This article was first sent to our newsletter subscribers. To receive our monthly reports on the 1st of each month, subscribe now for free.

We spent the New Year selecting ten takeaways that best represent the key changes and trends affecting the Irish electricity grid in 2025. It's a hefty one! Enjoy and, as always, reach out to us with your comments and questions.

-

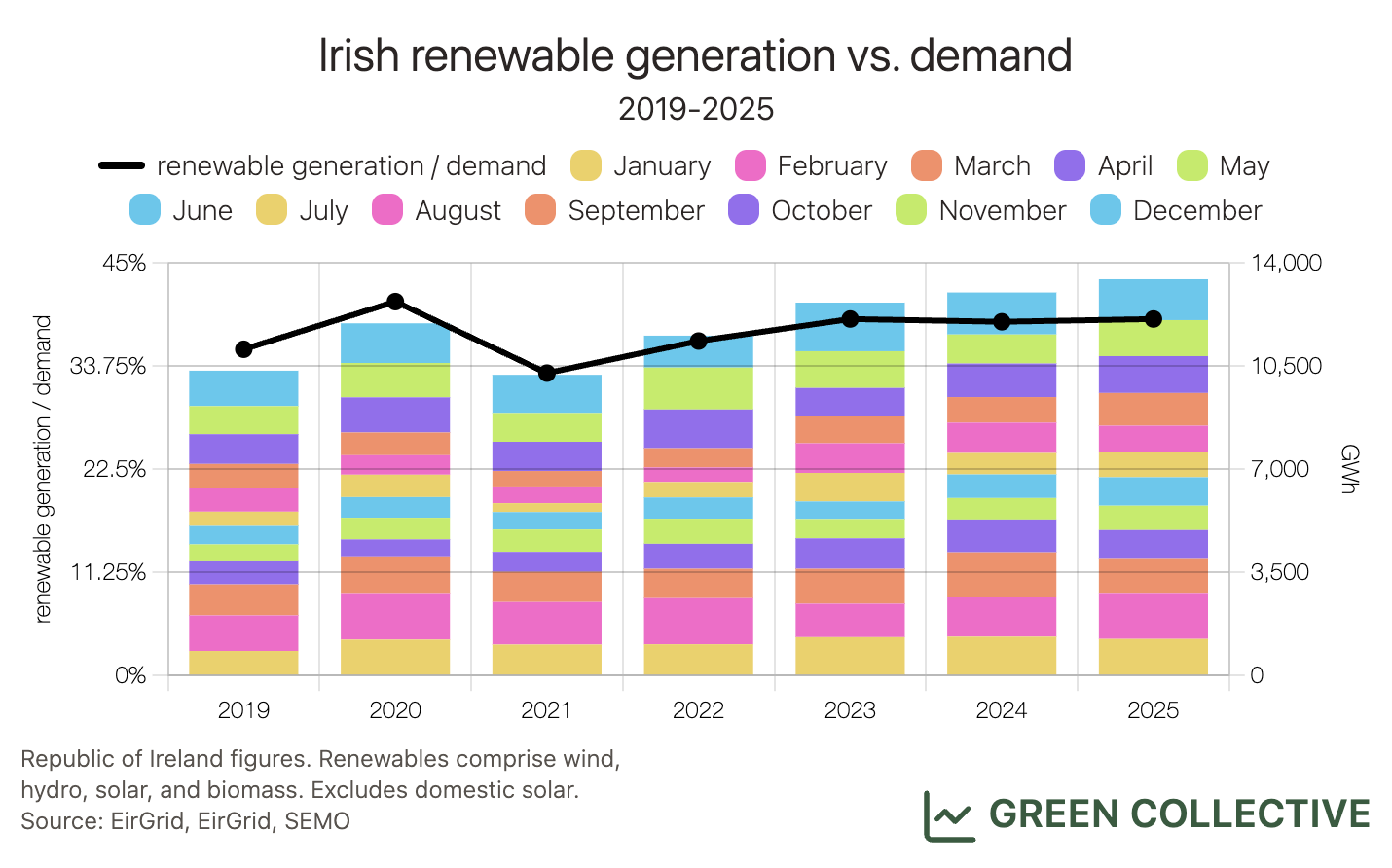

Across the island of Ireland, the ratio of renewable generation to demand continued to flatline in 2025: renewable generation equalled 38.4% of demand, compared to 37.5% in 2024, 38.3% in 2023, and 37.3% in 2022.

This is how all-island electricity demand was met by various sources in 2025:

- Gas: 42.8% (45.7% in 2024)

- Wind: 32.7% (32.4% in 2024)

- Solar: 2.8% (2% in 2024)

- Biomass and hydro: 2.8%

- Oil and waste-to-energy: 1.9%

- Coal: 1.1%

- Discharging storage (pumped storage along with batteries): 1%

- Net imports: 14.6%

This flatlining of the renewables to demand ratio is particularly true in the Republic of Ireland (ROI). While total annual renewable generation there grew grew by 3.5% in 2025, electricity demand also increased by 2.6%. The chart below shows renewable generation (wind, solar, hydro, and biomass) by month over the past several years in ROI.

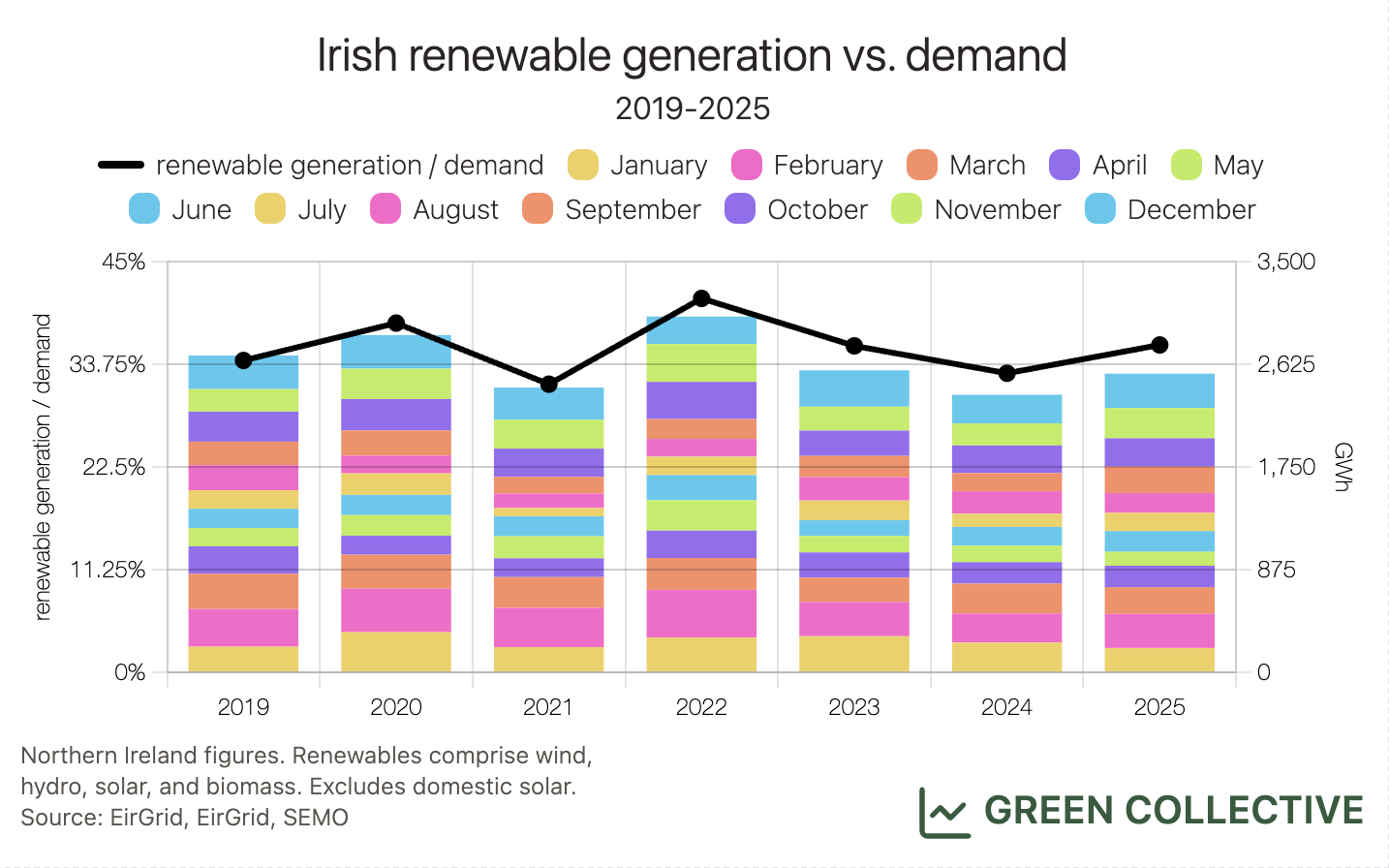

In Northern Ireland (NI), the renewables to demand ratio rose from 32.8% in 2024 to 35.9% in 2025. This is due to both a 7.6% increase in renewable generation (shown below) and a 1.6% decrease in electricity demand from 2024 to 2025. While this ratio fluctuates more in NI, the overall trend is similar to ROI: the share of demand met by renewables has not been increasing.

In addition to demand, factors such as increased imports via expanded interconnector capacity along with dispatch down also contribute to this flatlining trend. We cover both these topics and more below.

-

Greenlink, the third and newest interconnector between Ireland and GB, entered full operation in early 2025. As a result, net imports via interconnectors reached 14.6% of demand in 2025, up from 11.7% in 2024.

Along with the Moyle (500MW between NI and GB) and East-West (500MW between ROI and GB) interconnectors, the addition of Greenlink (500MW between ROI and GB) increased Ireland's import/export capacity to 1.5GW. In practice, a lower volume has been flowing through the East-West interconnector (EWIC) since Greenlink came online, because Greenlink has higher operational efficiency.

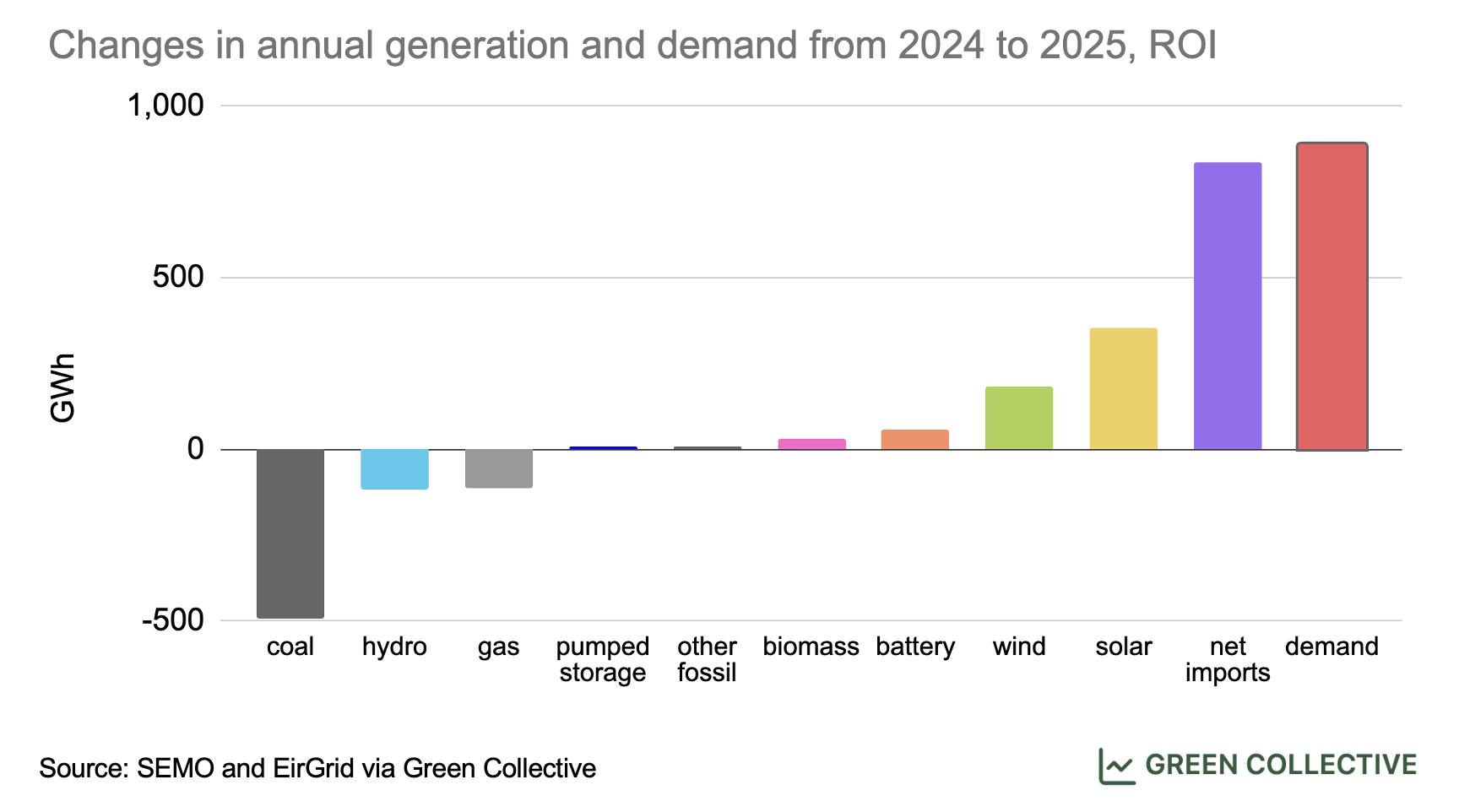

Compared to 2024, electricity demand in ROI increased by almost 900GWh in 2025. The chart below shows the changes in annual generation and discharging storage by type, along with the scale of increase in electricity demand.

While coal-fired generation left the fleet in the middle of the year, the biggest increase to meet additional demand comes from net imports followed by solar, wind, batteries, and biomass. As the chart above illustrates, thanks to increased interconnector capacity in 2025, the increase in net imports was more than additional solar, wind, biomass, and discharging storage combined.

-

Across the island, transmission constraints were the main reason for dispatch down (DD) of wind. In 2025, the wind DD rate in ROI was 11.3%: 4.7% due to curtailment and 6.6% due to constraints. In NI, wind DD rate was 21.7%: 3.2% due to curtailment and 18.5% due to constraints.

Solutions to reducing dispatch down of wind generation due to transmission constraints include expanding transmission infrastructure, increasing demand in constrained areas, and deploying more energy storage to store excess renewable energy.

While transmission constraints caused the most dispatch down, it's also important to examine curtailment's role. In 2024, EirGrid noted 96% of curtailment in ROI was due to the system requirement of keeping a minimum number of conventional fossil fuel generators online at all times. The other 4% was categorised as caused by system non-synchronous penetration (SNSP) limits, which is currently 75%. In 2025, while the minimum conventional generation requirement remained the biggest cause for wind curtailment, its share in ROI fell to 83% with SNSP rising to 17%.

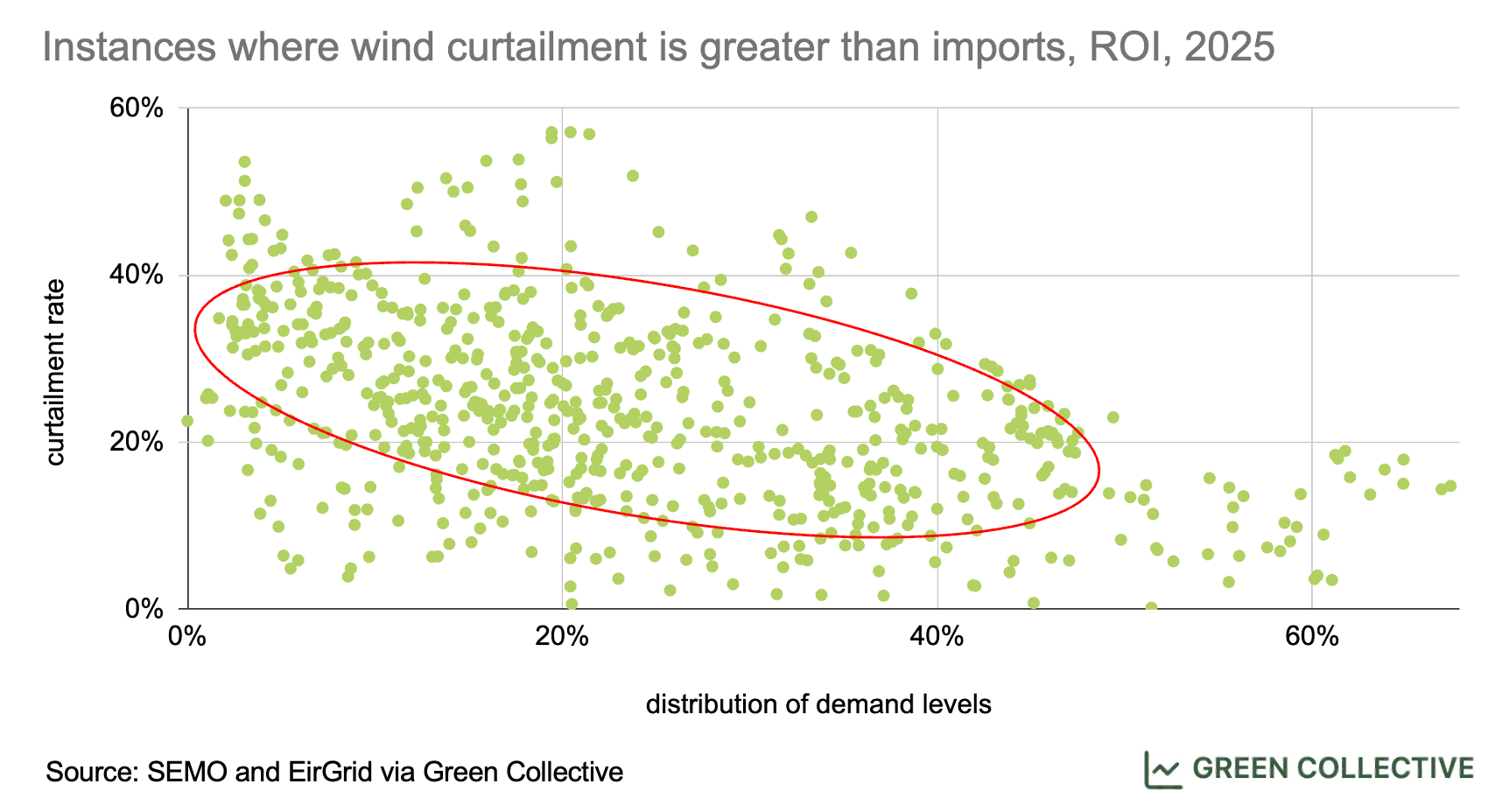

As mentioned earlier, imports via interconnectors increased significantly in 2025. Since imports directly affect curtailment decisions, there have been questions throughout the year about whether interconnectors displace indigenous renewable generation in Ireland. So, we decided to take a look at those times when wind curtailment and imports via interconnectors occurred simultaneously.

The chart above shows 30-minute instances where wind curtailment was greater than ROI's imports. It's important to note that almost all of these instances occurred when demand levels were at the lower end (usually in the middle of the night). We are not quite sure why imports would be prioritised over wind generation in these instances. We would definitely like to understand this pattern better in 2026, so please let us know if you have any leads.

However, while it's easy to pit interconnectors and indigenous renewable generation against each other, it's important to look at the bigger picture of transmission constraints being the biggest challenge when it comes to renewable dispatch down. Interconnectors may be displacing some local renewable generation, but the key to minimising dispatch down is to build more grid.

-

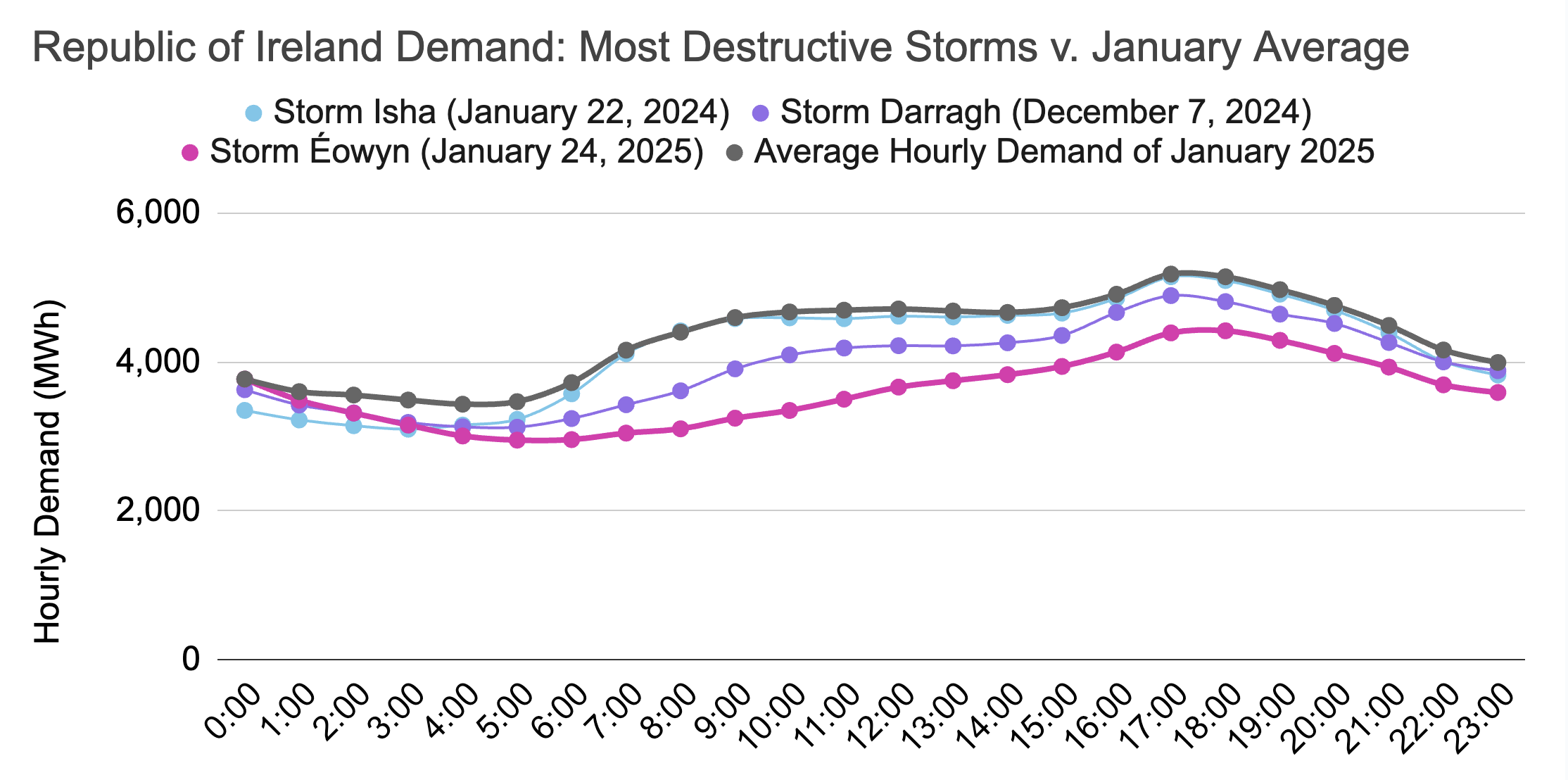

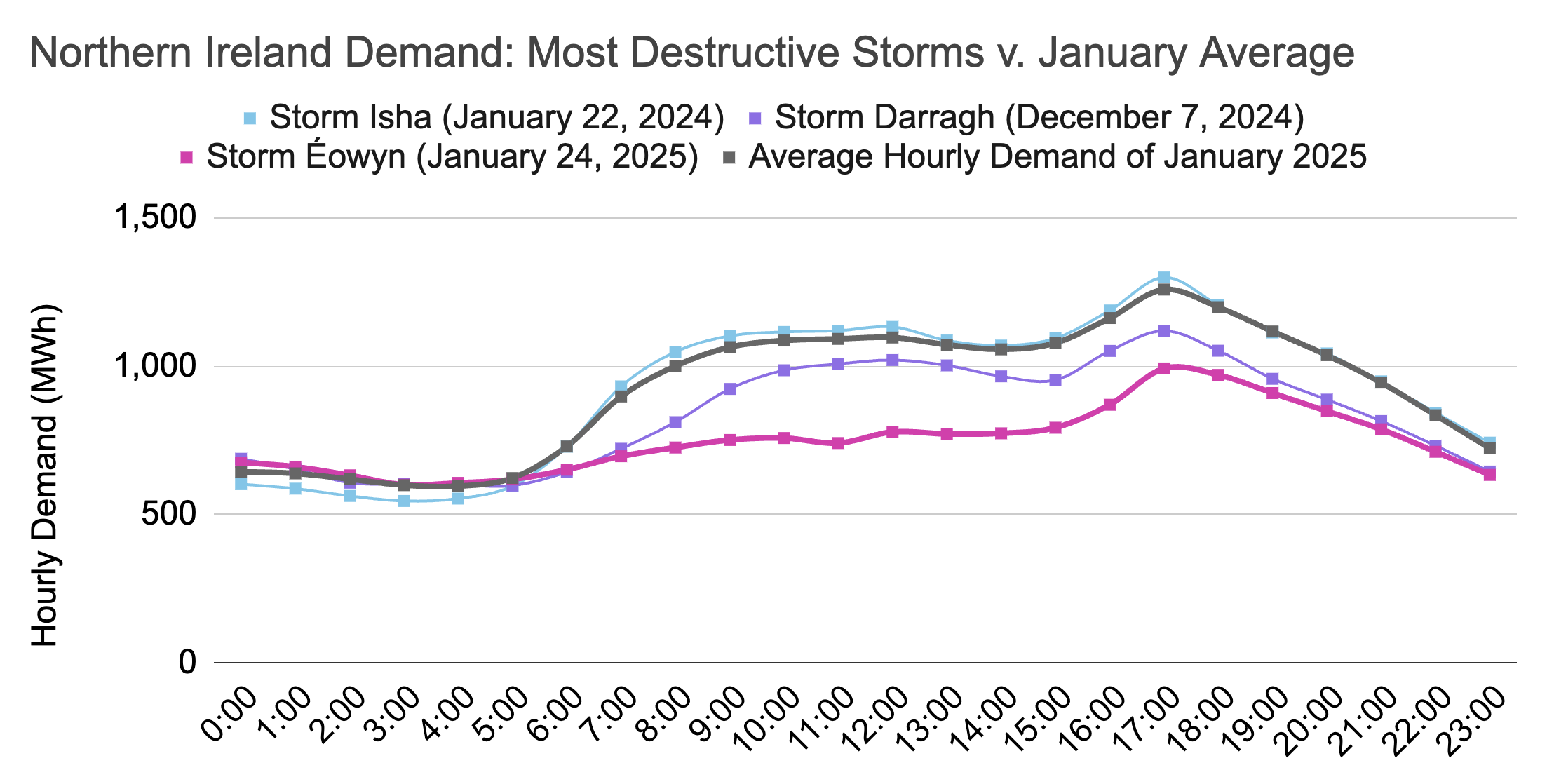

Demand-wise, January 2025 was the most dramatic month to date: after wintry conditions in early January (a new all-island peak demand record of 7497MW was set on January 8), Storm Éowyn battered the island in late January and left more than a million homes and businesses on the island without power. Demand curves confirm Storm Éowyn as the most destructive storm yet and fully exposed the vulnerability of low-density housing on the island.

Before Storm Éowyn, destructive storms included Darragh (December 2024) and Isha (January 2024). We took a look at demand during these storms and the sharp decline during Storm Éowyn is unquestionable, as its demand curves sit much lower even than other strong storms. At one point, more than 30% of customers were disconnected on the island, an unprecedented amount.

Last-mile restoration efforts take longer and pose more risks to residents in isolated locations. It takes a lot longer to bring back power to more remote and sparsely populated communities, and particularly to those in one-off houses. This destructive storm certainly highlights the need to reinforce and adapt grid infrastructure; just as importantly, however, it exposes the vulnerability of low-density housing and serves as a reminder of what we may need to change in order to cope with climate change.

-

It would be irresponsible to talk about demand without discussing data centres. In December 2025, two documents important to data centres were published: CRU's Large Energy Users Connection Policy and the Government's Private Wires Bill 2025. Unfortunately, our reading is that the requirements included in CRU's policy document seem to make private wires obsolete for data centers.

According to the Large Energy Users Connection Policy published by the CRU, new data centres need to satisfy different requirements based on their sizes: <1MVA, between 1 and 10MVA, or >10MVA. Since data centres with >10MVA capacity account for 82% of data centres' maximum import capacity in the Republic of Ireland, we will focus on the CRU's requirements for this category.

For this category of large energy users, they will need to have onsite or proximate generation and storage. Such onsite or proximate generation does not have to be renewables. Considering that 97% of data centres in Ireland are located in or around Dublin, that reads to us that data centres will rely on onsite backup generation, most likely fossil fuels.

In addition to onsite or proximate generation/storage, data centres will also have to meet 80% of annual demand with renewable electricity generated in Ireland, essentially buying clean energy credits through corporate power purchasing agreements (CPPAs). Large energy users will have six years to satisfy this 80% renewable requirement after energisation.

It's also important to note that CRU also requires such onsite and proximate generation and storage to participate in wholesale markets. Additional capacity via CPPAs used to satisfy the 80% renewable requirement also needs to be connected the national grid. Such requirements would essentially rule out private wires as a viable arrangement for data centres, especially for existing data centres planning to expand capacity in Dublin, which makes up the vast majority of new demand from large energy users in the coming years.

It seems like a missed opportunity to us, as if the CRU only wanted to place a requirement on the annual renewable proportion and insisted on not touching emission reductions. Regulating emissions would be a more effective way to manage data centres' climate impact and would work more hand-in-hand with private wires legislation, too.

-

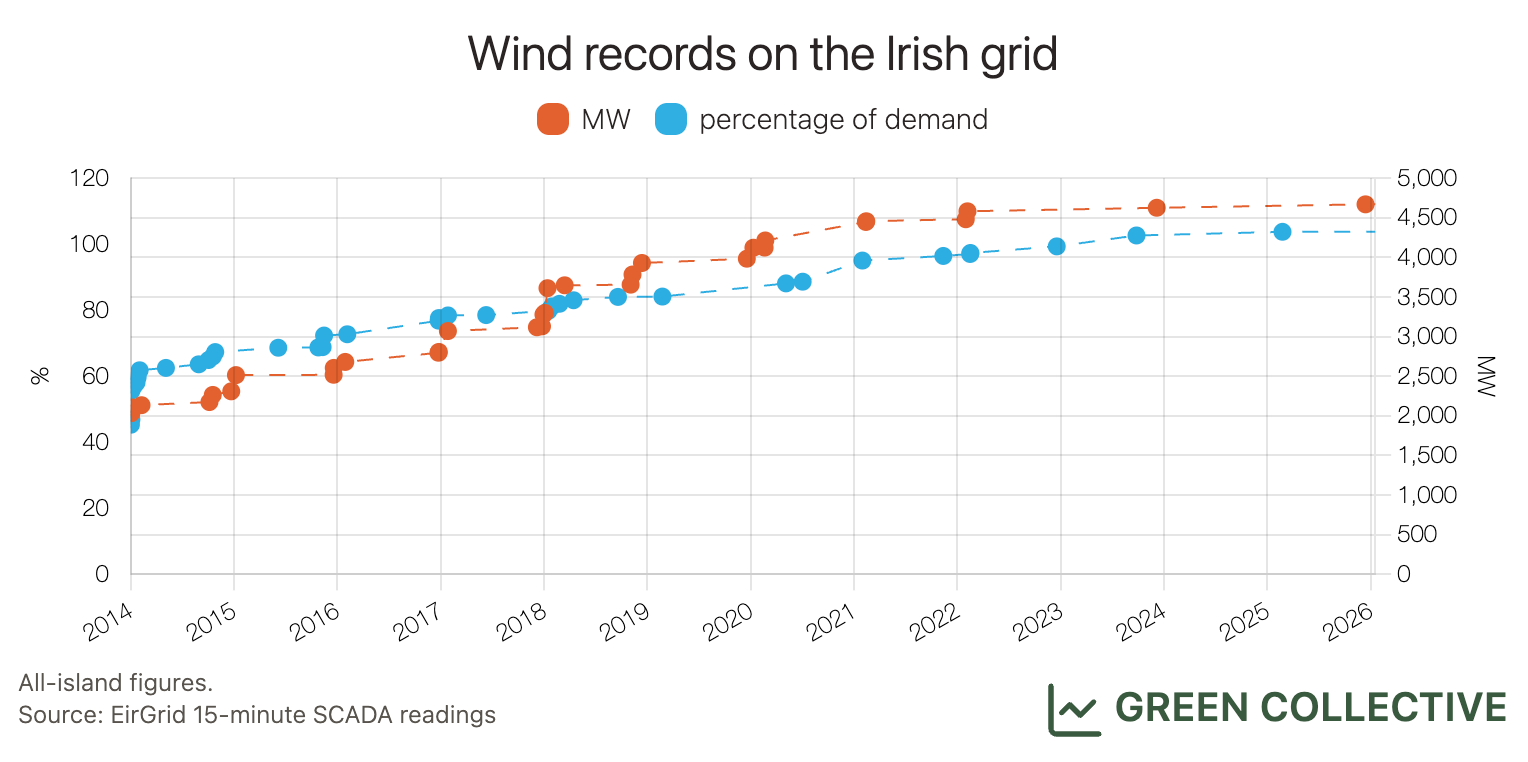

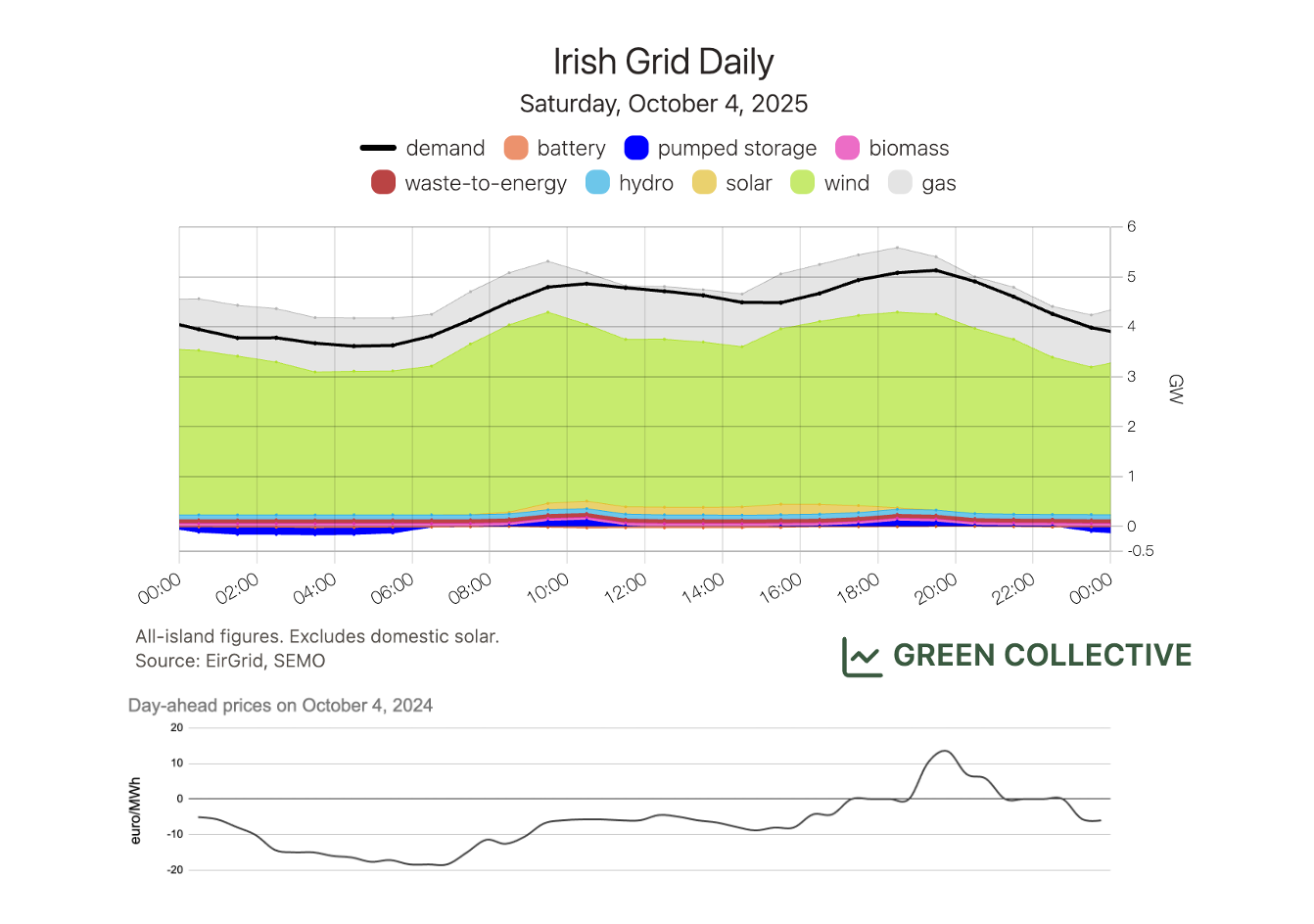

All-island wind output reached a new all-time high of 4668MW on December 13, 2025, beating the previous record of 4624MW set on December 6, 2023. More high wind periods also brought more hours with negative power prices in 2025: on October 4, during Storm Amy, day-ahead prices remained below zero almost all day for the first time in Ireland.

Between the two wind output records (December 6, 2023 and December 13, 2025), 471MW of wind capacity came online across the island. This makes the increase of 44MW in peak wind output after two years seem minimal and overdue, while highlighting the urgent need for grid upgrades.

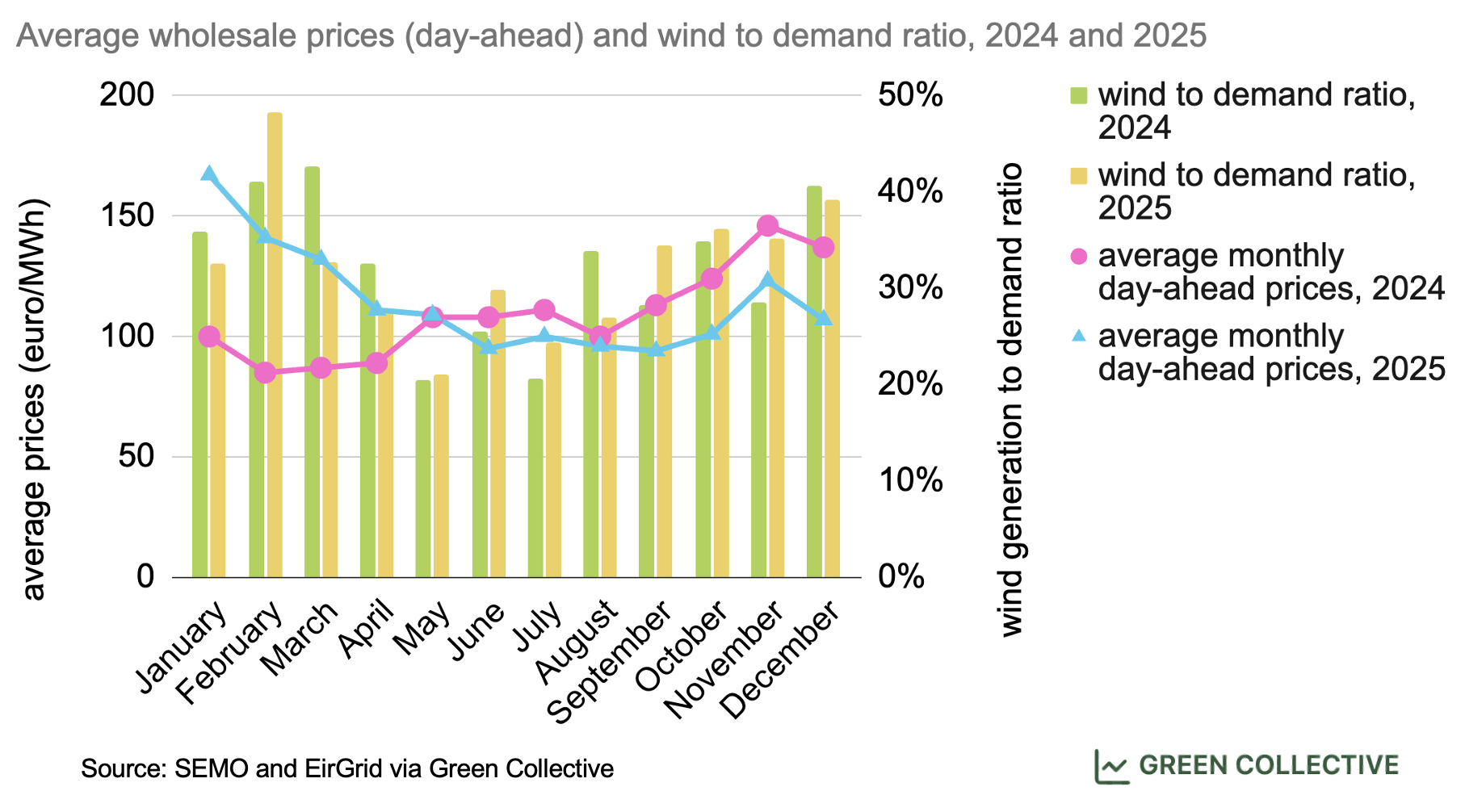

Similar to previous years, higher wind generation generally corresponds to lower wholesale electricity prices that year. In 2025, day-ahead prices averaged 113 euro/MWh, almost level with 2024's annual average of 108 euro/MWh. However, as shown below, January 2025 experienced high prices due to spikes in demand during a cold snap and volatility during Storm Éowyn. Prices came down after January and remained lower than 2024 from May and on.

There were more hours with negative wholesale prices in 2025 than 2024: nearly 60 hours in 2025 compared to 40 hours in 2024. On October 4, during Storm Amy, wind generation remained high all day. High winds coupled with lower demand on a Saturday led to negative prices almost all day, a first for Ireland. The chart below shows generation breakdown and day-ahead prices on October 4.

-

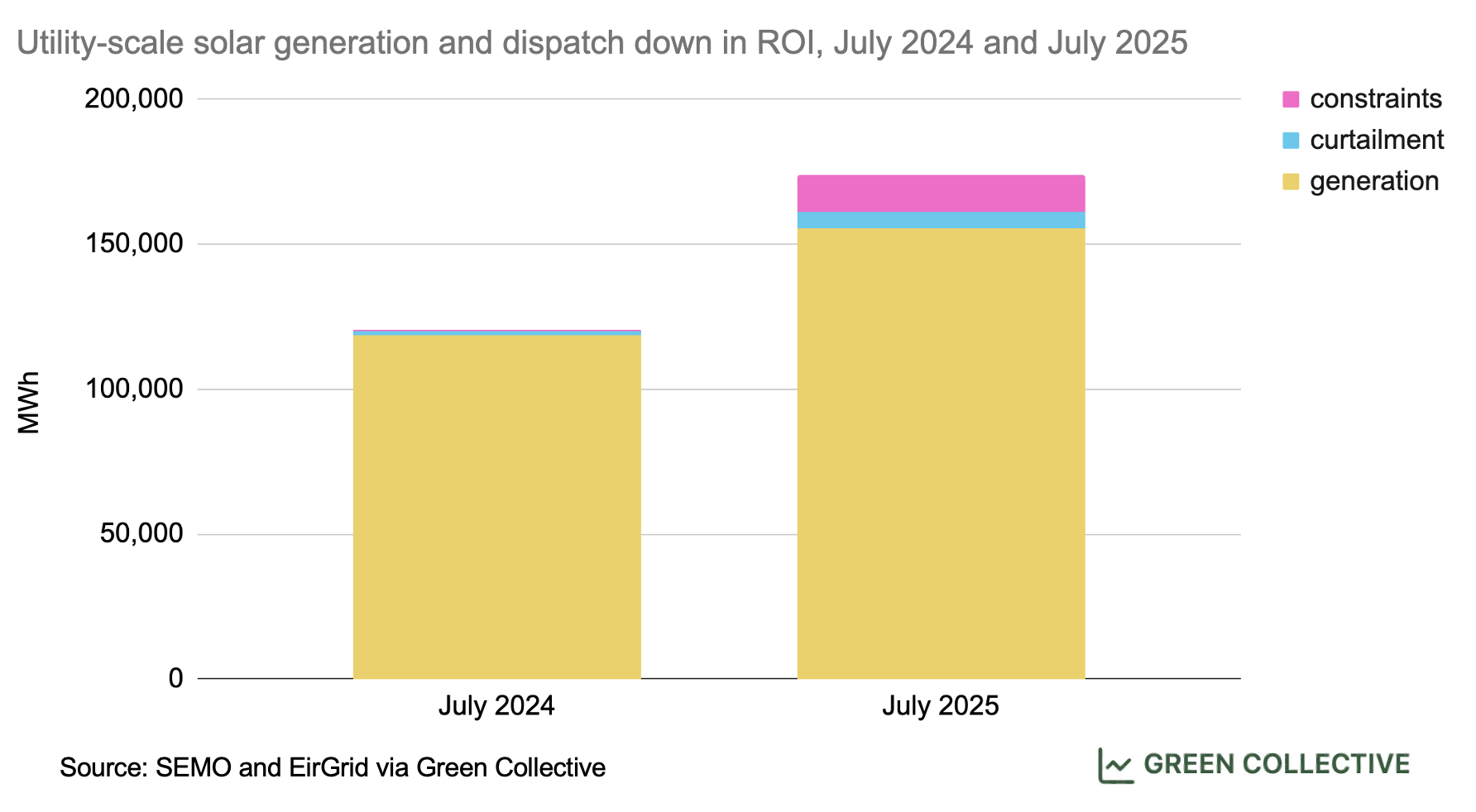

Annual generation from Irish solar farms exceeded 1TWh for the first time in 2025. Between July 2024 and July 2025, the month with the highest amount of solar generation, solar farm capacity in ROI increased by 43%, from 654MW to 937MW. However, when we compare solar generation in July of 2024 and 2025, the increase was only 31% due to increased dispatch down.

When we compare availability from utility-scale solar between the two July months, shown as the total of generation, curtailment, and constraints on the chart below, the increase in 2025 matches almost perfectly with capacity expansion at 44%.

Both constraints and curtailment increased for solar in 2025, but it's worth highlighting the fact that transmission constraints caused nearly 70% of solar dispatch down in July. Similar to wind dispatch down, this data point is yet another piece of evidence that transmission capacity needs urgent expansion.

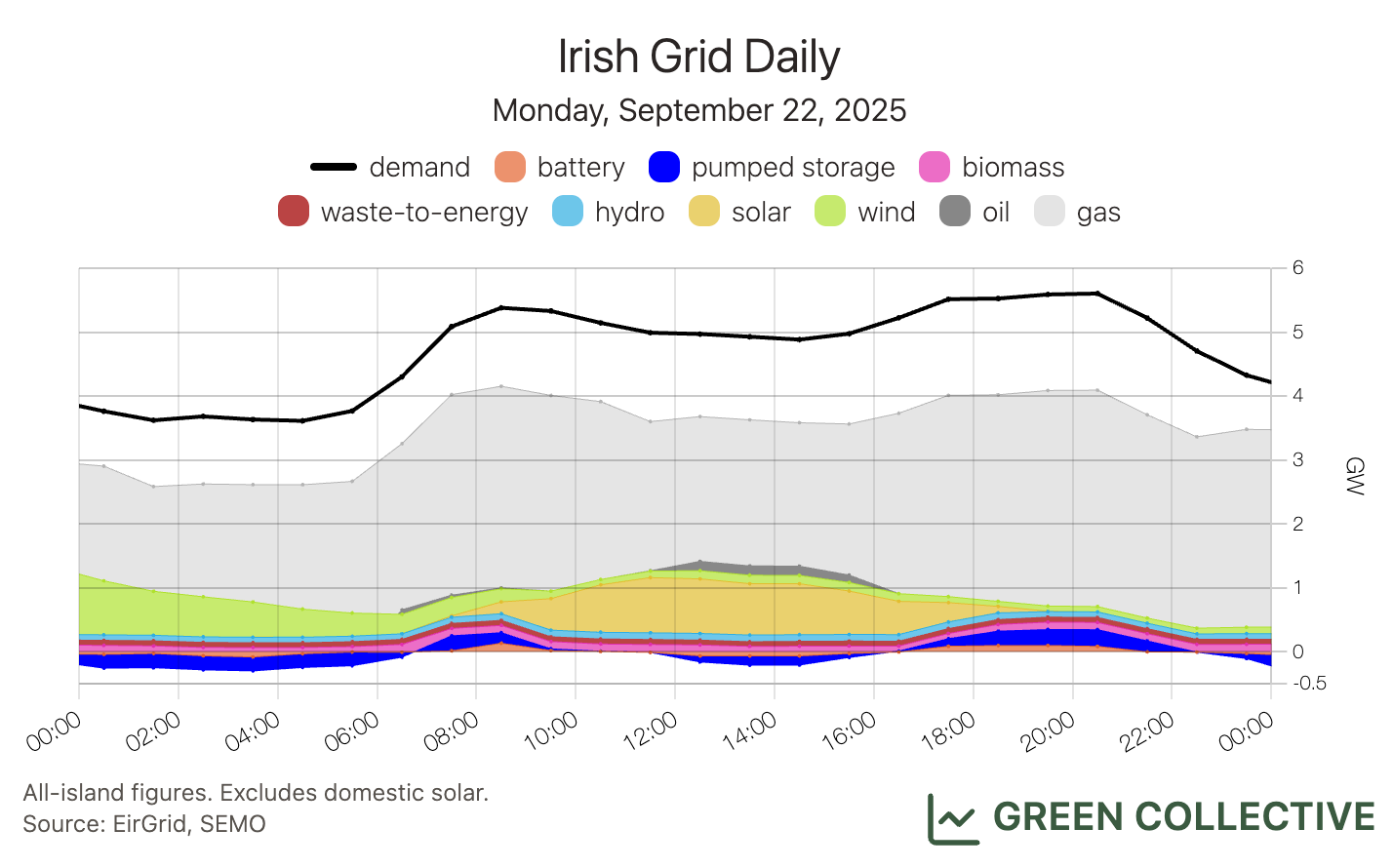

While July holds the record for highest solar generation, last year's all-island record solar output actually occurred in September: 870MW on September 22. This is not because it was a particularly sunny day but because there was almost no wind during the day which meant no dispatch down on solar, leading to an unexpected solar output record on the autumn equinox.

It's also important to point out our solar generation data always excludes rooftop solar, because that dataset is not publicly available. According to ESB Networks, rooftop solar has crossed the 1GW threshold in Ireland in 2025, reaching an almost 1:1 ratio with solar farm capacity. It's high time ESB Networks and/or suppliers make more data available concerning rooftop solar, particularly how much generation is feeding back to the grid. This is at least the third year in a row we are calling for this update – let's hope we aren't repeating it again in 2027!

-

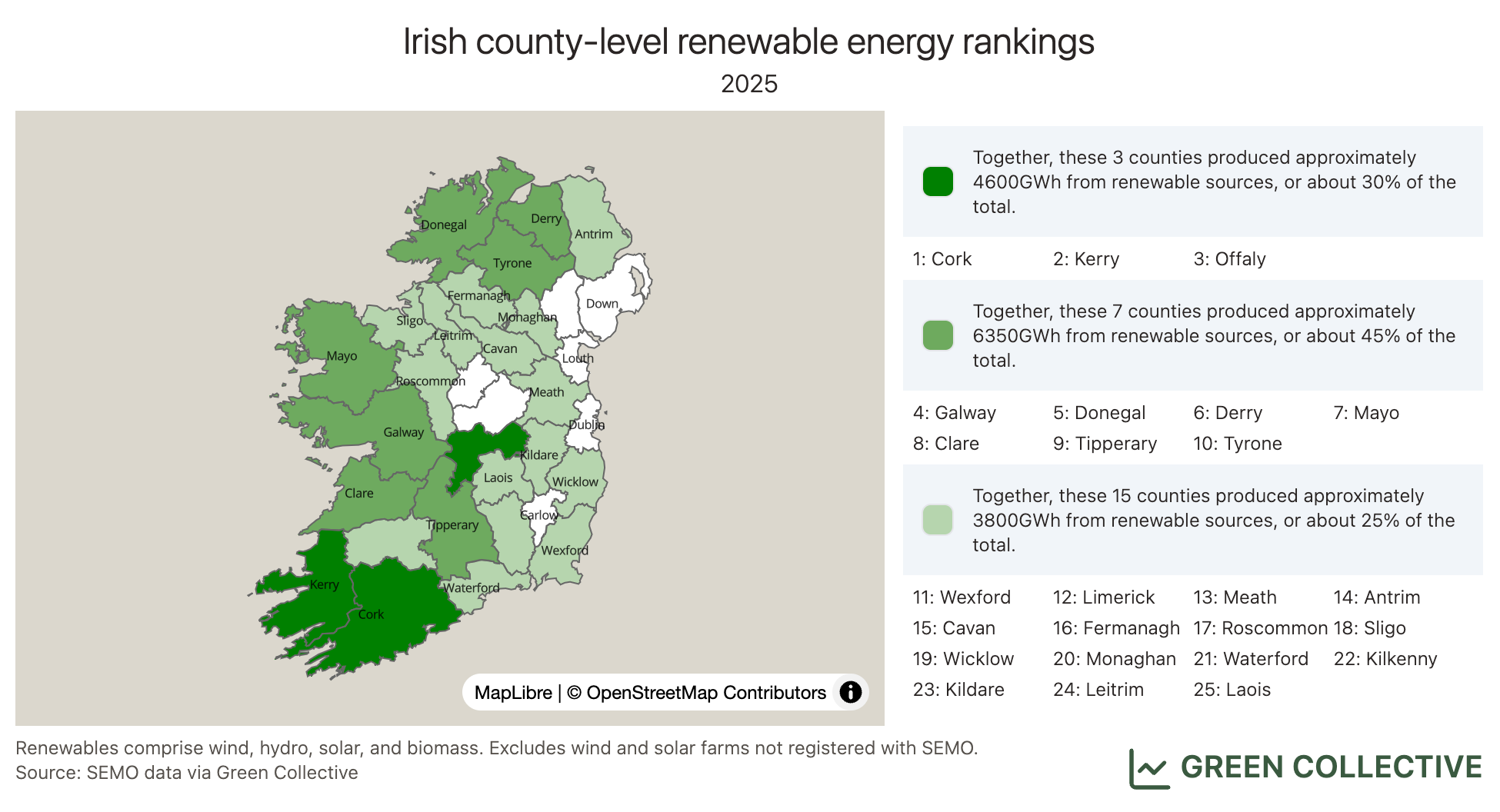

Cork, Kerry, and Offaly are the top three counties for renewable electricity generation in 2025, representing about 30% of the island's total renewable generation.

Long-time readers are probably familiar with our county rankings, which highlight the top wind and solar counties each month. In December, we shook this up a little: treating wind and solar separately, things just don't vary that much month-to-month. However, renewables as a whole varies a lot throughout the year – for example, did you know Ardnacrusha is still, a century after its construction, one of the largest-producing renewable plants during the winter? However, solar provides the best example: Meath has long been the biggest solar-producing county and over the past couple of summers has started to place as a top five renewable-producing county each June and July. We look forward to highlighting the changing seasons throughout the year and channeling our inner Mícheál Ó Muircheartaigh for a bit of harmless inter-county rivalry each month.

-

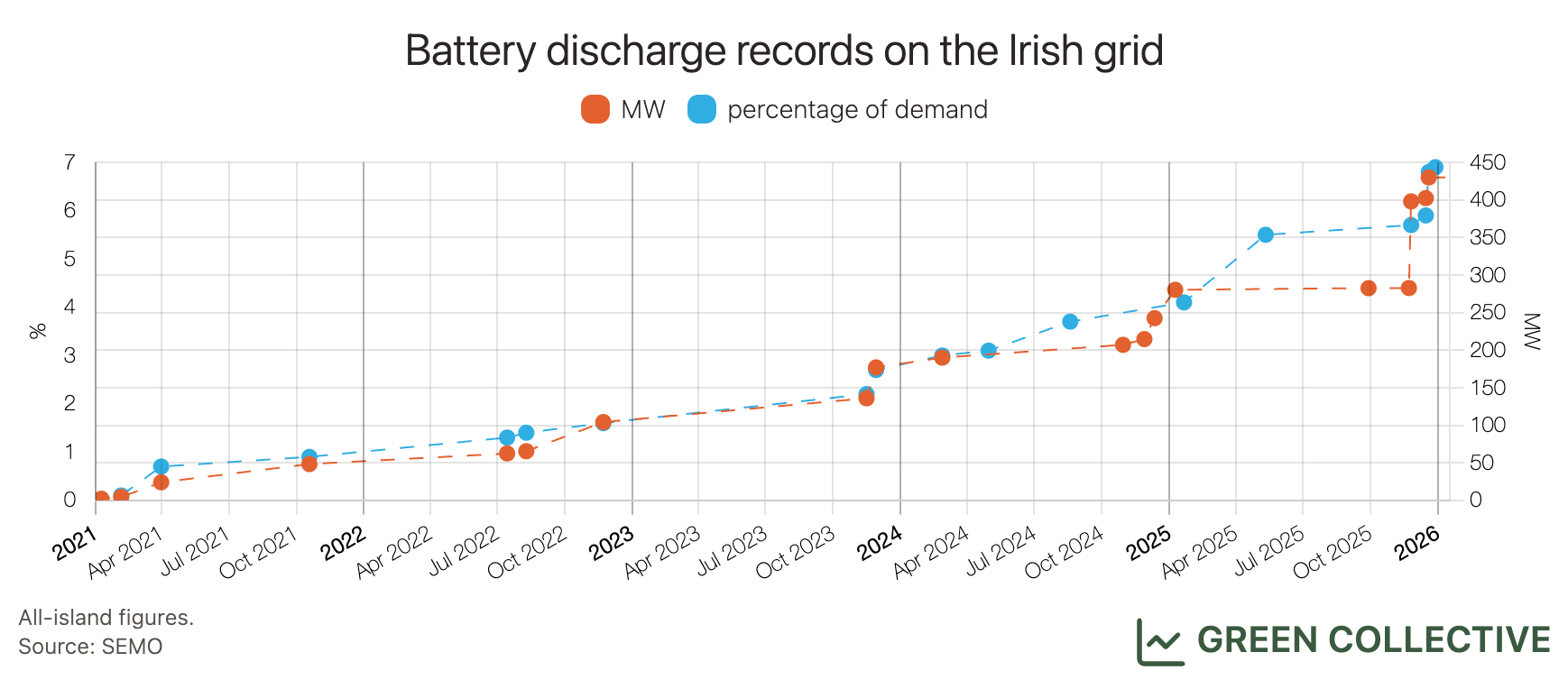

Battery energy storage system (BESS) capacity on the island of Ireland grew from 969MW/1074MWh in 2024 to 1052MW/1314MWh in 2025. Updates to the grid operators' scheduling and dispatch system came into effect in mid-November, improving BESS assets' participation in wholesale markets and leading to a record in discharging batteries at 430MW during peak hours on December 19 – equal to almost 7% of peak demand at that time.

Since mid-2025, we have been publishing the Benchmarking Batteries series as part of this newsletter. We track the performances of BESS assets on the island of Ireland, both in terms of dispatch and revenue streams. The main revenue stream for batteries is still the DS3 Programme, where batteries are compensated for being available for providing system services, but recent changes in the grid operators' scheduling and dispatch system have increased the share of revenues from wholesale trading. From a dispatch perspective, more wholesale trading means more battery discharging during peak hours. As illustrated above, since the scheduling and dispatch updates in mid-November, there has been a noticeable jump in battery discharge levels and we have witnessed multiple records, the latest being 430MW at 17:45 on Friday, December 19.

As we discussed in detail in the latest issue of Benchmarking Batteries, recent updates brought improvements in batteries' participation in wholesale markets, but there is still significant inconsistency in how batteries are dispatched. We will continue to track changes and provide benchmarks and indices in 2026.

-

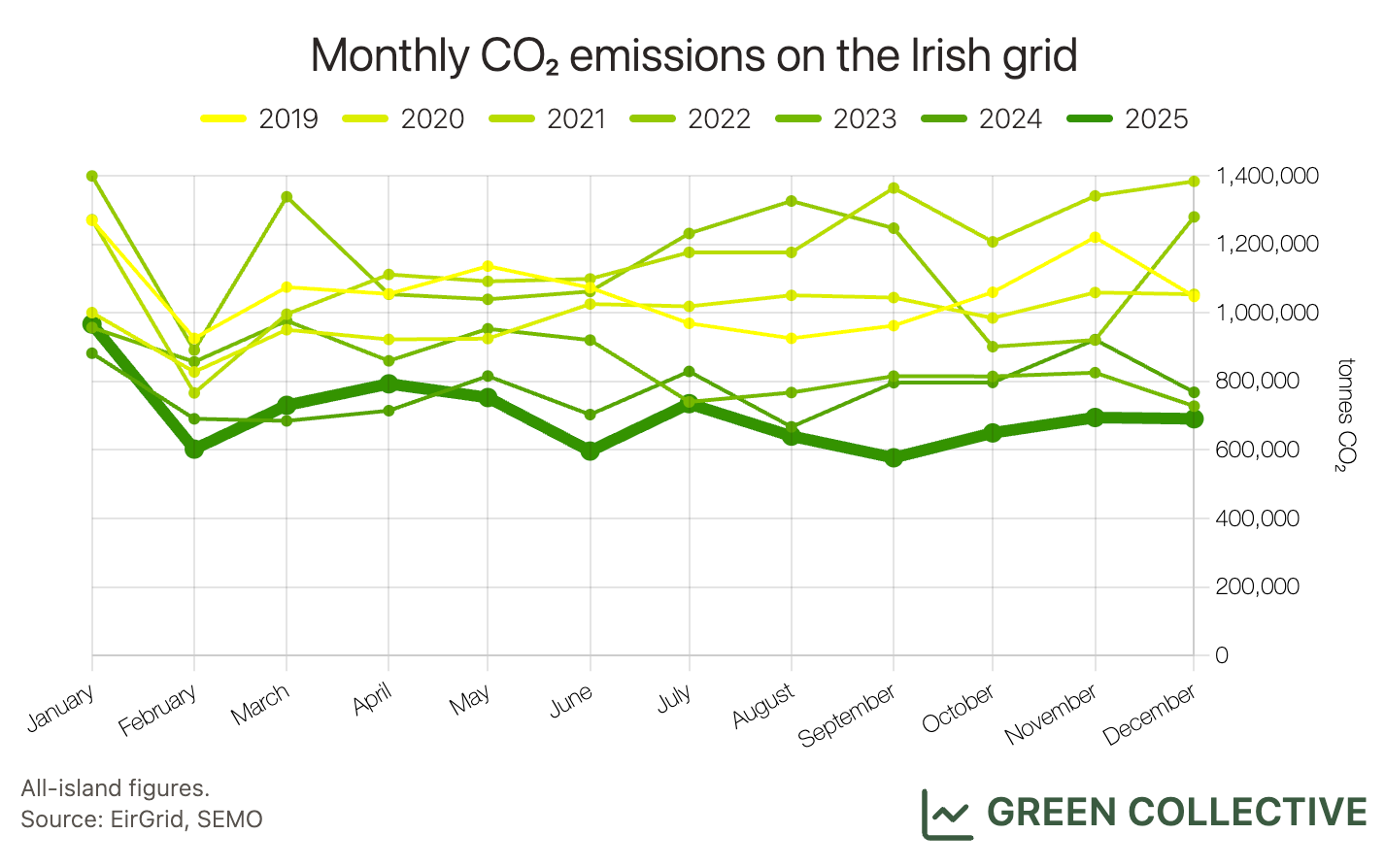

Carbon emissions from the power sector on the island of Ireland reached a new low of 8.4M tonnes in 2025, an almost 10% drop from 2024, thanks to two main reasons: 1) Ireland bid farewell to coal-fired generation in June; 2) imports from GB continued to increase. Grid carbon intensity wise, the Republic of Ireland averaged 234gCO2/kWh, Northern Ireland at 246gCO2/kWh, and GB at 126gCO2/kWh**.

The chart above shows all-island CO2 emissions from electricity generation on a monthly basis from 2019 to 2025. Nine out of 12 months in 2025 reported the lowest ever amount of emissions for that month – a fantastic achievement.

The last time we saw a significant decrease in emissions was when Ireland stopped burning peat to generate electricity – peat is the most polluting fuel – followed by coal. In 2025, the era of coal generation in Ireland also come to an end. The final remaining coal units on these islands – at Moneypoint, County Clare – burned their last on Friday, June 19.

To end this annual review on a high note, in addition to eliminating coal, more renewable generation and higher volumes of imports via interconnectors also means lower generation from fossil fuels. All these factors led to record low emissions from electricity generation in 2025 and we hope this trend continues in the years to come.

P.S. In 2025, Green Collective turned five years old! For a little insight into what occupies our days...:

- In May, EirGrid finally added solar to their real-time dashboard. This took us by surprise: the code we use to scrape data from their dashboard remains basically unchanged after five years, a lifespan almost unheard of on the ever-changing world wide web. While we had recently performed a bunch of work to improve our own real-time estimate of solar generation, we of course welcome any improvement in data transparency and immediately switched over – it's great the grid operator finally caught up with us almost a year after our own daily reports started including solar, although real-time biomass, hydro, etc., remain absent on their dashboard.

- In December, SEMO – the other main source of our data – started exhibiting issues. Following an unusually long wait for unit-level metered generation figures along with an unanswered query for information, a little digging uncovered metered generation in a previously unknown, ever-so-slightly different report. In the absence of any other feedback, we assumed this was the new way and refitted our scrapers – just in time for the old format to spring back to life.

In conclusion, it's not easy being a consumer of grid data on the island of Ireland: a mix of units and resolutions and slow publishing by multiple organisations who are barely reachable. We don't claim it's much better everywhere else — Texas, which we used to monitor, springs to mind — but we're a long way from the pretty real-time visualisations you see floating around for GB and it's maddening to consider the wasted collective effort and resulting drag on innovation here.

However, we'll keep at it. If you need reliable demand and generation figures both historical and real-time, just reach out to us. We spotted the BBC reporting renewables' performance over the past year in GB on January 2nd; we'd love to see anything so timely for Ireland and there's no good reason why we don't. Irish media: don't be shy in reaching out to us — we can't afford a PR firm, but we had all the data on January 1. Maybe in 2027!