This article was first sent to our newsletter subscribers. To receive our monthly reports on the 1st of each month, subscribe now for free.

Hello! We didn't want an annual review that was simply a concatenation of our 12 previous monthly reports, so we've whittled our findings down to eight things we think best represent the longer-term changes evident on the grid during 2024. While it's mostly encouraging, after following the Irish grid for quite a few years on a daily basis, we also want to convey the urgency to decarbonise more and faster. We go beyond the headline of "wind has met 1/3 of Ireland's demand": this has been happening FOUR years in a row now (spoiler alert).

Note: This article was updated January 22nd, 2024, to incorporate full utility-scale solar SCADA data from Eirgrid.

-

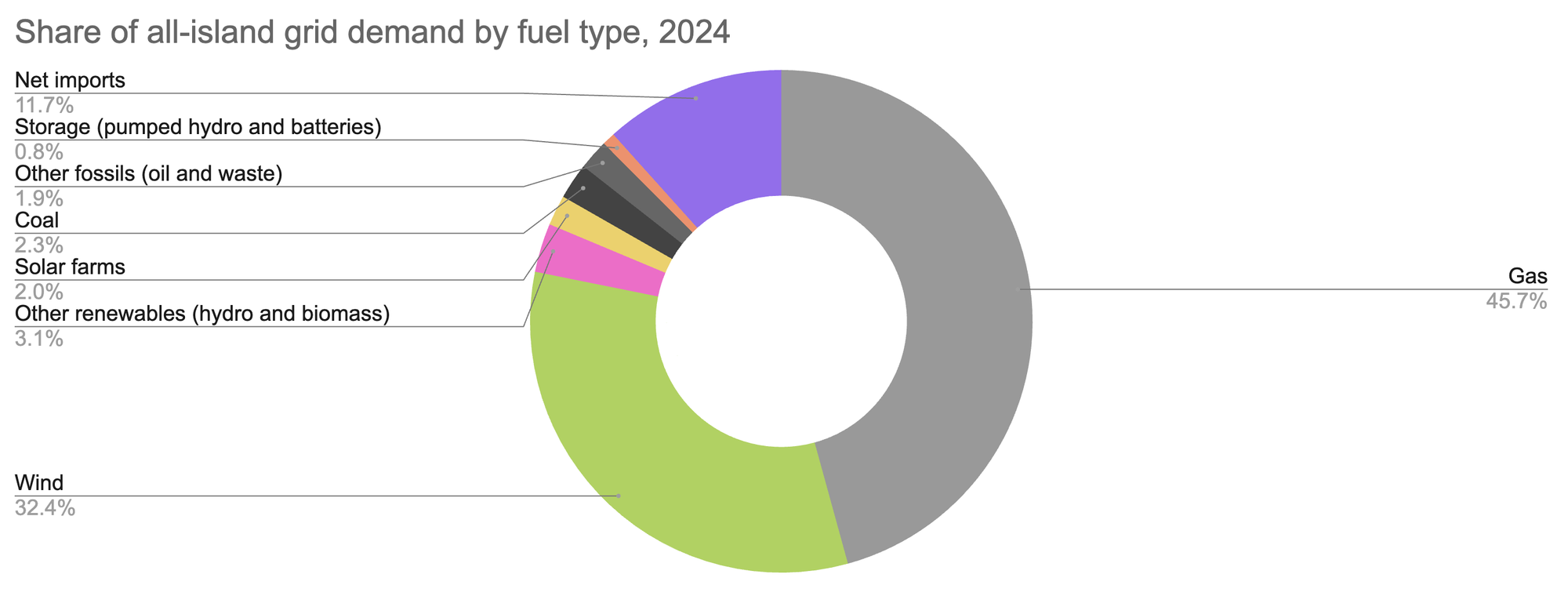

🍃 The most ever domestic renewable generation (barely). While generation from solar farms increased by 62% in 2024, wind energy was down 3.4% compared to 2023. This see-sawing between wind and solar - despite hugely increased biomass generation thanks to Edenderry's switch from peat - led to a mere 0.8% year-over-year increase in renewable electricity on the island. Demand grew faster, making this year's 15.4TWh of renewable generation equivalent to 37.5% of electricity demand, vs. 2023's 15.2TWh/38.4%.

Source: Green Collective, EirGrid, ESB Networks, SONI, SEMO

Source: Green Collective, EirGrid, ESB Networks, SONI, SEMO -

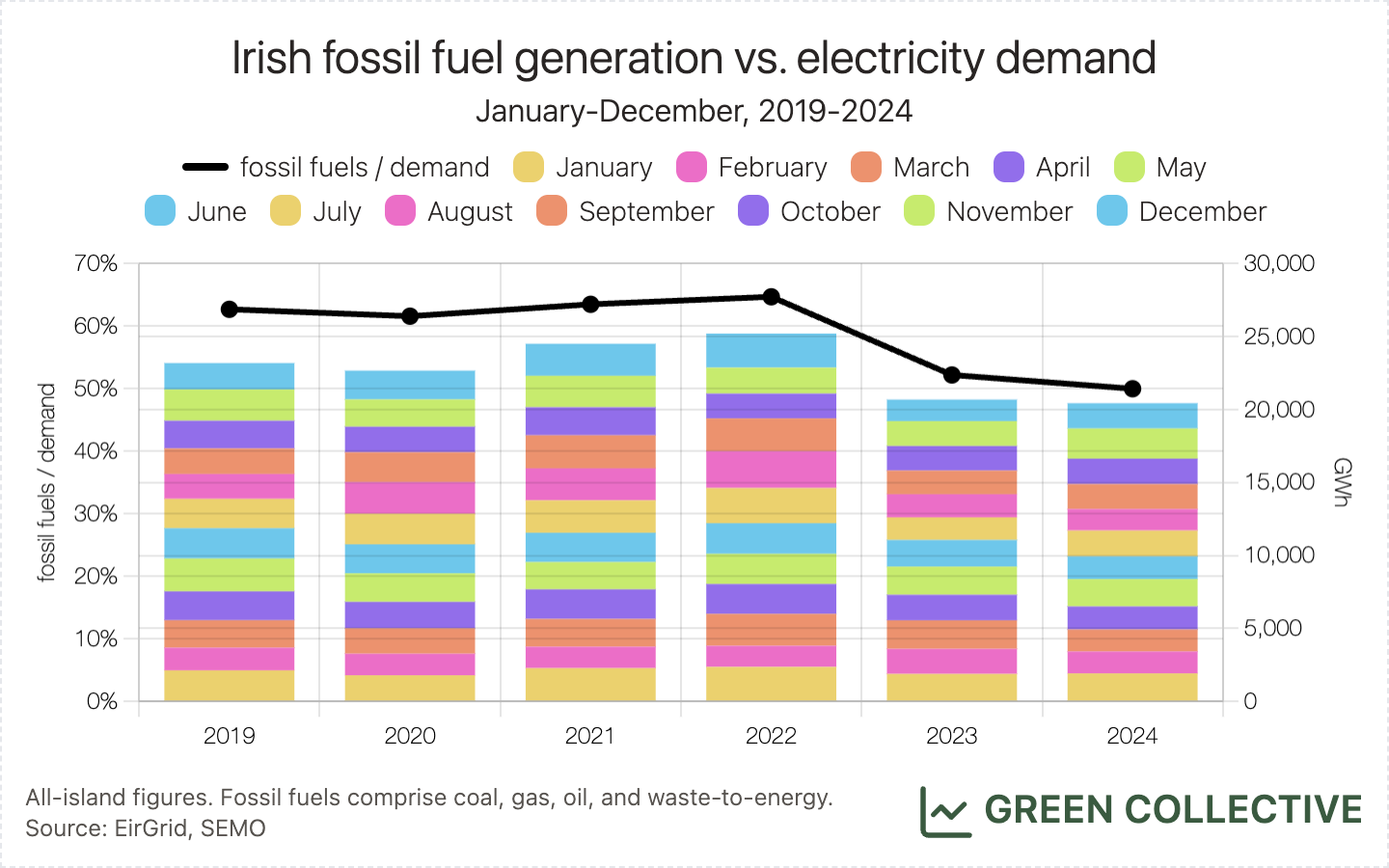

📉 The least ever domestic fossil fuel generation, which met less than 50% of electricity demand for the first time. After a successful trial from May 2023 to March 2024, the minimum number of large fossil fuel units that must operate in the Republic of Ireland has officially decreased from five to four. Fossil fuel burning was also (relatively) less dirty: Edenderry switched over fully to biomass as of January 1, making this the first full year without any peat generation (the most carbon-intensive source for electricity) and oil generation was just 10% of what it was in 2019. Coal generation is down 75% from 2021, although Ireland now has the dubious distinction of operating the last coal plant on these islands at Moneypoint, in Clare: ESB sourced a shipment of coal from South Africa as recently as October. An Bord Pleanála issued preliminary approval on September 30 to convert the remaining Moneypoint coal units to oil and we very much look forward to declaring the end of the coal era in Ireland towards the end of 2025.

-

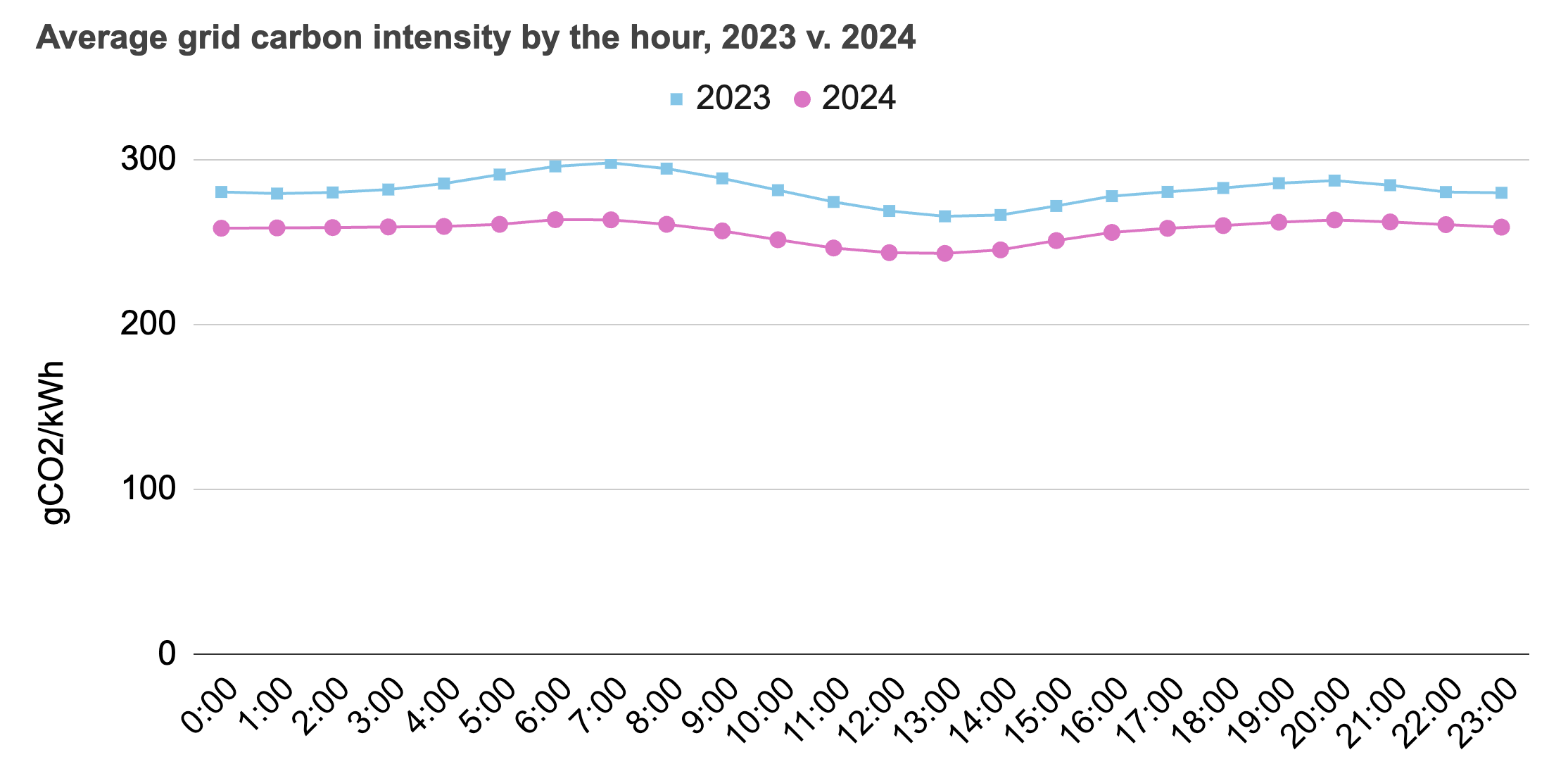

👏 The lowest ever grid carbon intensity of 82gCO2/kWh occurred at 17:30 on November 24, 2024. This new all-time low was reached while Moneypoint (see above) was offline for the day; as coal generation continues to fade in importance, we fully expect this record to be broken again in 2025. Grid carbon intensity during 2024 averaged 256gCO2/kWh, 8.6% lower than 2023's 280gCO2/kWh. When we calculate average grid carbon intensity by the hour (shown below), 2024 is consistently lower than 2023.

Source: Green Collective

Source: Green Collective -

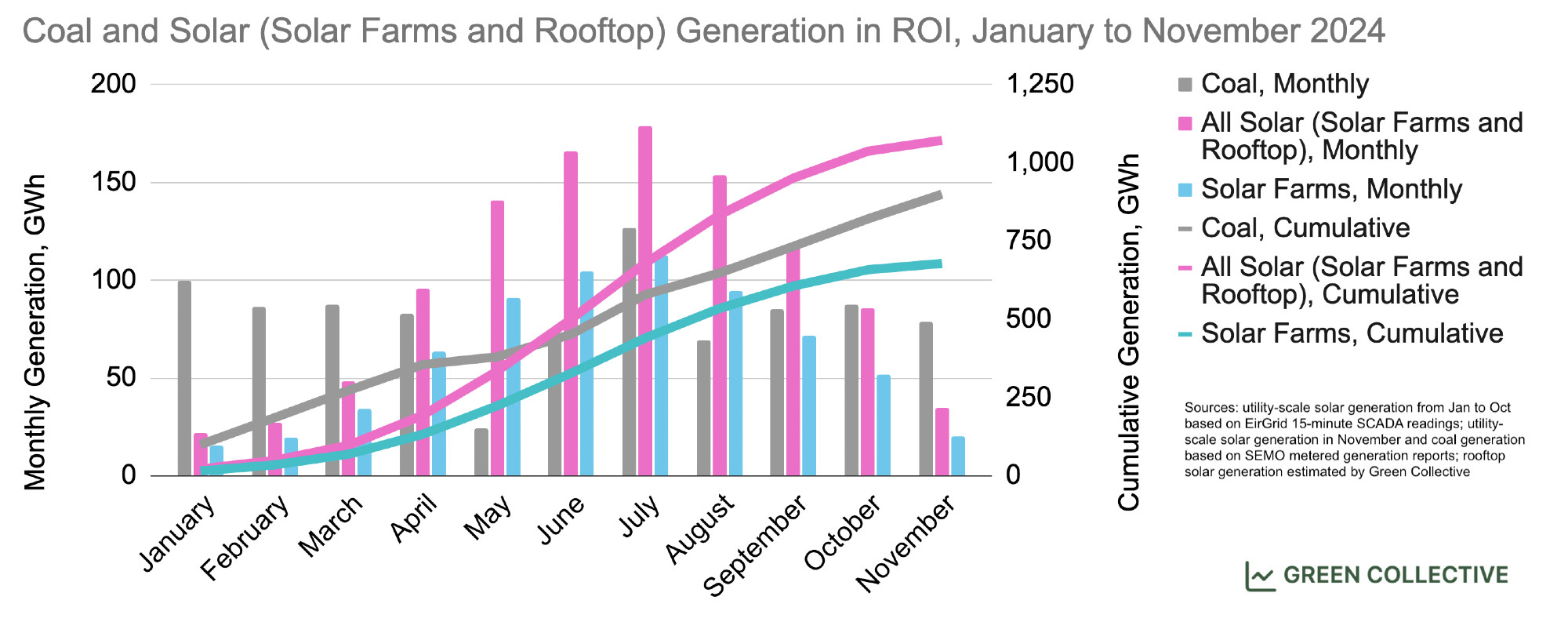

☀️ Solar overtook coal as the #3 source of electricity generation. Solar farms produced approximately 800GWh during 2024 (2% of demand), compared to around 950GWh from Moneypoint's coal units (2.3% of demand). However, it's important to note in addition to almost 1GW of utility-scale solar capacity, microgenerators total more than 450MW in Ireland. This means that during the height of summer, when combining utility-scale and rooftop systems, solar has already surpassed coal - possibly as early as June. We wrote about solar's stellar performance quite a bit last year and you can check out our detailed analysis in Irish Renewables' Best Summer.

-

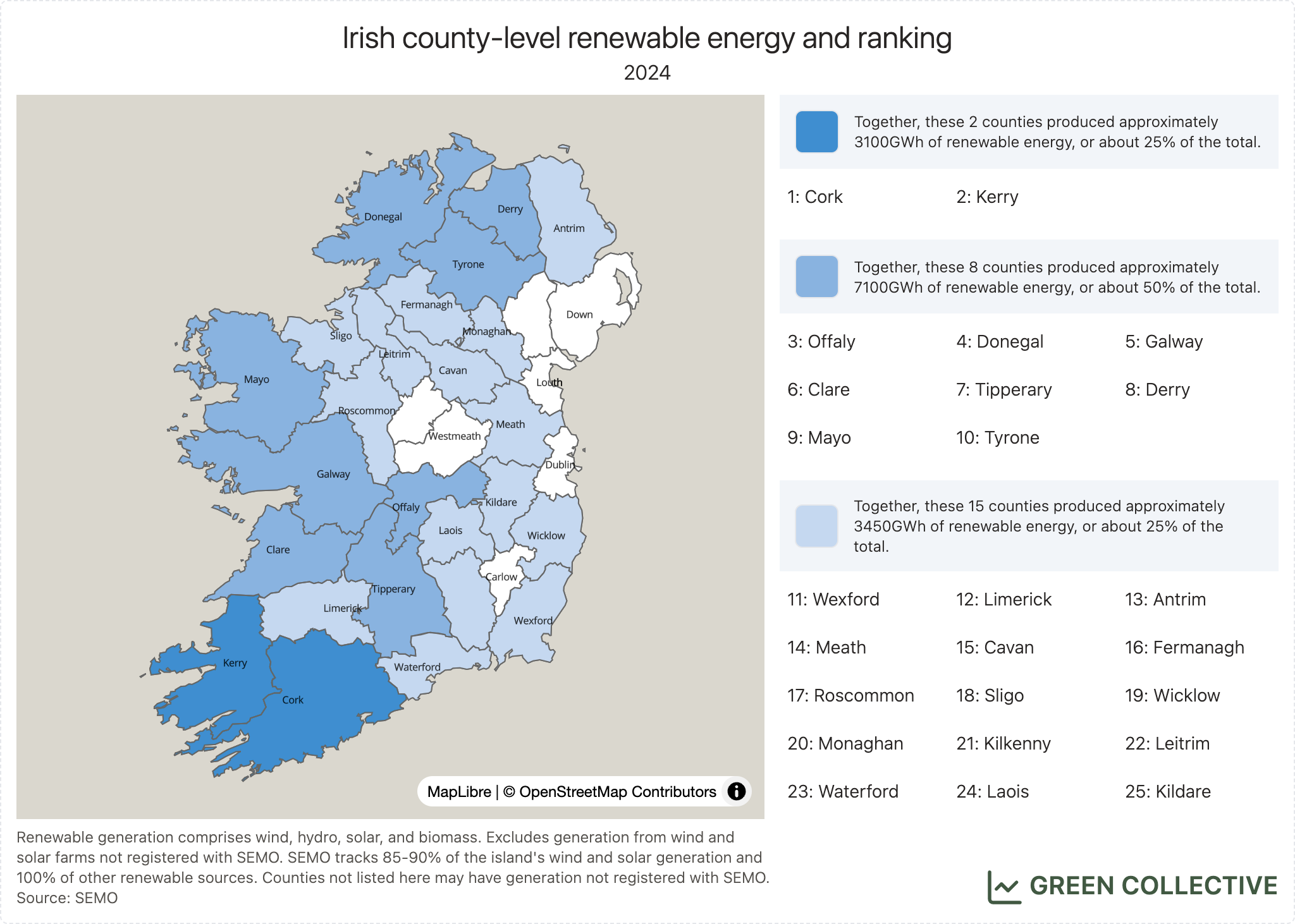

🏆 Cork, Kerry, Offaly, Donegal, and Galway were the top 5 counties for renewable energy in 2024. There was a lot of movement in the rankings this year. While Kerry retains top place for wind energy alone, Cork's hydro plants and solar farms (of which Kerry has neither, at least not registered in SEMO) get it to top place for renewables overall. Clare and Tipperary left the top 5 while Galway entered but Offaly is the most notable: it jumped a whopping seven places, from #10 to #3 thanks to Edenderry's conversion to biomass as well as three new wind farms opening there during 2024. Continuing efforts to convert former peat land and infrastructure are paying dividends there; indeed, Offaly now has the 5th highest wind capacity on the island. You can explore county-level wind energy stats throughout 2024 on our County Dashboard.

-

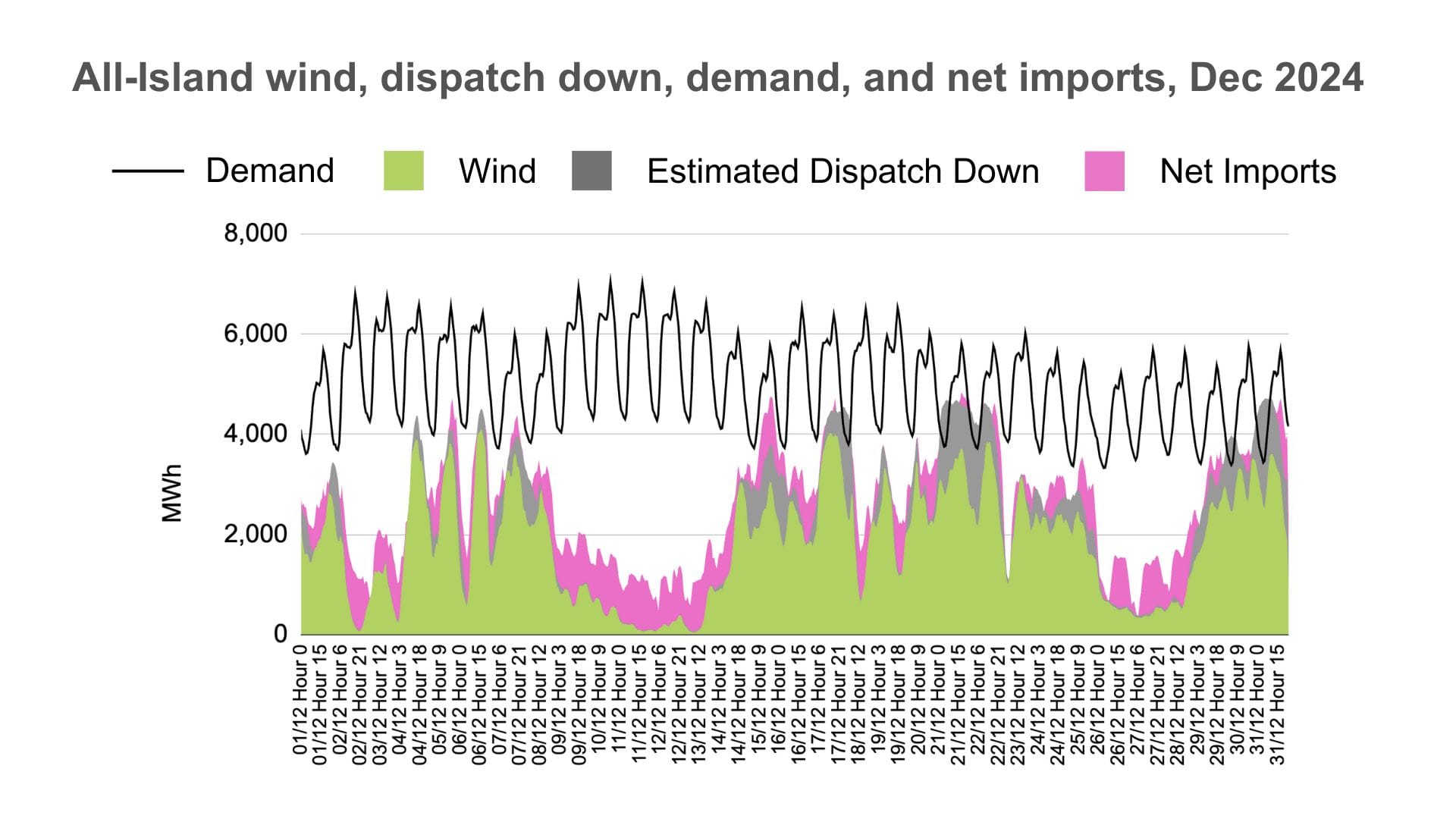

🌪️ The share of demand met by wind has been stuck at around 35% four years in a row now, due to a combination of reasons: 1) dispatch down has increased; 2) new wind farms are not coming online fast enough. Based on EirGrid data and our estimates, 2024's wind dispatch down rate is 14%, an increase from the 11% in 2023. It might be puzzling to see wind dispatch down and imports happen at the same time (Dec 5, Dec 15, and Dec 24/25 below). Why would Ireland import from GB while reducing domestic wind's output? Transmission constraints play a role (especially in Northern Ireland), but just as likely (in the Republic of Ireland) is the need for system operators to facilitate minimum level of fossil fuel generation and/or alleviate high frequency events through curtailment. While increasing dispatch down signals an ever growing need for more transmission infrastructure and energy storage, it's important to note dispatch down is a feature not a bug as the grid incorporates more intermittent resources.

Source: Green Collective; SEMO

Source: Green Collective; SEMOBut increasing dispatch down is only part of the reason why total wind generation has been flat for the last few years. The bigger issue is new wind capacity is not coming online fast enough to push the share of demand met by wind beyond 35% and meet Ireland's climate goals.

We have been looking for a concrete analysis of the slowdown in new wind capacity and we didn't expect to find one of the most approachable in a recent High Court judgement. On January 10 2025, the High Court ruled that An Bord Pleánala (ABP) must prioritise the Climate Act in the Coolglass Wind Farm vs. ABP case. The most striking thing out of this ruling, other than the many zingers Mr Justice Richard Humphreys managed to deliver while centering the climate crisis, is the direct link between more refusals of wind farms since late 2022 and county development plans. Counties updated their plans around then and designated some areas as off-limits to new renewables. You can go through the details yourself here (pages 39-41).

-

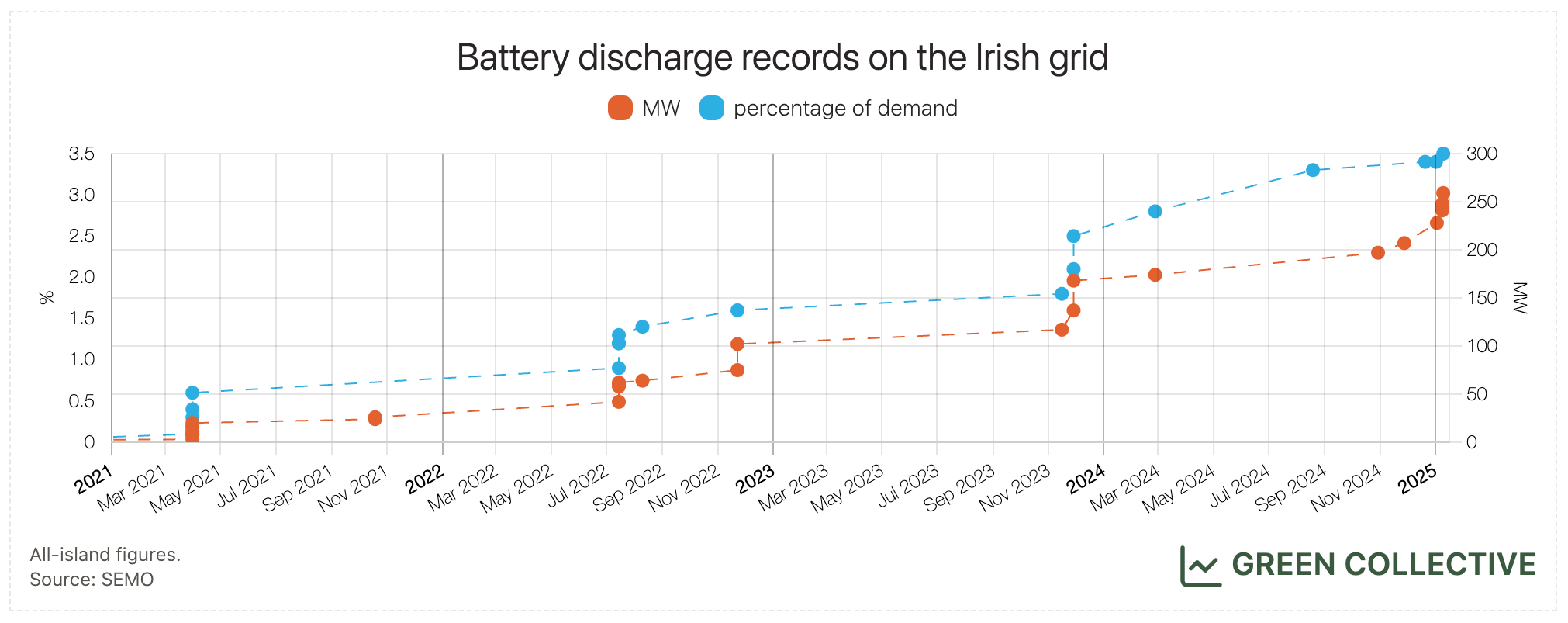

🔋 While battery energy storage systems' (BESS) overall capacity didn't increase significantly in 2024, they have been working more frequently during peak hours and have been reaching record discharges. After solar, storage was the source with the most positive change in 2024. Market incentives for batteries changed in October - namely a decrease in potential revenue from ancillary services (the DS3 Programme) - and we have seen much more batteries participating in wholesale trading since then, the chief reason behind record discharges. New battery discharge records have already happened in 2025; you can keep up to date via our Records Dashboard.

-

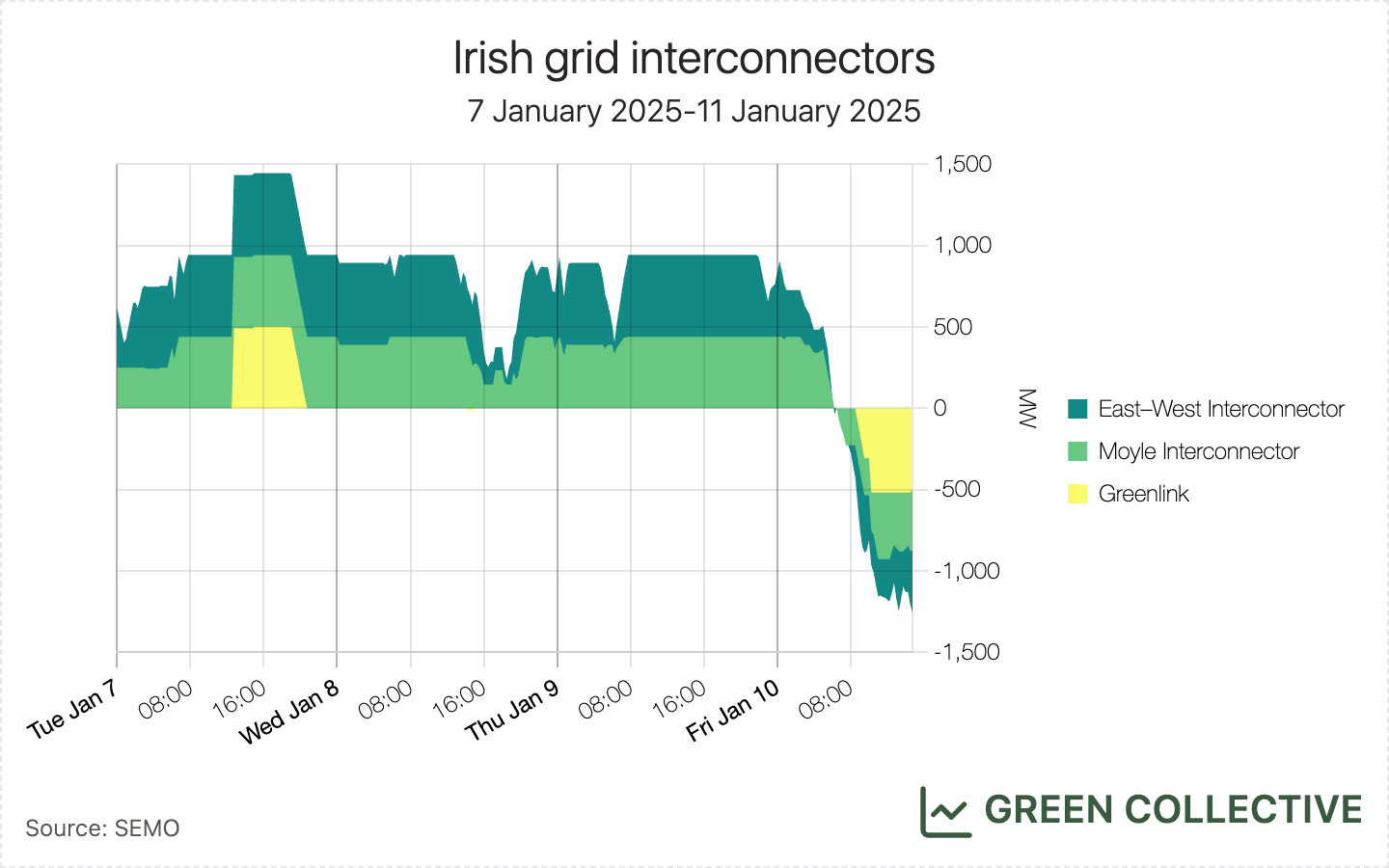

⚡️ Ireland imported a record amount of electricity in 2024, a trend set to continue in 2025 thanks to the new Greenlink Interconnector. Net imports equalled 11.7% of electricity demand in 2024, up from 8.7% in 2023. On December 13, Greenlink completed "coupling" for the first time and we have seen more testing activity since then. Our grid carbon intensity calculations are based on domestic generation only, as the treating of imports as zero-carbon is standard practice in emissions accounting. In reality though, since Ireland imports from GB which has a much cleaner grid (GB's 2024 average grid carbon intensity was 124gCO2/kWh, their cleanest yet, much lower than Ireland's 256gCO2/kWh), interconnectors help bring down all-island grid carbon intensity, in addition to facilitating more exports when there is excess renewable generation in Ireland.

Lastly, some shameless self-promotion: Green Collective had a busy year!

- We finally moved off Twitter (RIP Irish Energy Bot; long live Irish Energy Bot!) entirely, settling on Bluesky.

- More dashboards are up and running to open up our data more, including Irish Grid Today and Irish Grid Records.

- Our partnership with Wind Energy Ireland focused on the top 5 wind energy counties each month has led us to put together a county stats dashboard with up-to-date wind data. We will be adding the other renewable sources soon.

- We launched the grid carbon intensity feature in April and are delighted to report that our 2023 estimates matched EPA's press release exactly at 280gCO2/kWh. This makes us more confident about our 2024 estimates and we will see how the numbers compare when EPA releases stats during the summer.

- We have become the Ireland data provider for Ember, starting with this report focused on clean flexibility in the EU. No more embarrassing footnote about Ireland being excluded due to data quality issues! It was a true highlight for us to see "Ireland data was provided by Green Collective" in print.