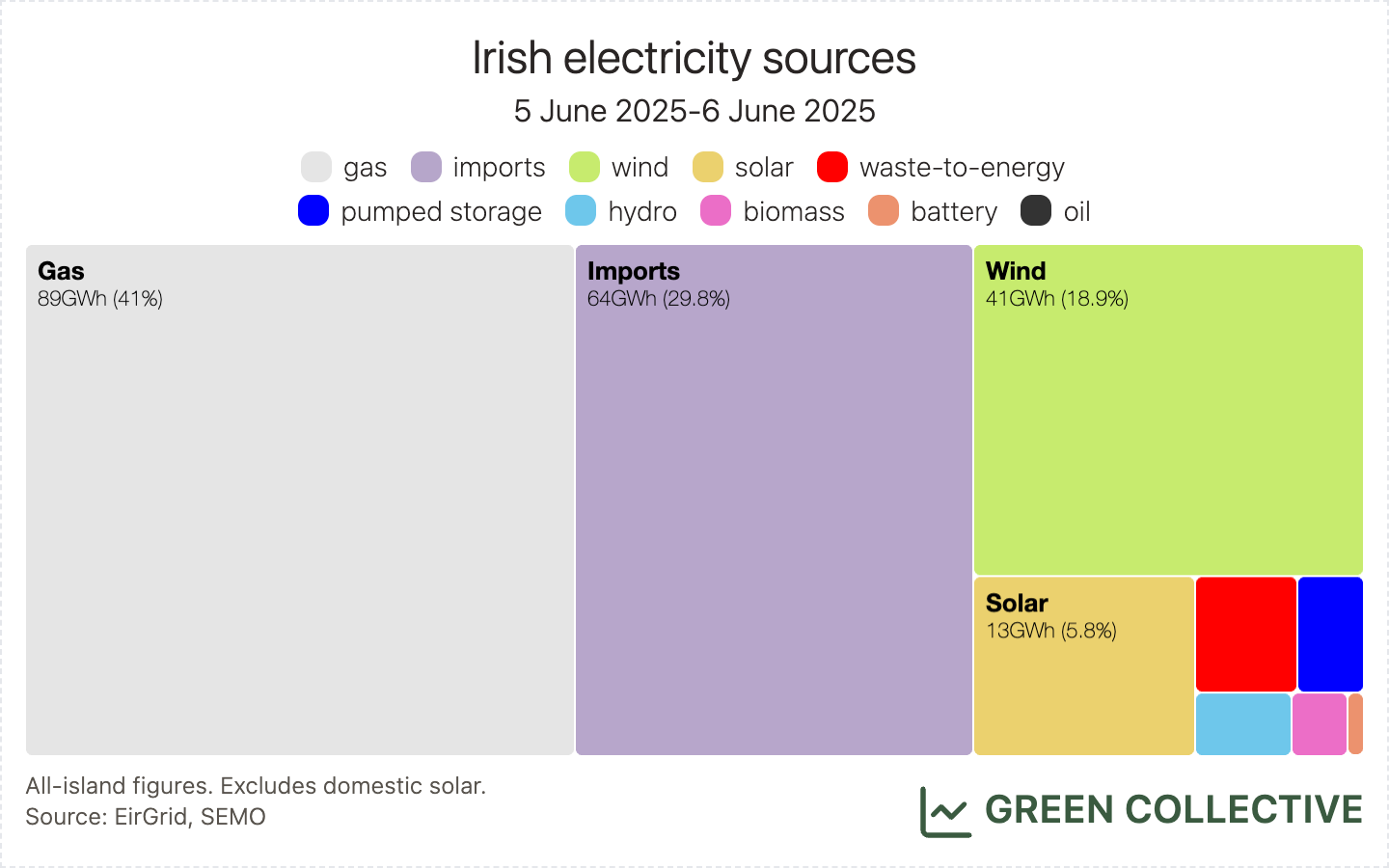

The island imported 635.7GWh last month. This was equal to 20.2% of electricity demand, a new monthly high on the Irish grid. We can attribute this to lower summer demand in tandem with the new Greenlink interconnector. We didn't see any records during June in terms of individual days but a few June days are now in the top ten and, to give you some idea, the island is importing just over 30GWh even on days with moderate wind power such as June 5-6, equivalent to approximately 30% of electricity demand.

Hatches & Dispatches

-

The end of coal in Ireland: Since we started offering 30-minute grid carbon intensity estimates, a main takeaway is that even though coal only contributes a small amount to all-island generation, every time coal is absent from the mix, grid carbon intensity decreases significantly. As we already covered in the CO2 emissions section above, we are delighted with the official announcement from ESB that on June 19, 2025, coal generation ended at Moneypoint, the last remaining coal-fired power plant on the island.

-

New wind and solar: This might be the first time since we started this newsletter that a new wind farm and a new solar farm have come online during the same month: Crossmore Wind Farm in Clare, with a maximum export capacity of 15MW, and Dunmurry Springs Solar Farm in Kildare, with a maximum export capacity of 12MW. It’s worth noting An Bord Pleanála overturned Kildare Council’s refusal of this solar farm planned on the site of the now closed Dunmurry Springs golf club back in 2021. Construction began in 2024 and this solar farm showed up in SEMO’s registered unit list in June 2025.