2023 saw quite a few milestones for renewable energy in Ireland, such as the most amount of power generated from wind in a year (13,726GWh); peak wind output (4,629MW); and record share of instantaneous demand met by solar (9.4%), to name just a few.

This annual report highlights ten key takeaways and illustrates the trends of an evolving electricity grid on the island of Ireland. The report also offers perspectives on what we at Green Collective are most curious about and excited to see in 2024. All the data used to create charts and graphs in this report comes from publicly available sources published by EirGrid and the Single Electricity Market Operator (SEMO).

1. Wind and solar combined made 2023 the year with the most ever renewable generation in Ireland.

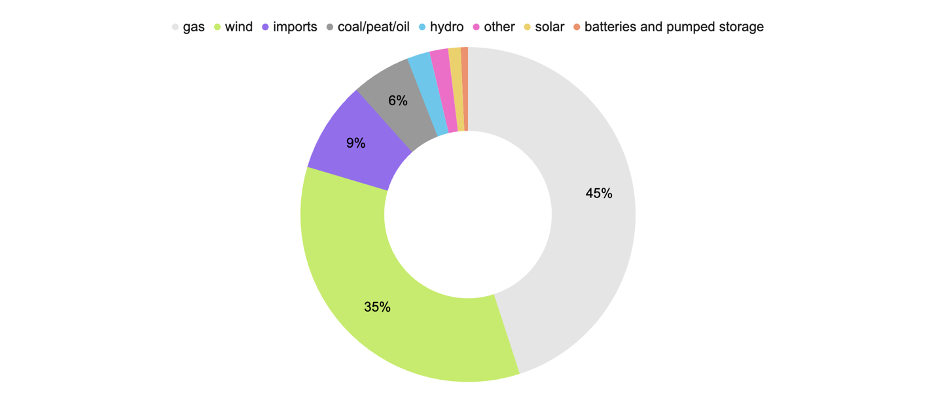

In 2023, 50.7% of Irish electricity demand was met by fossil fuels: 45.0% from gas and 5.7% from coal, peat, or oil. Wind has remained the dominant source of renewable generation with 34.6%, while solar contributed 1.2%. The year also saw a higher than usual level of imports via the East West and Moyle interconnectors from the GB market. Imports met almost 9% of electricity demand on the island.

Exhibit 1: Annual all-island electricity demand by source in 2023

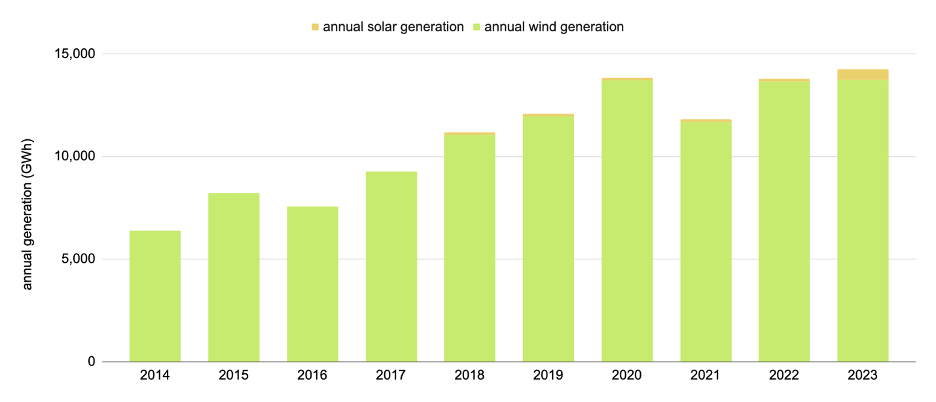

Wind generation in 2023 edged out 2020 ever so slightly, the previous record year for annual wind generation: 13,726GWh in 2023 and 13,699GWh in 2020. It’s worth noting total wind generation remained almost at the same level from 2022 to 2023, as wind generation in 2022 was only 0.3% behind the 2020 record.

As wind reached new highs in 2023, so did solar, the breakout star of renewables in Ireland. Utility-scale solar was only in Northern Ireland until the first half of 2022, when solar farms connected to the grid in the Republic of Ireland. As of 2023, there is 182MW of solar capacity in Northern Ireland and more than 500MW in the Republic of Ireland. The exhibit below shows the increase in solar generation from 2022 to 2023. Solar and wind together made sure 2023 is the year with the most renewable generation in Ireland.

Exhibit 2: Annual wind and solar generation, 2014-2023

2. The timeline of renewable electricity support schemes (RESS) has led to a slower pace of wind capacity additions over the last few years, but more wind was likely connected towards the end of 2023.

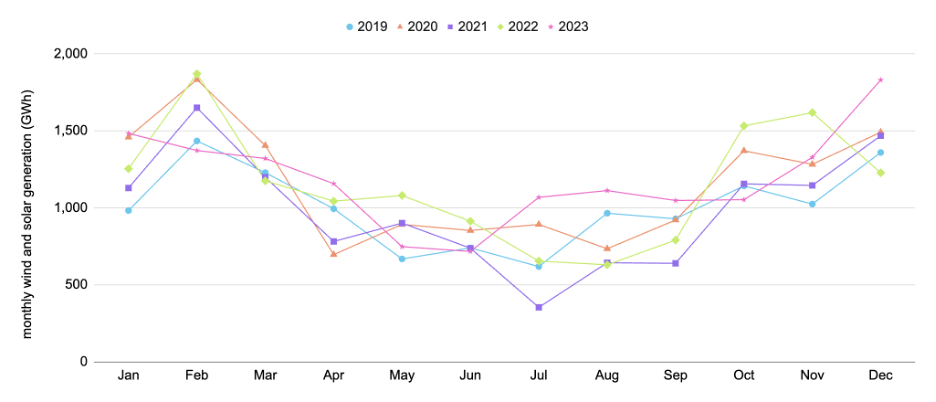

Although wind generation broke annual records in 2023, when we review monthly wind generation data from the past five years, it’s important to point out there has not been significant growth in recent years, even though the system can now accommodate more wind and solar. While grid infrastructure upgrades and innovation such as the Moneypoint synchronous compensator enable the Irish grid to allow up to 75% of inverter-based resources at a time, as of Q3 2023, only 270MW of new wind was connected in 2023, compared to almost 6GW of total wind capacity to date. 2021 and 2022 saw even less new wind, with just 164MW connected to the grid during those two years.

Exhibit 3: Monthly all-island wind generation, 2019-2023

The pace of new wind capacity is primarily a result of renewable support schemes. Under the first renewable electricity support scheme (RESS-1), any capacity awarded needs to achieve commercial operations by the end of 2023. Capacity awarded under RESS-2 has a commercial operation deadline of December 2025. Since the data cited in the previous paragraph doesn’t include Q4 2023, it’s likely we will see additional renewable capacity having coming online towards the end of 2023.

3. Despite record renewable generation in 2023, 2020 still holds the record of demand met by renewables as electricity demand continues to climb.

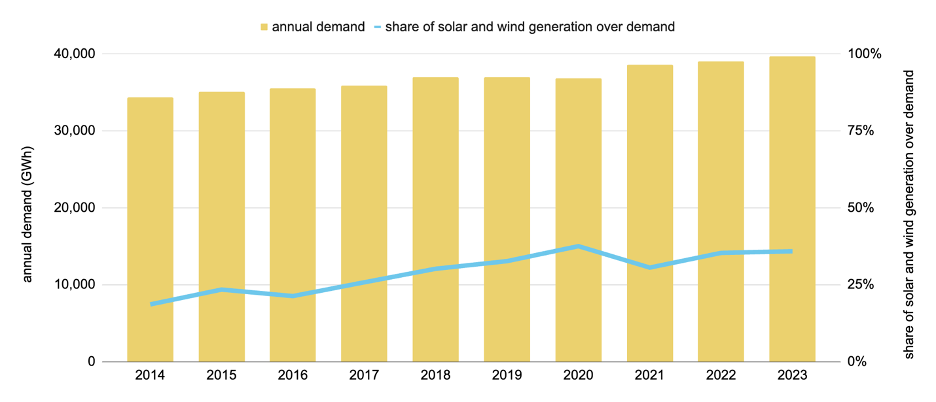

During 2020, the year-on-year change in annual electricity demand became negative at -0.4%, and 2021 saw a rebound post-COVID with an increase of 4.8% compared to 2020. Since then, total electricity demand continues to grow. Annual demand grew 1% in 2022 and another 1.7% in 2023.

Although wind and solar generation in 2023 is 3% higher than that in 2020, because demand is almost 8% higher, solar and wind met 35.9% of Irish electricity demand in 2023. While this is still lower than the 37.5% in 2020, 2023 managed to surpass the 35.4% in 2022 to take second place.

Exhibit 4: Annual all-island electricity demand met by wind and solar, 2014-2023

Although annual electricity demand was the highest ever in 2023, the peak demand of 7,015MW in 2022 remains the record. Highest peak demand in 2023 was 6,813MW. A lower peak demand in 2023 is primarily due to milder weather and high energy prices, which leads to reduced electricity consumption during peak hours.

4. Wind output reached 4,629MW, a new record, and wind output exceeded demand for the first time.

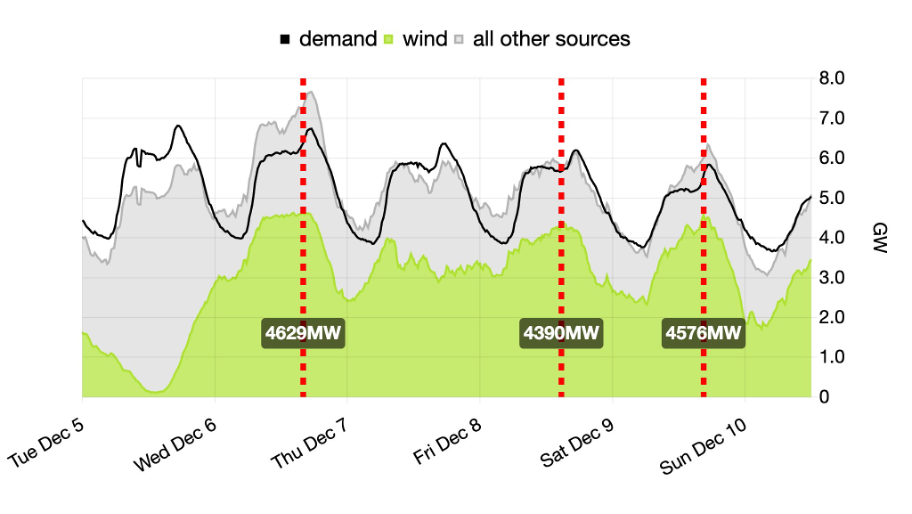

December 2023 was particularly windy due to storms Elin and Fergus. On December 6 at 4pm, all-island wind output reached 4,629MW, surpassing the previous record of 4,585MW set on February 5, 2022. Back-to-back storms led to high wind output throughout the week, exceeding 4GW on multiple days during the week of December 5.

Exhibit 5: Peak all-island wind output during the week of December 5

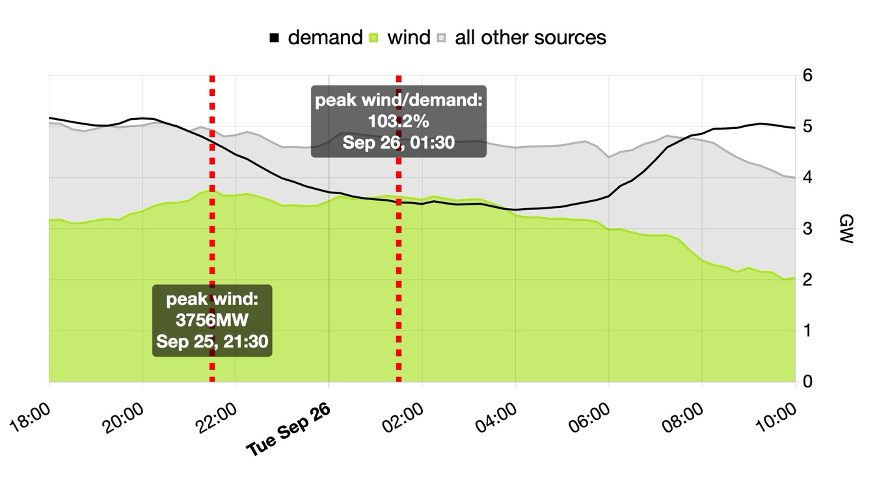

In addition to the record peak, wind output in 2023 exceeded, for the first time, demand at 1:30am on September 26. However, this doesn’t mean electricity supply at that time was 100% renewable: fossil fuel generation was still there and excess generation, a mix of fossil fuels and renewables, was exported.

Exhibit 6: Peak wind output higher than demand at 1:30am on September 26

5. More than 700MW of utility-scale solar has been connected to the grid, enabling peak solar output to reach 416MW on July 28.

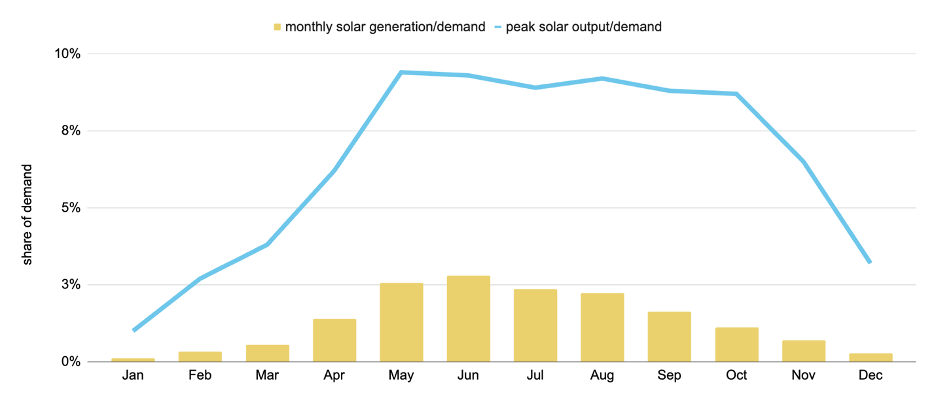

In 2022, utility-scale solar accounted for less than 0.5% of electricity demand in Ireland, and that share grew to 1.2% in 2023. While the annual total solar generation still seems small, it’s worth emphasizing that May to August saw consistently strong performance from solar, meeting around 3% of demand in those months.

At its highest, solar output reached 416MW on July 28 at 11:15am, meeting 8.9% of demand then. This is impressive, considering July was wet and windy. On May 13 at 3:00pm, solar output was able to meet 9.4% of demand, the highest share recorded ever, since EirGrid started making 15-minute solar generation data available in April.

Exhibit 7: All-island electricity demand met by utility-scale solar, 2023

6. Microgenerators get paid to export excess solar to the grid but there isn’t transparency in the total contribution of rooftop solar to the grid.

Utility-scale solar farms deliver the majority of solar power in Ireland and will continue to increase their share, as more solar capacity is contracted to come online. However, distributed solar, also known as microgeneration or rooftop solar, is also an integral part of the solar story in Ireland. The Sustainable Energy Authority of Ireland (SEAI) estimates distributed solar generation is about half of utility-scale solar generation in 2023, which would be a little over 200GWh.

Assuming a home or business has rooftop solar without battery energy storage, some of the microgeneration will be used for self-consumption, and the rest can be sent back to the grid. 2023 is the first full calendar year of the Clean Export Guarantee, a support scheme that pays microgenerator owners to export excess solar energy to the grid. The amount of payment a microgeneration owner receives depends on the energy provider, as energy providers can set different rates.

If a rooftop solar owner is qualified for a smart meter, a smart meter must be used to track export levels, which would be used to determine payments for exports. If they are not qualified for a smart meter, energy suppliers follow a formula approved by regulators to calculate deemed export levels.

The implementation of Clean Export Guarantee payments means that multiple entities, namely ESB Networks and energy providers, have increasingly better visibility into the scale and impact of rooftop solar on the Irish grid. As more utility-scale solar data becomes accessible, we hope the increased transparency in aggregate real-time rooftop solar export can also become a reality soon.

7. Battery energy storage started discharging in concert to meet peak demand for the first time, with a peak battery discharge record of 168MW on November 28.

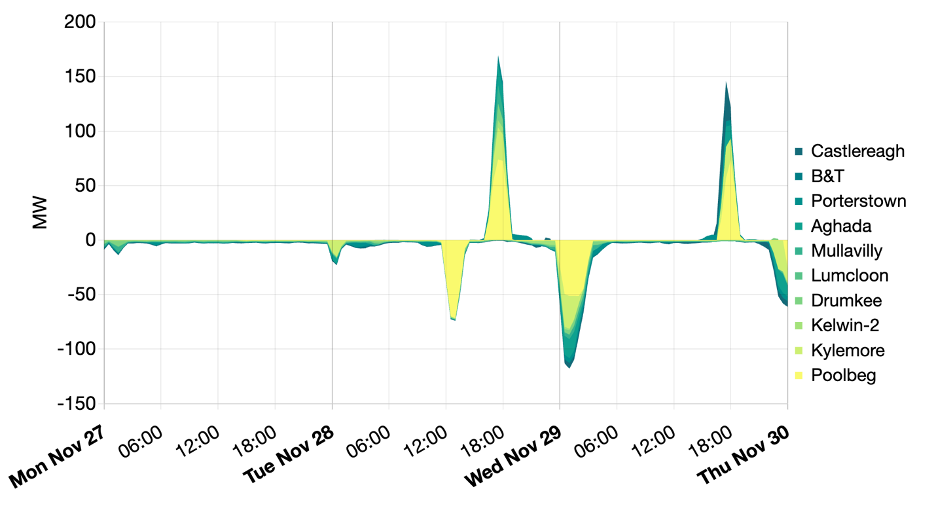

As of December 2023, Ireland has more than 900MW of battery energy storage capable of discharging between 30 minutes to 2 hours. For most of the year, the charging and discharging patterns of batteries seem random, meaning they are mostly used in ancillary services to provide fast frequency response.

However, since mid-November 2023, we noticed some batteries were sometimes discharging at the same time during peak hours around 6pm. For example, on November 28 and 29, as many as ten battery energy storage systems displayed this pattern together, as illustrated below.

Exhibit 8: Charge (<0) and discharge (0) of batteries in Ireland, November 2023

This discharge pattern indicates batteries are bidding into the day-ahead or intra-day markets. Allowing batteries to participate in wholesale trading unlocks the potential for battery energy storage to help meet peak demand, shown in the exhibit above. Batteries’ ability to balance the grid through fast frequency response is crucial, but their capabilities to serve during peak hours is also important. Electrification is expected to increase demand and batteries can work with renewable generation in a complementary manner. These factors highlight the importance of expanding wholesale market participation for batteries in Ireland.

8. New fossil fuel generation capacity was still coming online in 2023, though almost all are emergency or flexible generation capacity in or near Dublin, highlighting current grid constraints in Ireland.

Although it has been a year of many records for renewable energy, a total of six fossil fuel generators came online in 2023. Five out of the six units are in or near Dublin, where electricity demand is high and concentrated. These fossil fuel generators can ramp up and down quickly to either provide energy when there is a shortage in supply or provide inertia to enable more renewable energy in the system.

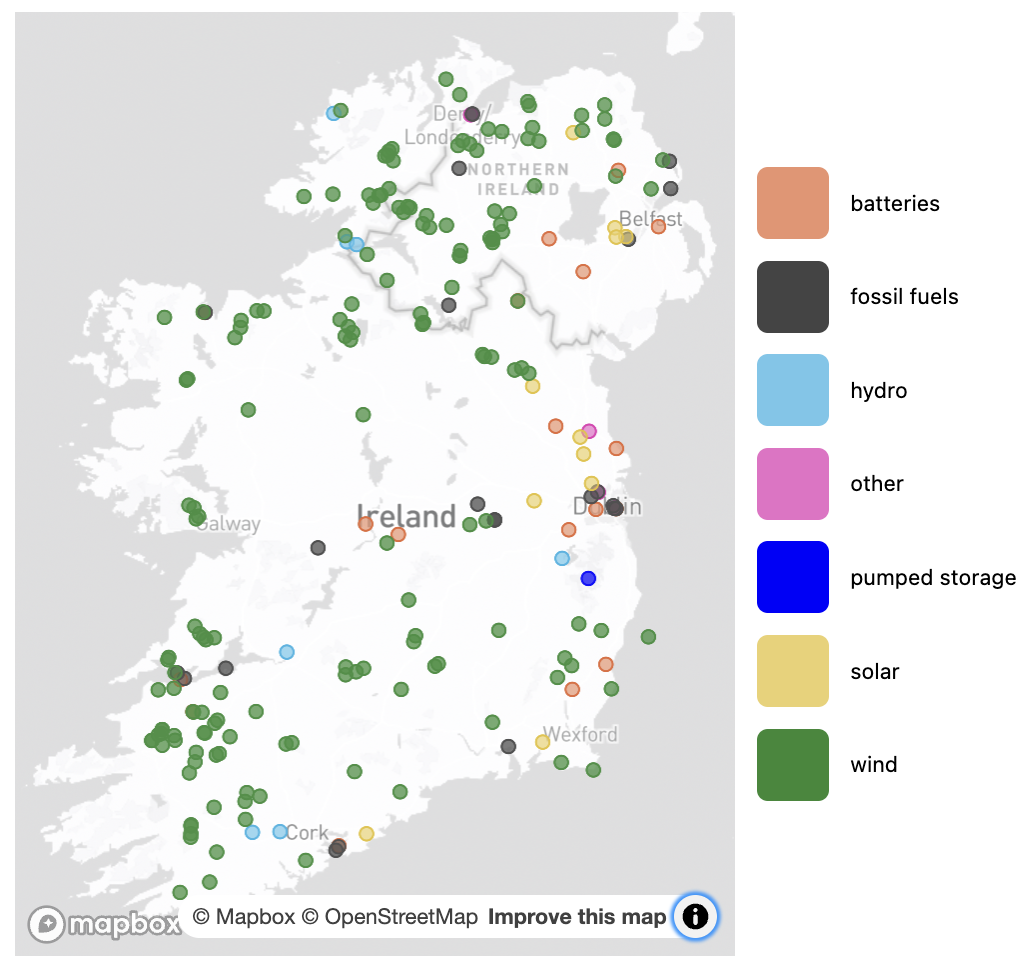

The map below shows the locations of all generators greater than 5MW in capacity that have produced electricity in 2023. The dots indicate location only and do not represent the scale of capacity and generation.

Exhibit 9: Locations of generators with >5MW capacity and generation in 2023

Wind farms are along the coast or in less densely populated areas, while much of the demand is in and around Dublin. In addition to fossil fuel generation, most battery energy storage systems in the Republic of Ireland are also deployed near Dublin to provide grid balancing services and help meet demand. The continued need for new fossil fuel generation also highlights issues of insufficient transmission capacity to deliver wind energy to areas with greater demand. Grid constraints are also a main reason why wind and solar are often asked to reduce output.

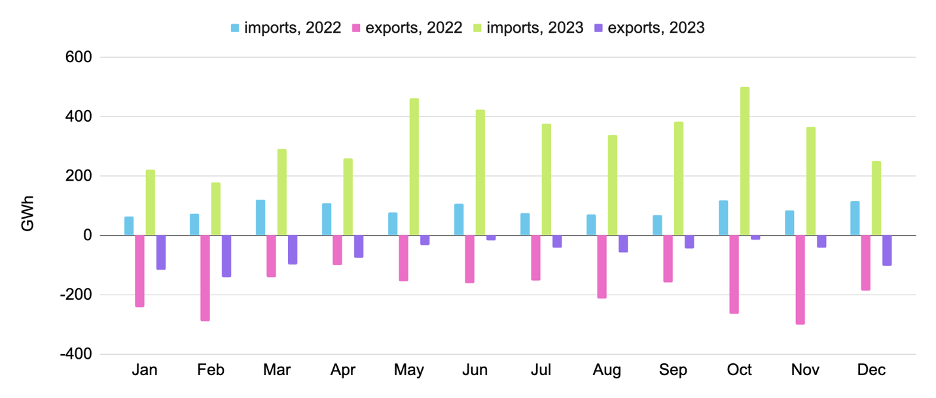

9. Ireland was a net importer of electricity from the GB market in 2023 due to differences in EU and UK carbon prices.

Ireland imported significantly more electricity via the interconnectors in 2023 than in 2022. Ireland was a net exporter in 2022 and a net importer in 2023. According to the SEAI, the main driving force behind the higher imports is the differences in carbon prices in 2023.

Generators in both the Republic of Ireland and Northern Ireland operate within the European Union Emissions Trading Scheme (EU-ETS), while the UK runs a separate system for the GB market. Carbon prices in the UK have been much lower than EU levels since March 2023, and this gap makes it more economical to import electricity from the GB market, essentially replacing domestic fossil fuel generation in Ireland with fossil fuel generation in GB.

Exhibit 10: All-island imports and exports in 2022 and 2023

While there has been a small increase in overall electricity demand and renewable generation from 2022 to 2023, Ireland’s carbon intensity of electricity decreased significantly, because imports replaced some domestic fossil fuels with those outside of Ireland. From a carbon accounting perspective, when the carbon intensity of electricity is calculated, only emissions from domestic generation are included, making imported electricity carbon-free under national carbon budget rules.

The differences in carbon prices between the EU and UK are expected to narrow or even disappear over time. To reduce emissions from the power sector in the long run requires accelerated renewable build outs and a much more resilient grid.

10. We look forward to more renewable capacity, more action from battery energy storage, more electricity demand, and a strengthened electricity grid in 2024.

Utility-scale solar capacity will continue to expand in 2024 and we are excited to see a higher share of daytime demand met by solar throughout the year. We are also curious to see how discharging patterns of battery energy storage are going to evolve in 2024, as they started discharging in concert during peak demand hours at the end of 2023.

We at Green Collective have spent a significant amount of time and effort in 2023 on mapping out individual generators. In 2024, we look forward to studying generator-level dispatch and creating a detailed analysis of grid constraints in Ireland. This type of analysis with data on local signals will hopefully be helpful in guiding new deployments of renewable generation, battery energy storage, and growing demand.

It's also crucial to point out that even though almost 40% of electricity demand in Ireland was met by renewable energy in 2023, the share of all energy demand met by renewable sources is much lower. Recently, Eurostat published data on the share of renewable sources in gross final energy consumption, and Ireland ranked at the bottom of the EU-27 at 13% in 2022. It’s important to clarify that this data point considers all energy demand, including electricity, heating and cooling, and transport.

According to the SEAI, 94.3% of residential heat in the Republic of Ireland still came from fossil fuels in 2022, slightly down from 95.8% in 2021. The decrease indicates households switching from gas or oil heating to heat pumps. Road transport energy relies heavily on fossil fuels: 93.9% from diesel or petrol, 4.7% from biodiesel blended into diesel, and 0.8% from bioethanol blended into petrol. This means electricity only accounted for 0.5% of road transport energy.

These numbers demonstrate Ireland’s overwhelming reliance on fossil fuels. They also scream the need to accelerate the pace of electrification of heat and transport, as electricity generation continues to become less carbon intensive.

In 2024, we will continue to track how the grid is evolving and we will also keep up to date with changes in heating and transport sectors, as further electrification in both sectors is urgently needed to reduce emissions and combat climate change.